Moments ago, the Treasury sold the week’s final coupon auction and after a stellar stopping through 2Y sale, a mediocre, tailing 5Y, today’s 7Y was the ugliest of the lot.

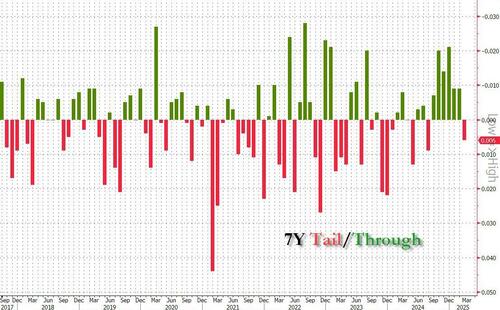

Stopping at a high yield of 4.233%, the auction yielded 0.4bps more than February and also tailed then When Issued 4.227% by 0.06bps; this was the first tail for the 7Y tenor since August 2024.

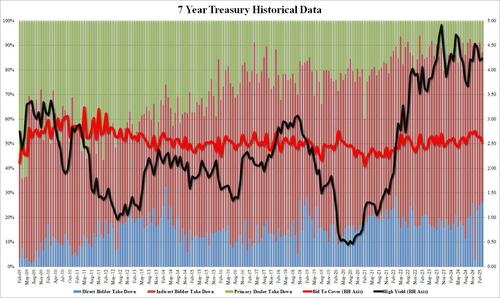

The bid to cover dropped to 2.534 from 2.638, the lowest since August 2024, and obviously below the six-auction average of 2.69.

But it was the internals there were downright atrocious, as Indirects were awarded only 61.2%, down from 66.1%, and the lowest since March 22! At the same time, Directs jumped to 26.1% (the most since, yes, March 22), which left just 12.7% to Dealers.

Overall, this was the ugliest 7Y auction in years, and while not as catastrophic as the legendary Feb 2021 auction which was, for all intents and purposes, failed, the taste left in investors’ mouths after the dismal lack of foreign demand will reverberate for a long time, because it has been a while since we saw such ugly auctions on days when the market is melting down.

Loading…