Authored by Kane McGukin via BombThrower.com,

A Controlled Unwind and a New Bretton Woods with Bitcoin

For over a century, the global financial system has been increasingly built on papered-over leverage, fiat expansion, and financial engineering. Since 1913, governments, financial institutions, and central banks have systematically distorted money and markets, creating an unsustainable system of derivatives, credit expansion, and hidden leverage.

That’s the state of the system today.

We are witnessing the tough decisions required to begin a great unwind—a shift back to sound money, a purge of systemic leverage, and the restructuring of the monetary order. If controlled, this transition will be painful but orderly. If not, we risk a chaotic collapse akin to 1929 or 2008.

The key players in this transition? Trump and Scott Bessent, who have both signaled a shift back to sound money. But they cannot simply declare a return to a gold-backed dollar overnight. Doing so would implode the current system immediately.

Instead, they appear to be executing a multi-step plan to transition the U.S. financial system away from fiat-based leverage and back toward a structure rooted in gold, commodities, and Bitcoin.

Step 1: The End of the Fiat & Derivative System

For more than a century, the world has been built on leveraged financial claims that far exceed the actual underlying assets.

-

Gold is the hidden anchor of the system, yet governments and central banks have deliberately suppressed its price through paper derivatives.

-

Rehypothecation and derivatives have created a massive pyramid of financial claims, where multiple institutions believe they own the same underlying gold, Treasuries, and assets… many times over.

-

The U.S. debt and Treasury market, supposedly “risk-free,” is now the most fragile part of the financial system, with debt levels soaring beyond sustainability.

Why Now?

Foreign buyers (China, Russia, BRICS nations) have all but stopped accumulating U.S. Treasuries—a clear sign of de-dollarization. De-dollarization efforts are accelerating, as nations seek settlement alternatives outside of the U.S. financial system. At the same time, the dollar is rising as countries scramble for them to pay off dollar-denominated debt. Is it the ultimate catch-22?

U.S. deficits have reached unprecedented levels. We are currently at 123% Debt to GDP while rising interest rates are making debt servicing mathematically unsustainable.

The only realistic way forward is monetary restructuring, either through a controlled transition (Bessent & Trump’s plan) or a disorderly collapse. Oh, and of course we have to cut out the political fraud. Robbing citizens via the tax code to create generational wealth for both sides of the aisle is beyond uncalled for.

Step 2: Signaling the Shift Toward Sound Money

Trump and Bessent appear to be signaling the end of fiat leverage and the return to a more sustainable monetary system.

The purpose of this move?

Send a clear signal to smart money that the system is shifting, pushing intelligent investors to exit paper holdings before an uncontrolled collapse forces them out at a loss.

Key Signs of the Shift

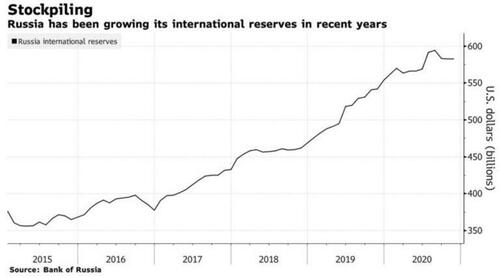

✅ Gold Accumulation – Russia, China and now the U.S. government have been quietly accumulating physical gold since 2016-2018.

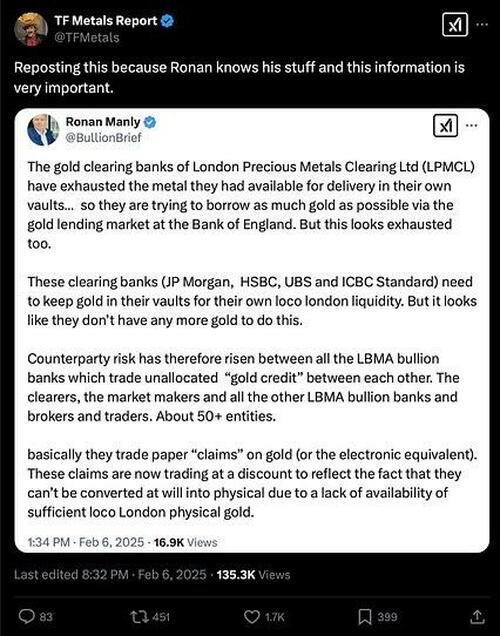

✅ LBMA & COMEX Physical Shortages – The inability to deliver physical gold in recent weeks hints that paper gold markets are running out of actual supply.

✅ Gold is Being Revalued Quietly – The price of gold is rising without triggering panic, suggesting strategic positioning before a formal acknowledgment of gold’s role in the financial system.

Step 3: Centralization of FICC Trading: Flushing Out Leverage

A critical component of this transition is the planned centralization of all FICC (Fixed Income Clearing Corporation) trading by 2025-2026. The SEC will require “most market participants to centrally clear cash and repo U.S. Treasuries, imposing significant changes to market structure.” The game board is being reset.

Why Does This Matter?

The U.S. Treasury market is a second derivative of gold, meaning its value is ultimately tied to faith in the dollar, which in turn rests on confidence in gold and sound money.

