Economists overwhelmingly regard uncertainty as economically corrosive. When households and businesses face murky outlooks—concerning inflation, policy shifts, or global crises—their response is remarkably predictable: hesitation.

This cautious behavior manifests in several ways: deferred consumer purchases, postponed hiring, and diminished capital investment, particularly for large-scale, irreversible ventures (such as data centers and energy projects to power a new information technology revolution.) Lenders compound the problem by tightening credit standards amid this heightened risk aversion.

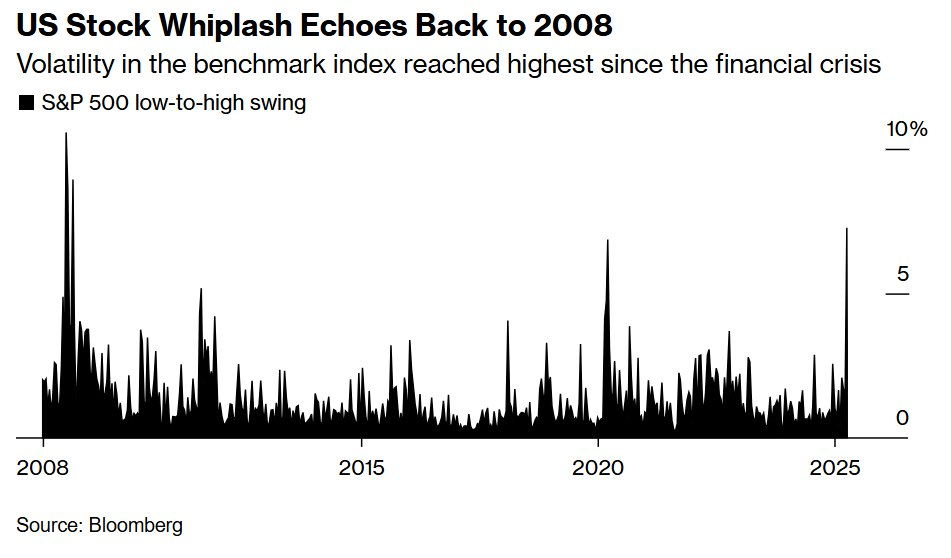

Historical data show that even modest upticks in uncertainty correlate with measurable contractions in industrial output and investment. The malaise intensifies during acute uncertainty spikes … such as those precipitated by the worst trade disputes in a century. The verdict is unambiguous: Uncertainty acts as a drag on economic dynamism.

But what do fancy-pants economists know? Just another group of point-ahead intellectuals!

For those with that populist opinion, The Wall Street Journal offers a compelling counterpoint in “Corporate Giants Shred Outlooks Over Tariff Uncertainty.” A group of WSJ reporters document how President Trump’s tariff unpredictability is wreaking havoc across Corporate America, turning strategic planning from science into guesswork. As airlines scale back hiring and fleet expansion while homebuilders brace for $5,000 price hikes on every house, the business landscape has become a minefield of unintended (although quite predictable by folks not working the White House) consequences.

Most striking, the WSJ finds, is the paradox of American manufacturers like RTX, an aerospace and defense company, facing $850 million in tariff costs despite spending hundreds of millions to expand US factories—a textbook case of trade policy working against its own goals.

The real damage isn’t just the tariffs—as harmful as they are—but their unpredictable nature. CEOs from Goldman Sachs to Virgin Group warn that while previous administrations imposed trade barriers, none did so with such shape-shifting inconsistency. When even auto industry giants and staunch allies like Elon Musk can’t influence policy, businesses have only one strategy left: hunker down and play it safe.

As economists correctly predicted, this protectionist chaos seems to be hamstringing the very economic boom it was meant to spur. Unfortunately for American business, help may not be on the way. This from investment bank Piper Sandler:

Tariffs today are higher than his most ambitious proposals during the 2024 campaign and are at the highest levels in more than a century. Trump has always been and remains the driver of the trade agenda. There are likely to be few, if any, comprehensive deals with our major trading partners over the next couple of months. … It’s possible this has sobered the president and he will quickly take an off-ramp. This is more likely than it was a few weeks ago, but we doubt it will happen soon. It seems much more likely that absent considerably more economic pain, Trump is going to leave tariffs roughly where they are today. We think Trump’s pain threshold remains high and investors should remain defensive until evidence accumulates Trump’s pain threshold has been reached.

The post Uncertainty from the Trump Tariffs Is a Certain Thing appeared first on American Enterprise Institute – AEI.