While many of the biggest trading desks are saying, “buy Mortimer buy!” as Trump provided the pain relief yesterday, most obviously highlighted by the 3rd best day for US equities in history, this morning it appears we have woken up with a hangover from the policy pivot party.

“We still believe the anxiety around tariffs are alive and well. Volatility works in both directions — down and up. The path forward likely includes more market swings as we do not have a conclusion. In fact, we have the opposite, a likely extension of the tariff negotiation process,” said Nathan Thooft at Manulife Investment Management in Boston, which oversees $160 billion.

CPI and Jobless claims this morning removed considerable threat of stagflation, though of course, the former – we are constantly told this morning – is ‘backward looking’.

“Healthy drop in inflation or big drop in demand?” said Bret Kenwell at eToro.

“At the end of the day, we do need to see lower inflation to justify lower rates from the Fed and ease the burden on consumers. However, getting lower inflation due to a material drop in economic activity — and thereby jeopardizing the economy — isn’t the best route to take.”

US equity markets have retraced more than half of the gains already….

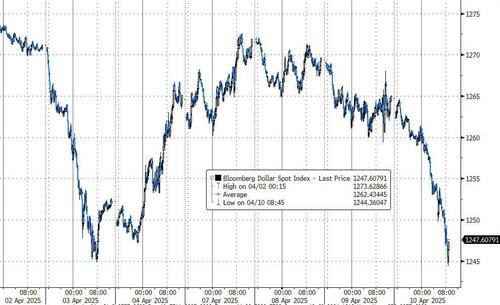

The dollar is getting clubbed like a baby seal…

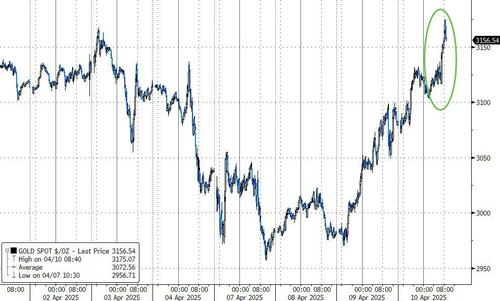

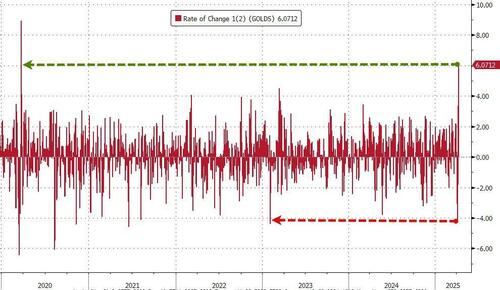

Gold exploded higher an uncertainty remains high, breaking out to a record high…

That is gold’s biggest 2-day gains since the COVID lockdown lows.

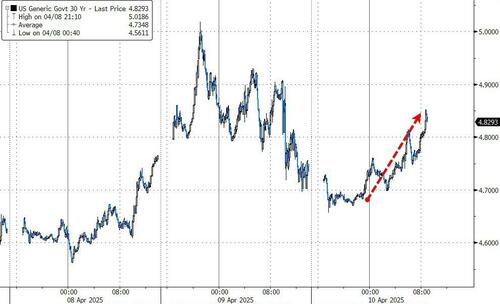

Treasury yields are blowing out again…

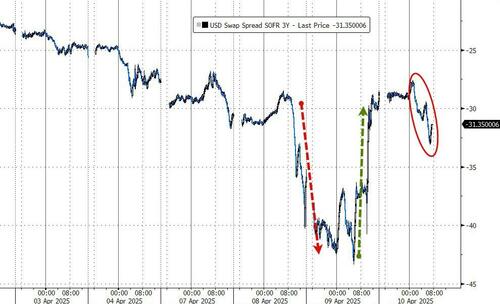

And even more problematically, SOFR swap spreads are plunging again as basis unwinds continue to stress funding markets…

“It’s the calm before the storm,” said Stan Shipley at Evercore ISI.

As one veteran trader at a major trading desk MSG’d us privately “shit’s breaking again… yesterday looks like the rip to sell.”

Somebody call Bessent!!!

Loading…