Well, the 10Y auction is in the bag, and after yesterday’s very ugly 3Y, today’s sale was very solid, at least until one looks a bit deeper.

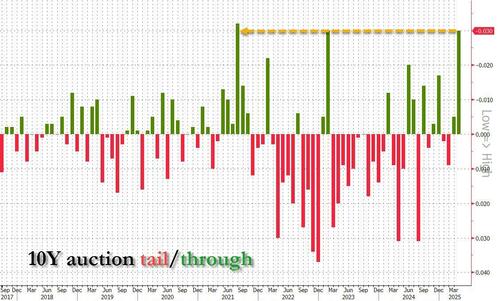

First, looking at the headline numbers, we find that the high yield jumped from 4.310% in March to 4.435% today, which is remarkable in itself considering the 10Y was 3.87% on Friday! Still, while the yield was clearly high (and could have been even higher had swap spreads not tightened ever so slightly), it stopped through the 4.465% When Issued by a whopping 3bps. This was tied for the 2nd biggest stop through on record, and the one previous time when we saw a 3bps stop through was in Feb 2023, just as the US banking crisis was raging.

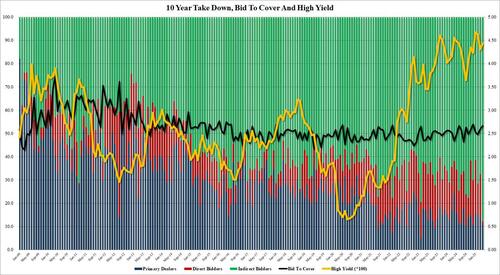

The bid to cover was also solid at 2.665, up from 2.588 and the highest since December.

But it was the internals where the real story was again for the 2nd day in a row. As a reminder, the big story yesterday was that the Directs had collapsed, a clear indicator that there was a funding squeeze taking place in the bond market (as we learned shortly after). And in fact, we warned earlier today that if the Direct award collapses in today’s 10Y auction, it could be ugly.

Yesterday’s collapse in the 3Y Direct award was the clearest indication there is a funding squeeze.

If we see a plunge in Directs in today’s 10Y auction (from 20% to ~7%) all bets are off

— zerohedge (@zerohedge) April 9, 2025

Sure enough, that’s where the punchline was in today’s auction because while Indirects soared to a record 87.9%, up from 67.4% and, well, the highest ever, Directs imploded from 19.51 to just 1.40%, the 3rd lowest on record!

Finally, Dealers were left with 10.7%, modestly lower from 13.1% last month.

Overall, the bond market was delighted with the outcome, and even though Directs did collapse, the fact that Foreign buyers are still active and seemingly couldn’t get enough of US paper, is the main reason why yields slumped shortly after the auction. This, coupled with the news that Trump was pausing tariffs on virtually everyone except China is why yields have collapsed to session lows after the tariff news.

Loading…