Submitted by QTR’s Fringe Finance

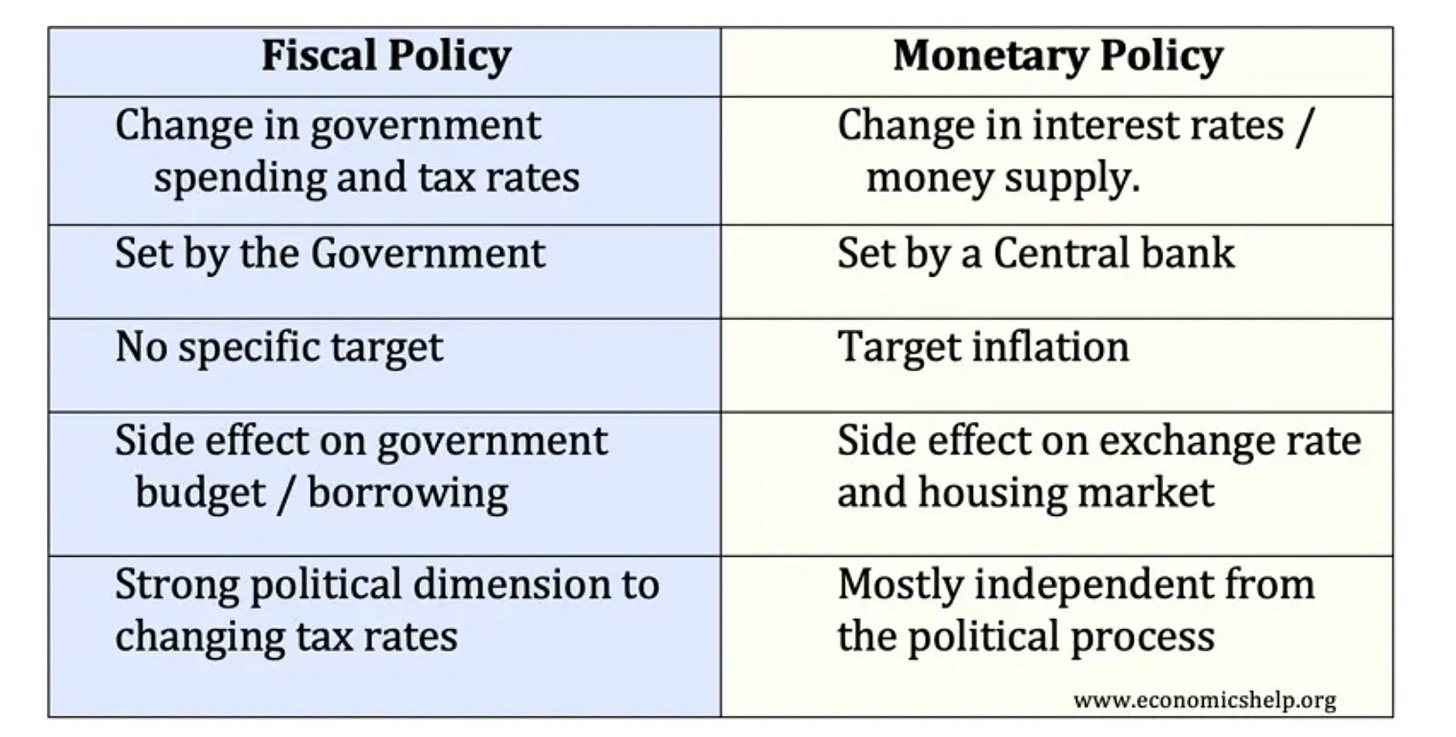

I’m a realist. I understand there’s always going to be hypocrisy on both sides of the political aisle. And I also understand that, as far as politics go, monetary policy is pretty much “the third rail.”

As I’ve always said, if there’s one thing that should alarm you about today’s monetary policy — which is damn close to full-on modern monetary theory — it’s the fact that both political parties agree on it. Are there any other issues that you can think of off the top of your head that both parties agree on and never argue about? I sure as hell can’t.

But while both parties have generally embraced the way the country has run monetary policy, their respective stances on how the country runs fiscal policy are quite different. And therein lies the basis for why today’s revelation matters.

There’s no doubt the United States needs to make dramatic spending cuts to prevent itself from spiraling—either downward into an eventual debt default or upward into hyperinflation. If you want a primer on why that is, I’d recommend listening to this one-hour, simple-to-understand synopsis of the country’s financial position, followed by this appearance by Jim Bianco on the Julia LaRoche podcast a couple of days ago.

