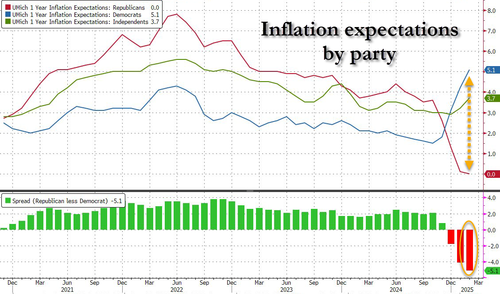

Back in February, economists and strategists were stunned by the February UMichigan consumer sentiment survey which indicated an absolutely ridiculous surge in 1Yr inflation expectations (from 3.3% to 4.3%), but not because everyone expects more inflation but because Democrats now expect something approaching hyperinflation at 5.1%, even as Republicans expect 0.0% inflation in 1 year (and how the average of these two adds up to 4.3%, maybe socialist UMich “professor” Justin Wolfers can tell us). Yet despite the clearly political, and thus unreliable, nature of the print the market moved dramatically, and hundreds of billions of market cap was wiped out as stocks sold off on fear of more Fed tightening in coming months.

Just because the number was so galactically stupid, we said that when the NY Fed’s inflation expectations printed last month that they would show an unchanged print and “dunk on the UMich idiocy.”

Watch as NY Fed 1Yr inflation expectations are flat and dunk on the Umich idiocy.

— zerohedge (@zerohedge) February 10, 2025

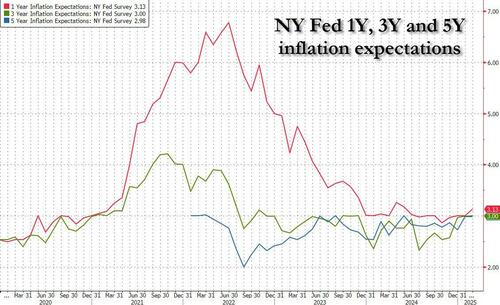

That’s precisely what the Fed revealed when it confirmed that far from soaring, 1-Year inflation expectations were not only unchanged at 3.00% – as we said they would be – but they came in below the median analyst estimate of 3.1%.

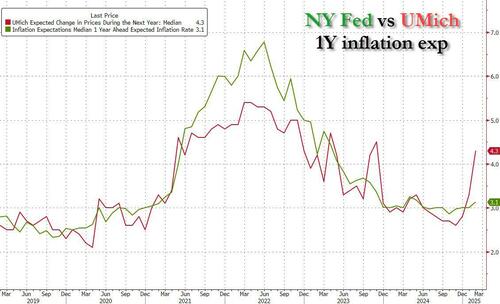

So fast forward one month to today, when this time we didn’t even bother to dunk on the ridiculously useless and politicized UMich “data”, and instead we knew that the latest NY Fed numbers would show continued normalization, and that’s precisely what happened, when according to the New York Fed’s survey of consumer expectations, inflation expectations at the one-year horizon were just barely higher at 3.1% in Feb. from the previous month’s 3.00%. At the same time, both 3Y and 5Y inflation expectations were unchanged! So much for some imaginary surge in inflation.

As a result, the gap in 1 Year inflation expectations between the NY Fed survey and the UMich survey – which will deliver its latest pile of steaming horse shit “data” later this week – has exploded so wide…

… even WSJ Fed mouthpiece Nikileaks Timiraos was compelled to comment on it for the second month in a row (and mock it).

That big jump in inflation expectations in the U-Mich survey? It isn’t registering in the NY Fed’s consumer survey for February.

Median 1-year-ahead inflation expectations increased by 0.1 pp to 3.1% and were unchanged at the three-year and five-year horizons (both at 3.0%) pic.twitter.com/uUc7YE5gBz

— Nick Timiraos (@NickTimiraos) March 10, 2025

And for those who claim that this is all due to confusion by the respondents, the NY Fed dunked on that as well, reporting that the the measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at the one-year horizon and was unchanged at the three- and five-year horizons.

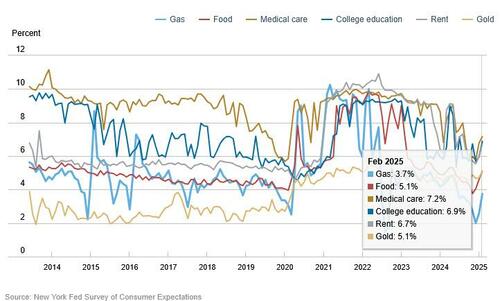

The report also showed that Americans now see faster price growth for gas, food, medical care and rent. Taking a closer look at the composition, year-ahead commodity price expectations increased for all commodities. Median expected price growth increased by 1.1 percentage points for gas to 3.7% (its highest level since June 2024), 0.5 percentage point for food to 5.1% (its highest level since May 2024), 0.4 percentage point for the cost of medical care to 7.2%, 1.0% percentage point for the cost of a college degree to 6.9%, and 0.7 percentage point for rent to 6.7%.

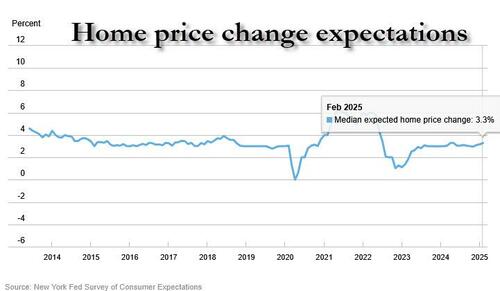

Rising inflation expectations are not just bad news: in deed, the median home price growth expectations increased by 0.1% point to 3.3%, suggesting household believe they will have more home equity in the future. That said, this series has been moving in a narrow range between 3.0% and 3.3% since August 2023.

