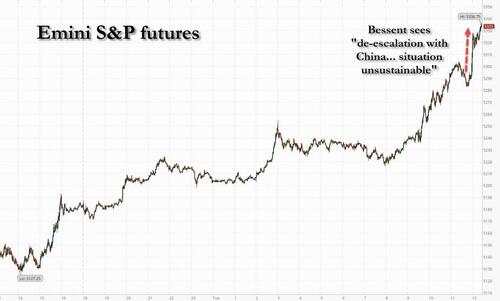

US equity markets were already ramping higher, as yesterday’s massive short pile up reversed and transformed into a squeeze (and force out of underexposed systematic funds), when an 11:58am ET headlines from Bloomberg, suggesting… well… the obvious, namely that the trade war with China is unsustianable in the long run according to Bessent…

- *BESSENT SEES DE-ESCALATION WITH CHINA, SITUATION UNSUSTAINABLE

… sent the US equities to session highs, up 3% and reversing all of yesterday losses.

The broad risk on move has sent the dollar higher, hitting the yen and euro, and pushing the USDJPY well above 141 (after sliding below 140 overnight) and the EURUSD has pushed to session lows, down 0.5%, while the US 10y yield is near its richest levels of the day, down 3bp. Gold is also sliding and was below $3400 after hitting a record high $3500 just a few hours earlier.

Today’s rally is already shaping up as the biggest since Trump’s tariff pivot on April 9. According to UBS S&T, money is flowing back into High Momentum {UBQQHMTM}, up 3.5%, with groups like M&A Banks {UBXXMABK}, up 2.8%, and AI Power {UBXXVOLT}, up 3.4%, benefitting. Some more notable flows:

- A risk-on rotation is visible in Volatility {UBPTVOL}, up +2.5%, versus Quality {UBPTQLTY}, down 1.4%. Lower quality pockets are bouncing back most forcefully with De-SPACs {UBXXDSPC} up 3.5%, and Low Quality Credit {UBXXCRED} up 3%.

- Tariff Losers {UBXXTTL}, up 2.8% stabilise, note the basket outperformed meaningfully during Monday’s selloff in a sign of washed out positioning.

- Defence Primes {UBXXPRME} are down 3%, though note about two-thirds of the move is driven by Northrop after disappointing earnings.

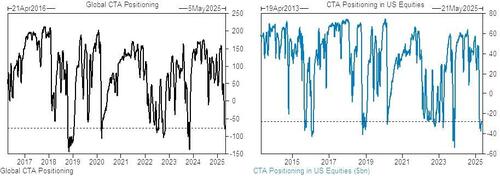

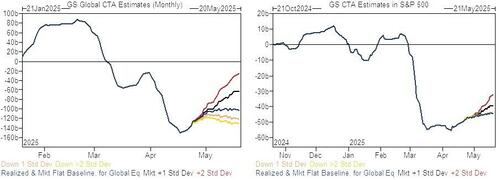

Another reason for today’s meltup is the reversal of yesterday’s meltdown, as panicked systematic funds scramble to buy. According to Goldman’s Cullen Morgan, the systematic macro rebalance has effectively been completed, with global equity length going from approximately an 8 out of 10 during the YTD/February highs to a 1 out of 10 currently, of $53bn and representing a short position from CTA/trend followers and 1-yr low lengths from risk parity style + VA vol-control products.

As a result, Goldman now has CTAs as modeled buyers in every scenario over the next week and month.

Loading…