Right now, the political climate consists of Republicans taking a chainsaw to anything they can get their hands on in government to cut spending, and Democrats protesting any and all cuts for any reason they can drum up. Hashing out individual issues worthy of cuts is not what this article is about, so we’ll save that discussion for another day.

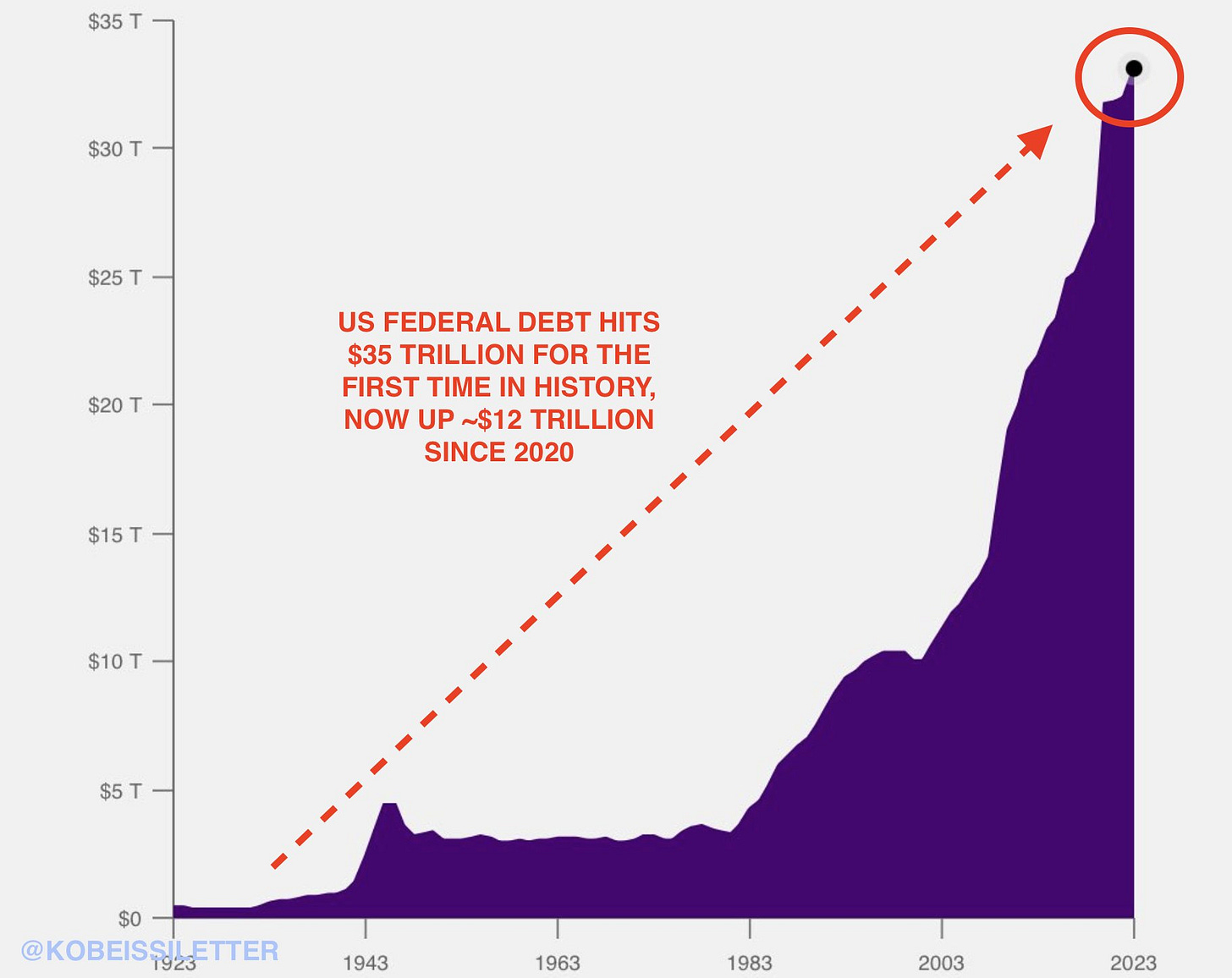

This article is meant to point out the fatal hypocritical flaw that exists in Democrats’ reasoning as it relates to the country’s financials. Everybody understands the simple idea that if we run up too much debt, the country could, in essence, go bankrupt. But what’s really alarming now is the pace at which we are running up this debt. It’s why this chart of the national debt is going parabolically higher. The number $35 trillion is astonishing — but the rate with which we are moving higher is beyond breakneck.

Source: Kobeissi Letter

The cuts that are being attempted are a direct effort to address the size of the deficit, which is a fancy word for how much more money the U.S. goes into debt every year. The idea is to slow the pace of debt accumulation and then eventually reverse course to start paying it down.

