So where are corporate profits going to come from as globalization, price-gouging, planned obsolescence, shrinkflation and immiseration run out of rope?

We all know there’s a time lag between the moment Wile E. Coyote runs off the cliff at full speed and the moment he realizes there’s nothing but thin air beneath his feet. His expression in the second before he begins his descent communicates surprise, fear and a woeful awareness of impending impact with unforgiving ground.

This is an apt description of the present moment. The economy has already run off the cliff, but we haven’t yet experienced that second of realization that there’s nothing but thin air below.

We can call this the Wile E. Coyote Recession, as there is a time lag of around one quarter between the moment we left the cliff edge and the moment we start falling. The economy has momentum, as what’s in transit and in the warehouses is already in the pipeline. But now that Deglobalization has disrupted supply chains, once what’s in the pipeline has been distributed, the new realities start playing out.

Legions of economists and financial pundits are claiming to measure the odds of a recession. This is akin to Wile E. Coyote attempting to measure his odds of catching the Roadrunner in mid-air: the recession is already a matter of gravity.

Similar prognostications are being issued about the stock market, which depends on many factors, but the one that looms largest is corporate profits. If profits rise, this justifies higher stock valuations. If profits fall sharply, then stock valuations will adjust downward.

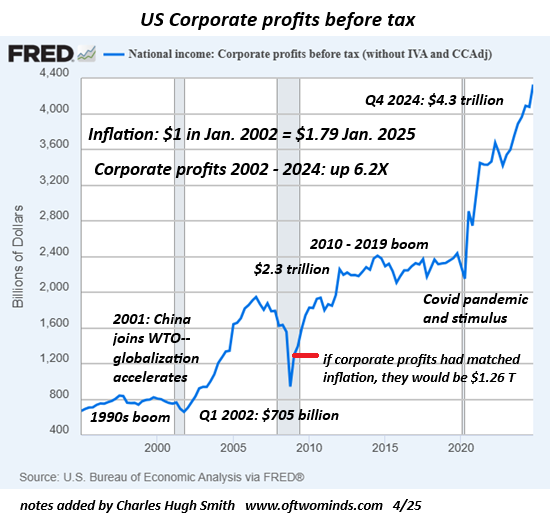

Two charts reveal the primary sources of soaring corporate profits: globalization from 2001 to 2024, and profiteering from 2020 to 2025.

Here we see that corporate profits were in the $700 billion to $800 billion range all through one of the greatest booms in American history, 1995 to 2000. This was sufficient to spark an economic boom and a booming stock market.

Then globalization kicked into high gear in 2001 with China’s entry into the WTO (World Trade Organization). As corporations rushed to offshore production. profits soon tripled to the $2.2 trillion – $2.4 trillion range, a range that held steady through the 2010-2019 boom in GDP and stocks.

The Covid pandemic lockdown triggered a mini-crash which was reversed by unprecedented monetary and fiscal stimulus. In the span of a few years, corporate profits nearly doubled. Since globalization had been a force for two decades, this extraordinary rise can’t be attributed to that factor.