Speaking after BlackRock’s Q1 earnings report on a call with Wall Street analysts, CEO Larry Fink said he was troubled by the size of President Trump’s tariff war with China.

“The sweeping US tariff announcements went beyond anything I could have imagined in my 49 years in finance,” Fink told analysts.

As of Friday morning, Beijing retaliated against President Trump’s tariffs by hiking levies on U.S. goods to 125%, up from the prior 84%. The retaliation came a day after Trump hit China with an effective tariff rate of 145% as both the U.S. and China are locked in a heated, once-in-a-century trade war.

“This isn’t Wall Street versus Main Street,” Fink emphasized, adding, “The market downturn impacts millions of ordinary people’s retirement savings.”

The good news: Two days earlier, Trump announced a 90-day suspension of additional country-specific tariffs for countries that have refrained from taking retaliatory measures—an apparent attempt to isolate China and use tariffs to get Beijing to strike a trade deal.

“Yes, in the short run, we have an economy that is at risk,” Fink said, but noted that artificial intelligence and rising infrastructure demand present “transformative investment opportunities.”

After the earnings call, Fink joined CNBC, where the globalist voiced even more concerns…

BlackRock CEO Larry Fink is in full panic mode over Trump’s new tariffs, warning they’re shaking global markets and pushing the U.S. toward deeper economic trouble.

He says the U.S. has gone from being a global stabilizer to a destabilizer under Trump’s leadership.

Fink also… pic.twitter.com/j5bBa8aqtU

— Shadow of Ezra (@ShadowofEzra) April 11, 2025

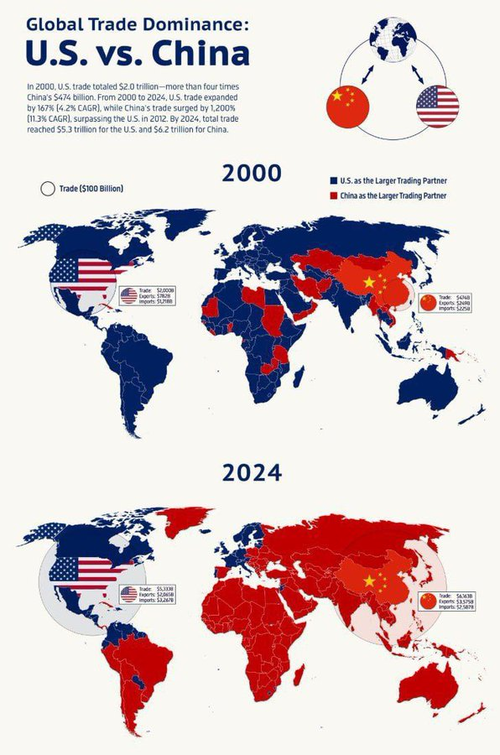

Yet Trump’s trade war is fundamentally about reviving America’s hollowed-out manufacturing base. Naturally, reshaping global supply chains will come with disruptions.

To end the week, there are no indications that either China or the U.S. is willing to sit down and resolve trade disputes, while new evidence mounts that dislocations in global trade have begun to emerge:

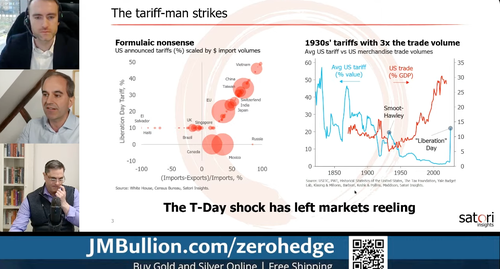

Separately, HSBC Head EM strategist Alastair Pinder and the legendary Matt King (formerly Citi’s top strategist who correctly called the Lehman collapse) debated on ZeroHedge on Thursday night with warnings about the incoming economic fallout from the trade war…

Continuing on the theme of global trade disruptions, Goldman analysts Dominic Wilson and Vickie Chang provided clients earlier with a note titled: Too Early for the “All Clear” that highlighted four downside risks for markets:

-

Substantial tariffs remain in place and the outcome even as it stands today looks considerably hawkish than was expected ahead of April 2. A simple thought experiment is to imagine that the current outcome—a 10% across the board tariff, a more than 100% China tariff, potential sectoral tariffs and large reciprocal tariffs to be implemented after a 90-day pause—had been announced. The implied roughly 15pp overall effective tariff rate increase would still have been a significant negative surprise to markets and its impact is still likely to be meaningful without further changes.

-

While the pause to reciprocal tariffs reduces some key tail risks, policy uncertainty remains very high, and businesses and consumers are likely to continue to be wary of making long-term commitments when the path of policy going forward remains very unclear.

-

Allocators are also likely to remain worried about the institutional and policy uncertainties that have led them to question their historic overweight in U.S. assets, while the recent price action has highlighted the risks both to longer-dated Treasury holdings and to the potential for simultaneous declines in U.S. equities and the USD that are especially painful for unhedged overseas investors. With some of the financial stress risk receding that often ultimately works to push the USD stronger (the left edge of the “dollar smile”), we think the case for ongoing USD weakness is intact, if not clearer.

-

The turmoil has revealed some cracks in the ability of the market to function effectively in the face of these kinds of large shocks. Confidence that Treasuries will provide an effective “safe haven” in periods of extreme risk is likely to have been dented and the back end of the UST curve could remain fragile.

What’s clear is that global trade disruptions are emerging, and this risk suggests to Goldman analysts that it’s still too early to give the “all clear” for markets.

As we were the first to warn this week – all eyes are on the Basis Trade blowing up (read here & here).

Loading…