Make no mistake about it—the Biden administration did not give a single solitary f*ck thought to how fast we were running up debt. The deficit under the Biden presidency propelled the debt to unprecedented levels that put us on an extremely dangerous trajectory. There appeared to be zero discretion or care in how the Biden administration spent. This is pretty much par for the course for Democrats, who generally believe there should be no ceiling on how high taxes can go and how big government can get, and nothing is off-limits to tax, regardless of how regressive.

The topic of government ever getting too big or taxes getting too high is never broached. As policy, Democrats fight for their right to push the economy to the brink.

🔥 50% OFF FOR LIFE: ZH reader exclusive | This coupon entitles you to 50% off an annual subscription to Fringe Finance for life: Get 50% off forever

Economists on the left have supplemented this asinine policy with the complex-sounding bullshit jargon of modern monetary theory, which, without getting into the intricacies of it, posits that the Fed can print as much money as it needs without any consequence, and we have through the miracle of academia, in essence, unlocked some Game Genie-like cheat code for the nation’s economy.

Again, both parties embrace monetary policy as it exists today (i.e. Trump calling for rate cuts this week) but only one party believes that spending can be unlimited and that there are no consequences to poor economic decisions.

The modern-day left presents themselves as the party that fights for not just equality, but equity. They’re no longer happy with just equality of opportunity; they want to push for equality of outcome. In other words, Democrats claim they want a system that moves closer toward a socialist state planned economy. While I don’t agree with the idea, I understand that many people who vote Democrat do and think the world would be a better place if the rich had a little less, paid a little more in taxes, and the lower class had a little bit more. These voters believe that more top-line revenue should go toward increased federal spending and social services to benefit those at the bottom of the economic totem pole. Sounds altruistic enough, right?

But the darkest secret of the party that pushes for far-left monetary policy and far-left fiscal policy is this: the more the Federal Reserve continues operating as it has — monetizing debt, bailing out the U.S. economy, and generally perpetually implementing easing conditions — the faster our nation moves away from the socialist utopia that Democrats often say they envision. And you don’t need any more proof of that than a look at how the inequality gap has widened over the last three decades.

This one chart tells the whole story, and lays bare the Democrats’ attitude toward monetary and fiscal policy bare for the hypocritical farce it is. So much for equity:

Once again, on monetary policy, both parties are guilty.

But on fiscal policy, the Democrats are causing significantly more harm than Republicans with the way they view the nation’s finances. Most modern-day Democrats believe that since the U.S. dollar is the world’s reserve currency, we can print as much as we want and there will be no consequences. They don’t believe in any type of basic economic laws anymore, instead choosing to have faith that these laws have been hypnotized, stunned and then usurped by the magic spell of modern monetary theory, which has solidified the ideas that up is down, down is up, the sky is green, the grass is blue, and Paul Krugman has superpowers that supersede thousands of years of mathematics and economic laws as the human race once knew them.

Looking at the above chart, I think both parties would agree that we have an inequality problem, and the current trajectory we are on with monetary policy is making it worse.

But only one party is at least trying to do something fiscally to keep this monetary fueled gap somewhat steady at where it is today. Democrats, on the other hand, believe they have perfected both monetary and fiscal theory, and that, for the years they have been in charge, everything has gone exactly as planned.

Except it hasn’t. What the above chart shows is that the top 10% of the nation gets significantly, extraordinarily, disproportionately wealthier every time the Federal Reserve steps in to implement quantitative easing.

And what you’ll notice in the chart is that the gap between the lowest 50% of the nation and the top 10% continues to widen. In other words, this is a problem that is getting worse, accelerating and shows no signs of stopping today. On this trajectory, at some point, quality of life for the bottom 50% of the nation is going to get so poor that someone will make this same point on a platform that garners significant attention, and it’s going to click with more everyday people. Maybe at that point, both parties will come together and have a legitimate discussion about monetary policy.

But one thing is for sure: If a lot of center-left Democrats I know understood this point clearly, they might seriously reconsider what it is that their party claims to be fighting for in the first place. And if the concept takes hold and has time to sink in with the nation, it could wind up being yet another issue that Democrats lose a significant tranche of voters over—at a time when their party can least afford it.

Both parties are to blame for flawed monetary policy, but at least Republicans are now floating some sound money ideas and cuts that work toward balacing the budget. As for Democrats, they may say their interests are in increasing equity and equality for their voters, but the policies they put forth instead scream that they want the billionaires and the mega-rich to get significantly wealthier, while the bottom 50% of the nation’s quality of life continues to be brutalized.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. Assume any and all numbers in this piece are wrong and make sure you check them yourself. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Loading…