The Institute for Energy Research (IER) has released a new report titled Revenue Estimates for Repealing the Clean Vehicle Tax Credits (30D, 25E, and 45W). The analysis was conducted by EY’s Quantitative Economics and Statistics team on behalf of IER.

At the heart of this analysis is a growing concern over the soaring costs of the Inflation Reduction Act (IRA)—particularly its energy and electric vehicle subsidies. When the IRA was passed in 2022, the Congressional Budget Office estimated the cost of its energy-related provisions at around $370 billion over 10 years. However, subsequent estimates have significantly increased this figure. In 2023, Goldman Sachs projected the total cost of these subsidies at $1.2 trillion, while the Cato Institute placed the upper bound at $1.97 trillion as of March 2024. A major share of this spending stems from tax credits designed to encourage the adoption of electric vehicles (EVs).

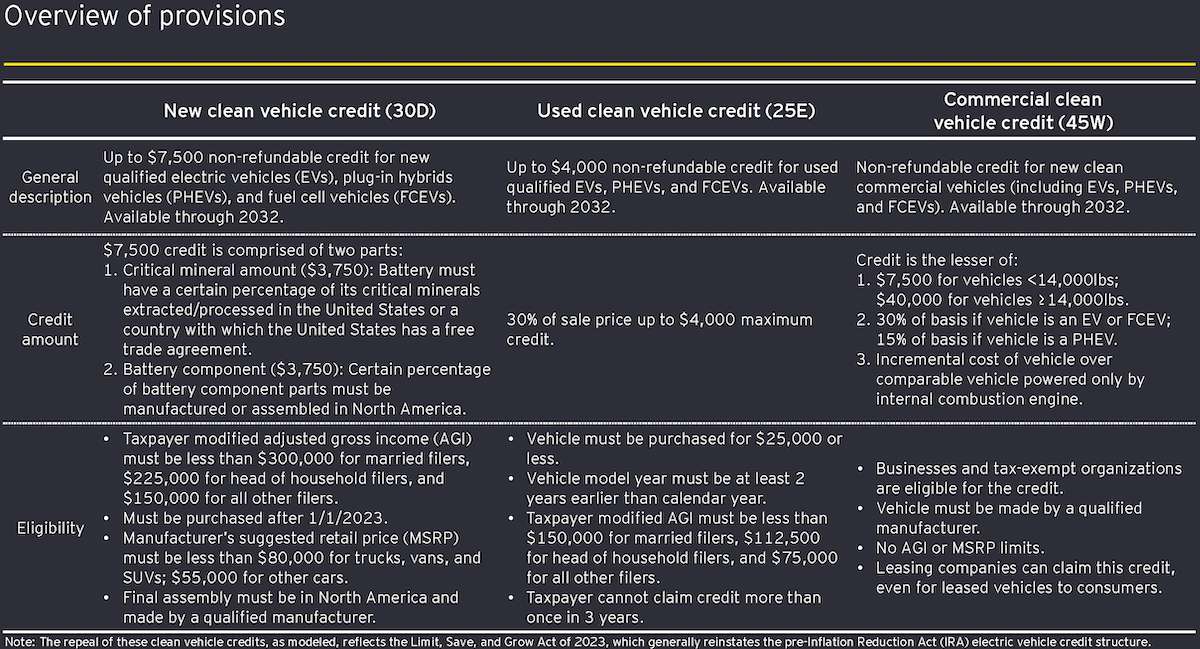

The new IER report outlines three key federal tax credits under the IRA:

- New Clean Vehicle Credit (30D): Offers up to $7,500 for the purchase of new EVs, plug-in hybrids (PHEVs), and fuel cell vehicles (FCEVs). To qualify, vehicles must meet sourcing requirements for critical minerals and battery components, and buyers must meet income caps ($300,000 for joint filers, $150,000 for individuals). There are also vehicle price limits: $80,000 for trucks/SUVs and $55,000 for other cars.

- Used Clean Vehicle Credit (25E): Provides up to $4,000 for the purchase of used clean vehicles priced at $25,000 or less. This credit is subject to similar income limits and may be claimed only once every three years.

- Commercial Clean Vehicle Credit (45W): Targets businesses, offering up to $7,500 for lighter vehicles and up to $40,000 for heavier commercial EVs. Leasing companies are also eligible for this credit.

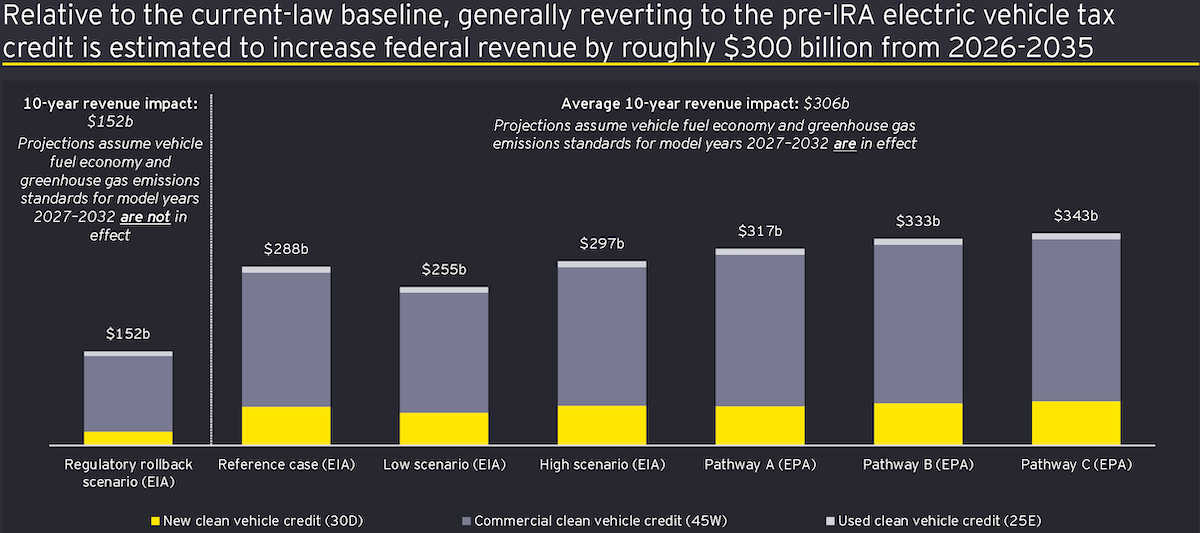

The report estimates that repealing these tax credits and reverting to the pre-IRA policy framework would increase federal revenue by roughly $300 billion between 2026 and 2035, depending on various policy scenarios.

This analysis indicates that repealing these tax credits and returning to the pre-IRA policy framework would generate approximately $300 billion in additional federal revenue between 2026 and 2035. As fiscal debates intensify, the future of the IRA—and its expensive electric vehicle (EV) incentives—should be front and center for lawmakers seeking ways to extend the Tax Cuts and Jobs Act (TCJA), the most sweeping U.S. tax reform since the 1980s. It’s also important to remember that not a single Republican supported the IRA, making its tax credits a politically straightforward revenue source for continuing the TCJA. Ultimately, the EV subsidy debate goes beyond budget figures—it raises a fundamental question: who gets to shape America’s economic future? Are we better off with government-directed spending that picks winners and losers, or with policies that can prevent tax hikes and empower Americans and the private sector?