Over the past year, U.S. importers have been frontloading shipments—ranging from e-commerce goods and small appliances to soft goods and replacement parts—across Transpacific trade lanes in anticipation of President Trump’s tariff threats.

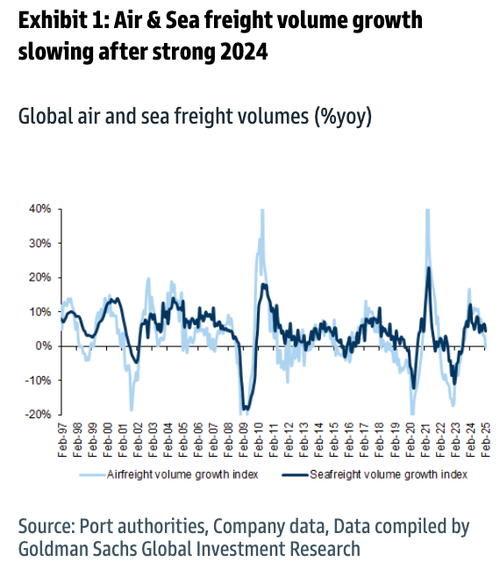

With Trump’s “Liberation Day” tariff blitz passed and the potential for even more tariffs ahead, signs are emerging that cargo flows across Transpacific routes are slowing. In fact, Goldman Sachs now expects the freight volume outlook could turn negative from here.

Goldman’s Patrick Creuset, Theodora Beadle, and others told clients Monday that first-quarter freight volumes remained solid. However, they noted this was primarily because of frontloading goods ahead of tariffs, and now, because of the deepening trade war, “the volume outlook is clearly negative from here.”

Creuset provided more color about the inflection point for the Transpacific tradelane:

Q1 freight volume data remained fairly strong, with Ocean volumes up c.5% on our readings for Jan/Feb, and China port volumes up 10%yoy, while air cargo is up low single digits following a strong Q4 peak. However, we believe a lot of this reflects frontloading of U.S. imports as we have highlighted in prior editions.

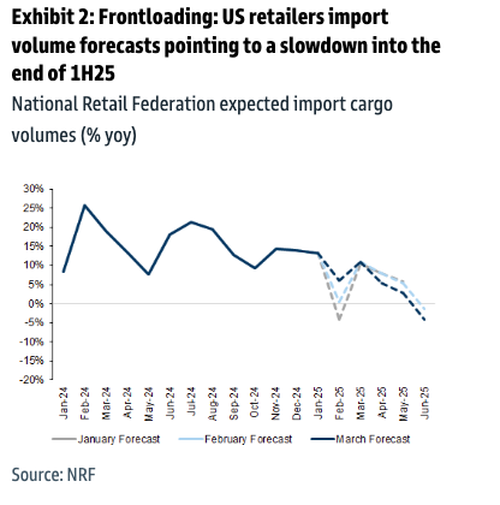

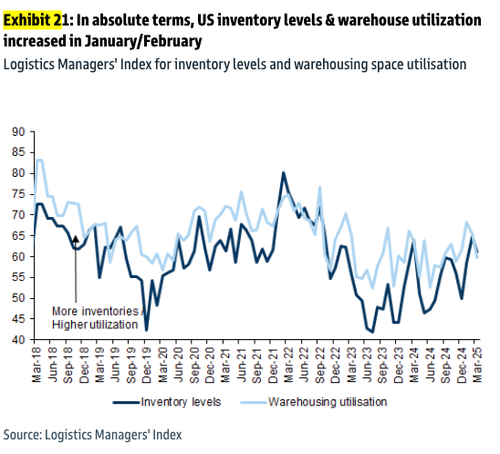

As U.S. tariff increases are set to take effect in April (and potential retaliation from trade partners) the volume outlook is clearly negative from here, in particular on the Transpacific tradelane. Prior to the latest tariff announcements, U.S. retailers were expecting a mid-single digit yoy import decline by June Exhibit 2 following the recent re-stocking Exhibit 21.

Exhibit 2

Exhibit 21

The analysts then asked question of how severe the slowdown will be—and what it could mean for freight rates:

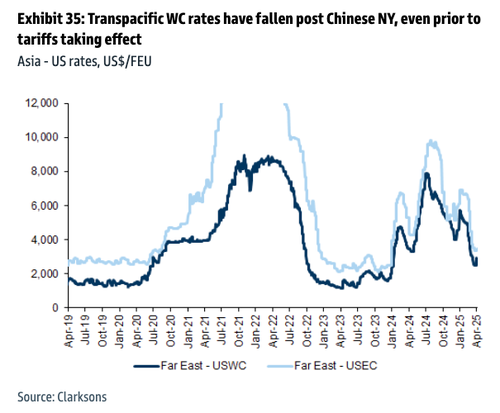

We believe the most likely scenario for ocean freight markets is a decline in Transpacific volumes driving further rate declines from still elevated levels Exhibit 35; this in turn will lead carriers to reduce capacity and hand back charters.

