German agricultural and pharmaceutical giant Bayer fell in European trading after a Georgia jury ordered Monsanto’s parent company to pay $2.1 billion in damages to a man who claimed the company’s Roundup weed killer caused his cancer.

Late Friday, the State Court of Cobb County, Georgia, reached a verdict in favor of the plaintiff, John Barnes, who filed a lawsuit against Monsanto in 2021, seeking damages related to his non-Hodgkin’s lymphoma.

“It’s been a long road for him … and he was happy that the truth related to the product (has) been exposed,” Barnes’ attorney Kyle Findley stated, adding the verdict is an “important milestone” after “another example of Monsanto’s refusal to accept responsibility for poisoning people with this toxic product.”

Bayer acquired Monsanto in 2018 and has since been battered with dispute claims that Roundup’s key ingredient, glyphosate, causes cancer. The German company has set aside over $16 billion to settle the lawsuits.

Bayer responded to the penalties awarded that include $65 million in compensatory damages and $2 billion in punitive damages for the plaintiff:

We disagree with the jury’s verdict, as it conflicts with the overwhelming weight of scientific evidence and the consensus of regulatory bodies and their scientific assessments worldwide.

We believe that we have strong arguments on appeal to get this verdict overturned and the excessive and unconstitutional damage awards eliminated or reduced.

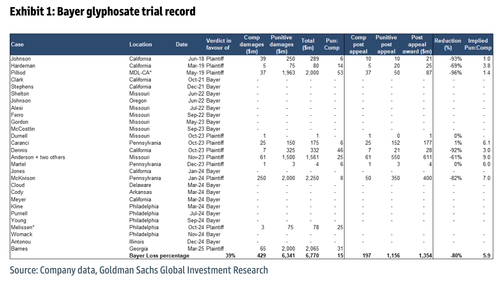

Earlier, Goldman’s James Quigley, Rajan Sharma, and others noted that this is the first case in Georgia, “typically awards are reduced on appeal.”

Here’s more from the analysts:

Late on Friday night (post EU market close), a jury ruled against Bayer in the Barnes Roundup case, leading to an award of $2.065bn (being $2bn punitive damages and $65m compensatory damages – see here). While each case is different, and this is the first case in Georgia (see Exhibit 1), typically awards are reduced on appeal. Bayer intends to appeal the judgment. As a reminder, at the end of 2024, the provision related to glyphosate related litigation was $5.9bn.

Bayer has been engaging with policymakers around the force of labeling regulations in the US (see here). Recently, in Georgia, both the state House and Senate approved SB 144 which ensures that any pesticide registered with the US EPA and sold under a label consistent with EPA standards, is sufficient to satisfy state label warning requirements. Bayer believes that this should prevent such state based claims from moving forward in court.

In addition, we also note that Bayer was recently granted an extension on the filing of the Johnson case with the US Supreme Court until April 18, 2025 (see here). As discussed in our 2025 outlook note for Bayer (see here), we continue to see positive risk/ reward into a potential Supreme Court filing/ acceptance by mid-25, with a final outcome expected by the end of the 2025/26 Supreme Court session.

Bayer glyphosate trial record

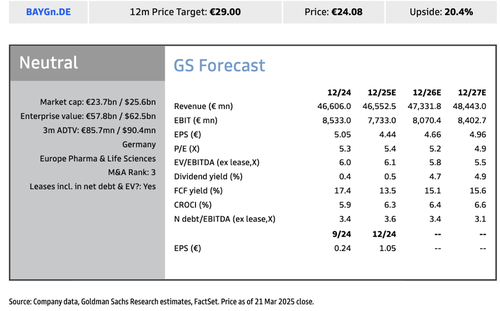

Quigley has a “neutral” rating on Bayer shares in Germany with a 28 euro 12mo price target:

Valuation: Our DCF is €30 per share which assumes a 10.8% WACC and TV growth rate of 1.5%, while our multiple based valuation is €28 per share, leading to our 12-month target price of €29 per share. Our target price suggests Bayer trades on c.6x 2026E P/E, with a 2026-29E PEG of around 1.0x which is below the sector average, but we think this is justified given uncertainty around the pipeline and the litigation overhang. We are Neutral rated.

Upside/downside risks:

-

Litigation outcomes (SCOTUS – glyphosate, Washington Supreme Court – PCB).

-

Success of clinical development pipeline and its ability to offset patent expirations.

-

High soft commodity price environment leading to sustained pricing power in the Crop Science division.

-

Slower-than-anticipated realisation of the cost and operational benefits form the new DSO operating model.

Bayer’s shares are down about 5% in European trading. Zooming out, shares are trading at 2004 lows….

. . .

Loading…