Whether or not economists are predicting an outright recession, forecasts of slower growth ahead are pretty common these days thanks to President Trump’s new tariff policies. Even he concedes there will be “pain.”

But let’s set aside near-term impacts. Assuming Trump doesn’t take an offramp ASAP, the Tax Foundation’s model predicts the announced tariffs will reduce US GDP by 0.7 percent over the next decade, not including any negative effects from foreign retaliation.

But that’s not all. And as my AEI colleague Kyle Pomerleau explained in a must-read blog post yesterday, that estimate—as gloomy as it is—fails “to capture the burden the tariffs place directly on investment, the inefficiencies of allocating more workers and capital towards less efficient industries … which will further reduce US output.”

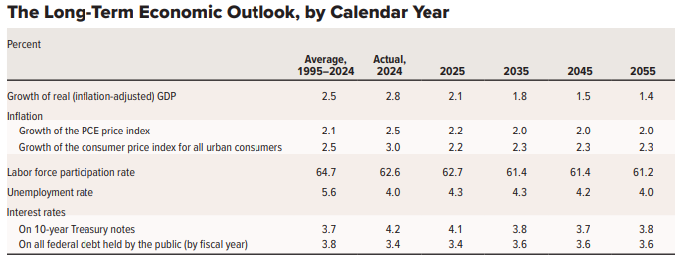

But what’s a few tenths of a percentage points here and there over a decade when you’re dealing with a $30 trillion economy? The problem is that we’re talking about an economy that doesn’t grow as fast as it used to. In the second half of the past century, real GDP averaged 3.7 percent annually versus 2.1 percent during the first quarter of the 21st century. And in the decades ahead, even slower growth is the consensus outlook.

Here’s the Congressional Budget Office long-run forecast:

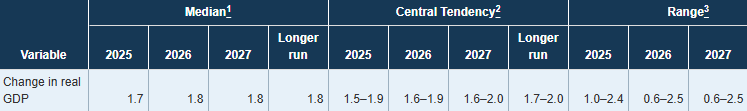

And the economic projections of Federal Reserve board members and Federal Reserve bank presidents:

Sure, those numbers don’t include the possibility of a big productivity boom due to advances in artificial intelligence. But policymakers shouldn’t rely on AI to save them from bad, anti-growth decisions.

Wherever possible they should instead try to optimize for growth—or at least deeply consider the growth impacts—of particular policies, whether about taxes, immigration, R&D investment, regulation, or, yes, trade. The stark divergence between post-war prosperity and 21st-century sluggishness highlights the cost of complacency. Each percentage point, or fraction of a point of foregone growth representing hundreds or billions or even trillions in lost prosperity over time as even modest policy missteps compound dramatically.

For example: I note in my 2023 book, The Conservative Futurist, that if post-1973 growth had matched the pre-1973 pace, the US economy could be twice its current size. Similarly, median household income could have exceeded $125,000 instead of hovering around $70,000. (Numbers through 2022.).

Oh, and we shouldn’t forget the risk to AI progress from tariffs. These import taxes on steel, electrical transformers, and data center components will raise costs throughout the AI supply chain. The result: higher costs for AI users, leading budget-conscious companies to scrutinize such technology spending more carefully. This could slow both adoption and innovation in an already dodgy and uncertain economic environment.

Yet another tariff downside that’s tough to model but with a serious potential impact.

The post Tariff Harms: Economic Injury by a Thousand Cuts appeared first on American Enterprise Institute – AEI.