Fast-fashion retailer Forever 21 filed for bankruptcy Sunday — for the second time in six years. The filing, published in a Delaware court, comes as the company grapples with rising inflation, fierce competition from Chinese e-commerce giants, trade uncertainty, and declining foot traffic in shopping malls, among other mounting headwinds.

F21 OpCo, LLC, the operator of Forever 21 stores and the licensee of the Forever 21 brand in the U.S., stated in the filing that it “will conduct liquidation sales at its stores while simultaneously conducting a court-supervised sale and marketing process for some or all of its assets.”

Brad Sell, the company’s chief financial officer, explained in a statement: “While we have evaluated all options to best position the Company for the future, we have been unable to find a sustainable path forward, given competition from foreign fast fashion companies, which have been able to take advantage of the de minimis exemption to undercut our brand on pricing and margin, as well as rising costs, economic challenges impacting our core customers, and evolving consumer trends.”

It is evident that Forever 21 has struggled to compete with e-commerce giants such as Shein and Temu, particularly in the wake of the post-Covid online shopping boom. Additionally, uncertainty stemming from President Donald Trump’s trade war has further complicated the retailer’s outlook.

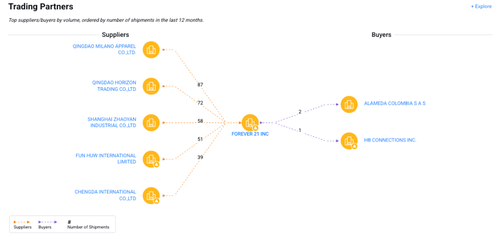

Public trade data compiled by counterparty and supply chain risk intelligence firm Sayari shows Forever 21’s suppliers reside mainly in China…

Bloomberg provided more color on Forever 21’s first round of bankruptcy in 2019:

It’s the clothing brand’s second stint with bankruptcy. Its first in 2019 was rife with fighting, left creditors little recovery and resulted in the closing of hundreds of locations it had during its heyday.

A group of buyers — including Simon Property Group, Brookfield Corp. and Authentic Brands — teamed up to buy Forever 21 out of bankruptcy through a venture called Sparc Group. That group partnered with Shein in 2023 as Forever 21 attempted to solve some of its operational issues.

The move to liquidate means that Forever 21 is not “forever”… in other words, executives could not find a buyer for the retailer that operates 350 US stores and hundreds more globally.

Loading…