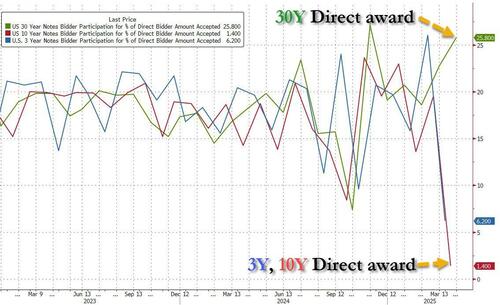

After this week started with a dismal 3Y auction and a solid 10Y auction yesterday, both of which however saw a collapse in the Direct bid, many – certainly we…

30Y auction in an hour: Directs were 22.7% in March. How low will they drop today? (over/under 3%)

— zerohedge (@zerohedge) April 10, 2025

… were dreading to see what the Direct award would be in today’s auction. We get the result moments ago when the Treasury sold a $22 billion reopening of the February 30Y in the form of a 29 Year, 10 Month reopening.

The results were stellar across the board!

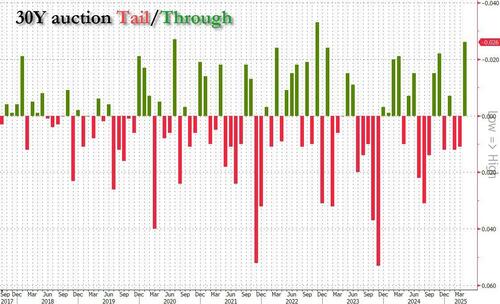

The high yield was 4.813%, up sharply from 4.623% last month and the highest since January. But more importantly, while many were expecting the auction to tail, instead we got a massive 2.6bps stop through the When Issued 4.839. This, as shown below, was the highest stop through since Nov 2022 and the third highest on record!

Looking at the bid to cover, no big surprises there: at 2.435, it was above last month’s 2.366 but just below the recent average 2.47%.

But it was the internals that were the big story again: while Indirects were awarded 61.88%, or roughly the same as last month’s 60.45%, below the recent average 67.0%, and hardly an upside outlier like yesterday’s record Indirect award to the 10Y auction, it was the Directs that everyone was looking at again because as we noted earlier today, the Basis Trade is blowing out again.

Basis trade resumes rapid unwind https://t.co/Jkbi76Otw9 pic.twitter.com/9Lr3R555j1

— zerohedge (@zerohedge) April 10, 2025

Only this time, this did not manifest itself in a collapse in the Direct award, on the contrary. As shown in the chart below after plunging Direct takedowns in the 3Y and 10Y auctions, today’s 30Y auction saw a surge in the Direct award to 25.8%, up from 22.7% and the 2nd highest on record!

The market reaction was curious: while yields dropped modestly amid relief there was not major challenges to digesting the sale of long-dated paper, stocks plunged, with spoos tumbling from 5300 to below 5200 in minutes, in what appears to have been disappointment that yields arent going to blow out and force the Fed to step in and bailout the market sooner!

Then again, since the Fed continues to allow the unwind of the basis trade (just look at the ongoing collapse in the swap spreads) we are confident that stocks will have more than enough opportunities to blow up the bond market and force Powell to finally panic.

Loading…