The carry trade (T-Bill arbitrage) has become one of the most leveraged trades in history, with estimates of 150-300% leverage on second-order derivatives.

We’ve watched this movie before with the LIBOR fixing scandal that led to 2008.

In 2017 the Alternative Reference Rate Committee (ARRC) announced that lending markets would transition from LIBOR and Eurodollar to SOFR (in 2023). Even with six years of warning, when actual implementation went into effect we saw major liquidity disruptions, contributing to regional bank failures like Silicon Valley Bank, First Republic, and Signature Bank.

Yes, it’s true. SVB and First Republic made very basic bond 101 trading mistakes. Signature Bank was captured by Elizabeth Warren’s Chokepoint 2.0. The real point, changing the foundations of the system tends to cause major liquidity problems.

What Tends to Happen?

- Forced purging of leverage, much like the collapse of FTX, Celsius, and BlockFi in the crypto market.

- Major market disruptions, liquidity freezes or credit crunches similar to 2023.

- Forced selling and margin calls, wiping out hedge funds and institutions like 2008. The current bet is massive risk-free Treasury arbitrage trades—which are, in reality, “all risk and no free part”.

This is a necessary but painful process to clear bad leverage from the system before a sound money reset.

Step 4: Early Exiters Moving into Bitcoin: Is it a 1930s Gold Rush Replay?

During the Great Depression (1929-1933), those who saw the collapse coming moved their wealth abroad, into gold, or other hard assets. Those who didn’t, maintained debt and excessive spending right up until they were wiped out. After FDR confiscated gold in 1933 and revalued it in 1934, those who had already positioned themselves benefited massively.

Is the Same Happening with Bitcoin?

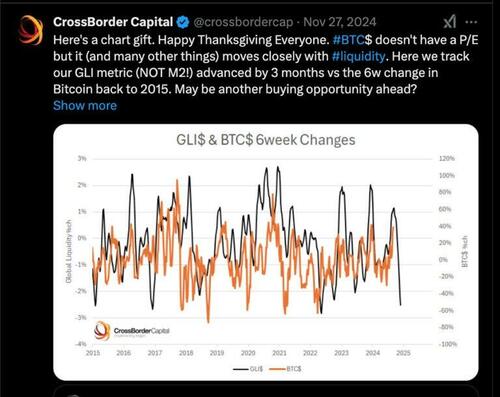

Worst case, Bitcoin is serving as the next central bank liquidity tool. Best case, Bitcoin is serving as the escape hatch; allowing early movers to front-run the financial system reset.

source: https://x.com/crossbordercap/status/1861814218971812298

Institutional Bitcoin adoption (BlackRock, Fidelity, MicroStrategy) has already begun, positioning themselves ahead of the shift into the maturity phase.

Bitcoin ETF Authorized Participants (APs) most likely will enable Bitcoin rehypothecation, because they are banks and that’s what they do. This will start a new leverage cycle from a clean basis (post-reset). The chairs will be returned and the music will start again.

Early movers will have preserved their wealth, while those who remain trapped in the old system risk being wiped out as it unwinds.

Step 5: An Unavoidable Market Collapse and the New Bretton Woods

What Happens Next?

A some point, the tough decisions will lead to a financial crisis that will pop the “everything bubble” we’ve pumped full of air. The Treasury market unwinds and leverage will be purged. After the carnage, the foundations will have been laid and the new global monetary system announced—a modern Bretton Woods 2.0. That’s just how the story always unfolds.

If the US does launch a Sovereign Wealth Fund it will likely include Bitcoin as part of the new reserve framework. A multi-reserve structure is likely, where nations hold gold, Bitcoin, and commodities as settlement assets, instead of relying solely on fiat. This will bring optionality and internet rails to money.

Final Thoughts: A Controlled Transition or a Chaotic Collapse?

History suggests that financial markets rarely unwind in an orderly fashion when leverage is this extreme, and we currently sit at the tip of a debt iceberg of historic proportions.

🚨 Key Risks to Watch:

-

The Fed and Treasury losing control of the unwind, leading to chaotic deleveraging and rampant inflation.

-

Foreign actors China, Russia, BRICS, and their positioning for a role in the new global order.

-

Market participants panicking too early, creating a domino effect of collapses.

If the transition is executed successfully, it will stabilize the system, reset the monetary order, and prevent an outright collapse.

However, if panic takes over, at some point we would likely repeat a 1929 or 2008 but on a much larger scale. Debt will be the key. It’s in uncharted territories this time. Countries and individuals will find they are no different. The less debt you have the easier it will be to manage your way through the crisis that always comes.

Key Takeaways

✅ The fiat and derivative system is mathematically unsustainable.

✅ Trump/Bessent/DOGE (Elon) are positioning for a return to sound money.

✅ Gold accumulation and market signals are the first signals.

✅ FICC centralization could trigger a leverage purge when implemented in 2025-2026.

✅ Bitcoin will serve as a liquidity tool or an escape valve for early movers.

✅ A new Bretton Woods will emerge. Will it feature Bitcoin and gold?

The only question left is: Will this transition be controlled or chaotic? Because it is underway, whether we like it or not.

* * *

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto and The CBDC Survival Guide when it drops. Subscribe to Kane McGukin’s Substack here.

Loading…