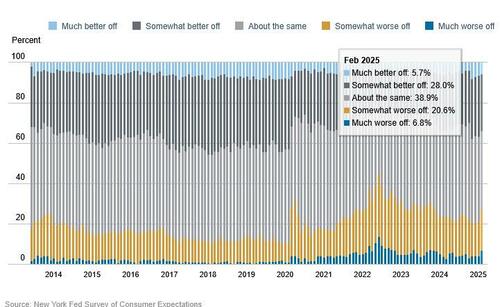

While expectations of inflation rose ever so slightly, consumers seem to be more pessimistic about their finances, and according to the latest survey, consumers’ year-ahead expectations about their households’ financial situations deteriorated considerably as the share of households expecting a (somewhat or much) worse financial situation one year from now rose to 27.4%, its highest level since November 2023.

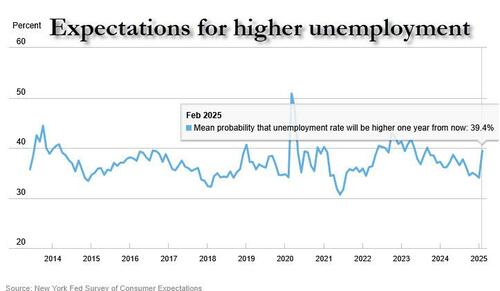

At the same time mean unemployment expectations, or the mean probability that the U.S. unemployment rate will be higher one year from now, jumped up by 5.4% to 39.4% in February, its highest reading since September 2023.

“Households expressed more pessimism about their year-ahead financial situations in February, while unemployment, delinquency and credit access expectations deteriorated notably,” the New York Fed wrote in a statement.

Workers were also more downbeat about their job prospects. The average probability of quitting a job in the next year — typically a sign of how confident consumers are in the labor market — fell to 17.6%, the lowest level since July 2023. The odds of finding a job in three months after becoming unemployed also declined, remaining below its 12-month average.

Aside from the job market, the report showed consumers dimmed their outlook for the stock market. The expected probability that stock prices will be higher in a year fell again to just 37%, the lowest since December 2023.

Finally, a larger percentage of consumers, 14.56% vs 13.32% in prior month, expect to not be able to make minimum debt payments over the next three months

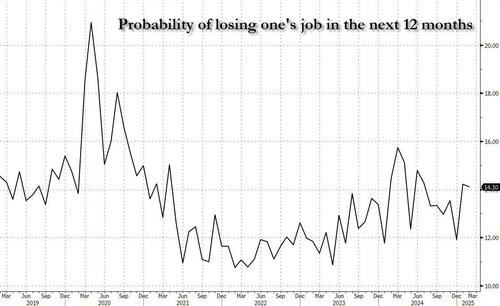

There was some good news: the survey found that the mean perceived probability of losing one’s job in the next 12 months dropped by 0.1% to 14.1%, after increasing by 2.3% in January, to 14.2%, which at the time was the highest since July

Here are some more observations from the latest survey, first looking at the Labor Market:

- Median one-year-ahead earnings growth expectations were unchanged at 3.0% in February. The series has been moving within a narrow range between 2.7% and 3.0% since January 2024.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—jumped 5.4 percentage points to 39.4%, its highest reading since September 2023. The increase was broad-based across age, education, and income groups.

- The mean perceived probability of losing one’s job in the next 12 months decreased by 0.1 percentage point to 14.1%. The mean probability of leaving one’s job voluntarily (expected quit rate) in the next 12 months decreased by 2.3 percentage points to 17.6%, its lowest reading since July 2023. The decrease in the expected quit rate was broad-based across education and income groups.

- The mean perceived probability of finding a job in the next three months if one’s current job was lost decreased by 0.3 percentage point to 51.2%, remaining below its trailing 12-month average of 52.5%.

… and Household Finance

- The median expected growth in household income increased by 0.1 percentage point to 3.1% in February. The series has been moving in a narrow range between 2.9% and 3.3% since January 2023.

- Median nominal household spending growth expectations rose by 0.6 percentage point to 5.0%, moving just above its trailing 12-month average of 4.9%. The increase was broad-based across age, education, and income groups, but most pronounced for those with at most a high school education and those with an annual household income below $50,000.

- Perceptions of credit access compared to a year ago showed a larger share of households reporting it is harder to get credit, and a smaller share reporting it is easier. Expectations for future credit availability deteriorated considerably in February, with the share of respondents expecting it will be harder to obtain credit a year from now increasing to 46.7% from 35.6%. This reading is the highest since June 2024.

- The average perceived probability of missing a minimum debt payment over the next three monthsincreased by 1.3 percentage points to 14.6%, the highest level since April 2020. The increase was driven by those without a college degree and largest for those under age 40.

- The median expectation regarding a year-ahead change in taxes at current income level increased by 0.2 percentage point to 3.4%.

- Median year-ahead expected growth in government debt decreased by 1.0 percentage point to 5.0%, the lowest reading since July 2017.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.4 percentage point to 25.4%.

- Perceptions about households’ current financial situations compared to a year ago were mostly unchanged, but year-ahead expectations about households’ financial situations deteriorated considerably. The share of households expecting a worse financial situation in one year from now rose to 27.4%, the highest level since November 2023.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now dropped by 3.3 percentage points to 37.0%, the lowest level since December 2023.

More in the full survey available here.

Loading…