Which economy will Fed Chair Powell choose to discuss this afternoon as, for the second time in less than two weeks, he will weigh in with his sense of what’s in store for Americans on inflation and jobs, and what the central bank may do about it if they veer off course.

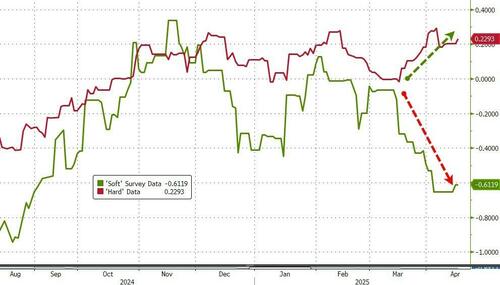

Will it be the ‘soft’ survey based economy (with this morning’s collapse in the New York Business Leaders survey as the latest example) or the ‘hard’ data based economy (with this morning’s surge in retail sales and manufacturing production showing strength)…

The last time he spoke (on April 4th – 2 days after Liberation Day), Powell voiced essentially a wait-and-see approach, saying “it is too soon to say what will be the appropriate path for monetary policy.”

Marcin Kazmierczak, Co-founder & COO of RedStone:

“Markets will be hyper-focused on Powell’s inflation commentary and rate cut signals, with any acknowledgment of economic growth concerns potentially triggering significant market reactions.”

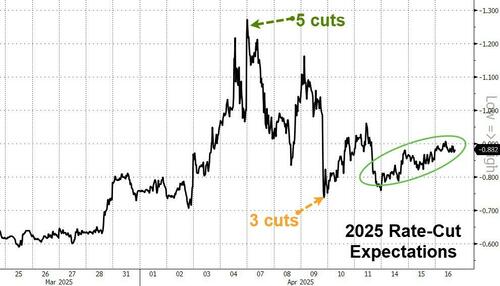

As Reuters reports, earlier this week Fed Governor Christopher Waller said that if Trump continues to peel back tariffs to a lower baseline, the central bank would do well to hang tight on interest rates in the first half of this year and perhaps cut gradually in the second half as tariff-elevated inflation subsides.

If Trump sticks to higher tariffs, Waller said, the unemployment rate could jump and the Fed would need to cut more aggressively.

Other Fed policymakers have been more hawkish, focusing on signs that short-term inflation expectations have surged and could, as St. Louis Fed President Alberto Musalem put it, “seep” into longer-term expectations, potentially forcing the Fed to keep rates high or even raise them further.

It’s not clear which view is closer to Powell’s, or in how much detail he might articulate which way he leans.

“Besides the guidance on rates (where a probability close to 80% is discounted for a rate cut in June), the market will be looking for cues about the Fed’s possibilities to deal with market turmoil,” says Commerzbank’s head of interest rates strategy, Michael Leister in a note this morning.

Of course, President Trump has been very public about his views on what he thinks Powell should do… demanding rate-cuts to prop up markets/economy during the interregnum between tariff teror and tax-cut euphoria.

Watch Fed Chair Powell speak live before the Economic Club of Chicago here (due to start at 1330ET):

Loading…