Key questions are:

the magnitude of the volume decline

the pace and magnitude of capacity cuts – there is a lot of headroom to cut, at least 5% of global capacity in our view Exhibit 43 but will depend on competitive dynamics amid the new alliance structure

whether vessels taken out of the Transpac are idled and scrapped, or cascaded into North-South trades (depressing rates there), and

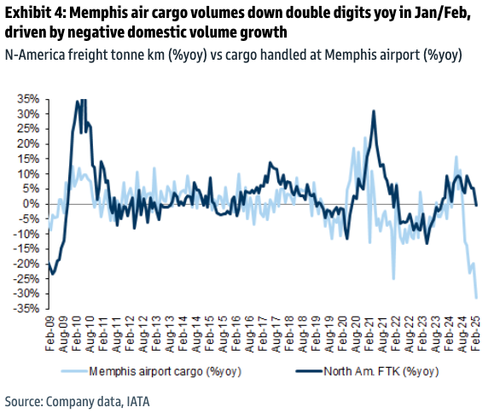

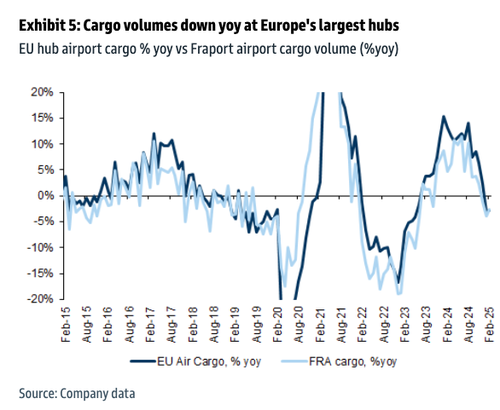

the extent of negative demand spillovers to RoW from weaker U.S. trade and growth. The impact from overcapacity in ocean will also be deflationary on air cargo, where slowing volume growth predates the latest tariff measures Exhibit 5.

The slowdown on Transpacific tradelanes also comes as Goldman’s chief economist Jan Hatzius downshifted his U.S. economic growth forecast in a note titled “US Daily: Countdown to Recession.”

Here are the highlights of Hatzius’ note:

-

We are lowering our 2025 Q4/Q4 GDP growth forecast to 0.5% and raising our 12-month recession probability from 35% to 45% following a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed. This baseline forecast still rests on our standing assumption that the effective U.S. tariff rate will rise by 15pp in total, which would now require a large reduction in the tariffs scheduled to take effect on April 9.

-

If most of the April 9 tariffs do take effect, then the effective tariff rate will rise by an estimated 20pp once those increases and likely sectoral tariffs take effect, even allowing for some country-specific agreements at a later date. If so, we expect to change our forecast to a recession.

-

In our current non-recession baseline, we expect the Fed to deliver a package of three consecutive 25bp insurance cuts starting in June (vs. July previously), lowering the funds rate to 3.5-3.75%. In a recession scenario, we would instead expect the Fed to cut by around 200bp over the next year. Our probability-weighted Fed forecast now implies 130bp of rate cuts this year (up from 105bp previously, reflecting the increase in our probability of recession), similar to market pricing as of Friday’s close.

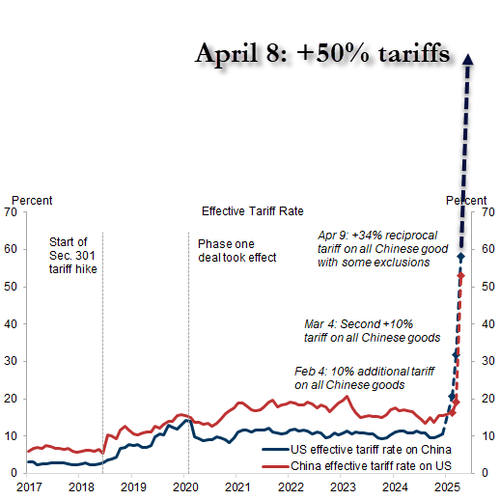

Making matters worse, President Turmp on Monday threatened to “impose ADDITIONAL Tariffs on China of 50%” unless Beijing withdraws a 34% retaliatory duty on U.S. goods (read full note: Trump Threatens China Escalation, White House Denies ’90-Day-Pause’ “Fake News”).

“If China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th,” Trump posted on social media.

The president also said “all talks with China concerning their requested meetings with us will be terminated!”

“Negotiations with other countries, which have also requested meetings, will begin taking place immediately,” he added

Additionally, Trump said that all talks with China will be terminated.

The takeaway: Frontloading by importers is subsiding and can exert deflationary pressure on the shipping industry. It also suggests broader growth drag and heightened recession risk. The question remains if Trump can solve trade disputes with top trading partners in a timely fashion.

Loading…