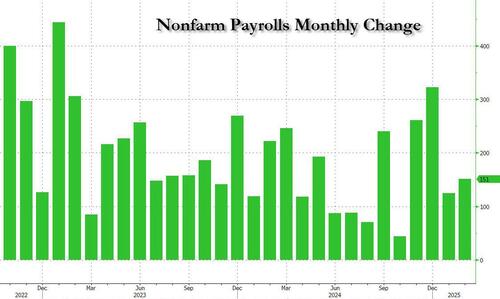

In our payrolls preview we said that contrary to whisper expectations of a 122K number, and even more widespread mumbled expectations of a negative print, the actual February number would “not be as bad as feared” (contrary to last month when we correctly warned the number would be a disaster), and sure enough moments ago the BLS reported that in February the US added 151K jobs, up from the (downward revised) 125K in January, just below the consensus estimate and well above the whisper number.

The change in total nonfarm payroll employment for December was revised up by 16,000, from +307,000 to +323,000, and the change for January was revised down by 18,000, from +143,000 to +125,000. With these revisions, employment in December and January combined is 2,000 lower than previously reported.

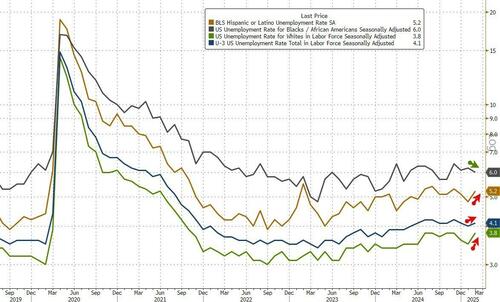

The unemployment rate rose to 4.1%, from 4.0% in January, just above the consensus estimate of 4.0% as the number of unemployed people, at 7.1 million, was little changed little in February. The unemployment rate has remained in a narrow range of 4.0 percent to 4.2 percent since May 2024. Among the major worker groups, the unemployment rate for Whites (3.8%) increased in February. The jobless rates for adult men (3.8%), adult women (3.8%), teenagers (12.9%), Blacks (6.0%), Asians (3.2%), and Hispanics (5.2%) showed little change over the month.

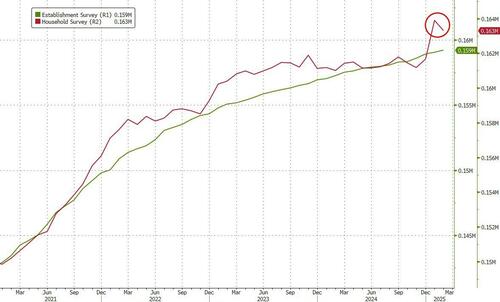

Looking at the household survey, the number of employed workers dropped by 588K after soaring in January; the number of unemployed workers rose by 203K from 6.849MM to 7.052MM.

Average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3%, to $35.93, in line with estimates. Over the past 12 months, average hourly earnings have increased by 4.0%, below the 4.1% expected. In February, average hourly earnings of private-sector production and nonsupervisory employees rose by 9 cents, or 0.3 percent, to $30.89. In February, the average workweek for all employees on private nonfarm payrolls was unchanged at 34.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 33.6 hours.

Some more details from the report:

- The number of long-term unemployed (those jobless for 27 weeks or more), at 1.5 million, changed little in February. The long-term unemployed accounted for 20.9 percent of all unemployed people.

- The employment-population ratio decreased by 0.2 percentage point to 59.9 percent in February but showed little change from a year earlier. The labor force participation rate, at 62.4 percent, changed little over the month and over the year.

- The number of people employed part time for economic reasons increased by 460,000 to 4.9 million in February. These individuals would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs.

- The number of people not in the labor force who currently want a job increased by 414,000 to 5.9 million in February. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.7 million, changed little in February. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, decreased by 128,000 to 464,000 in February.

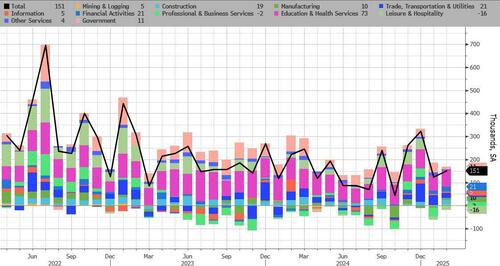

Digging deeper we find that manufacturing jobs, a closely tracked category, increased by 10K, the first increase since November.

Here is the full breakdown of jobs by sector:

- Total nonfarm payroll employment rose by 151,000 in February, similar to the average monthly gain of 168,000 over the prior 12 months. In February, employment trended up in health care, financial activities, transportation and warehousing, and social assistance. Federal government employment declined.

- Health care added 52,000 jobs in February, in line with the average monthly gain of 54,000 over the prior 12 months. In February, job growth continued in ambulatory health care services (+26,000), hospitals (+15,000), and nursing and residential care facilities (+12,000).

- Employment in financial activities rose by 21,000 in February, above the prior 12-month average gain (+5,000). Over the month, employment continued to trend up in real estate and rental and leasing (+10,000) and insurance carriers and related activities (+5,000). Commercial banking lost 5,000 jobs.

- Transportation and warehousing employment continued to trend up in February (+18,000), in line with the average monthly gain over the prior 12 months (+13,000). Over the month, job growth occurred in couriers and messengers (+24,000) and air transportation (+4,000).

- Employment in social assistance continued to trend up in February (+11,000), below the average monthly gain over the prior 12 months (+21,000). Over the month, employment continued to trend up in individual and family services (+10,000).

- Within government, federal government employment declined by 10,000 in February.

- Employment in retail trade changed little over the month (-6,000) and has shown little net change over the year. In February, employment in food and beverage retailers declined by 15,000, largely due to strike activity. Warehouse clubs, supercenters, and other general merchandise retailers added 10,000 jobs.

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; information; professional and business services; leisure and hospitality; and other services.

And visually:

Commenting on the report, Lindsay Rosner, head of multisector fixed income investing at Goldman Sachs Asset Management, weighs in: “To sum it up: Today’s print wasn’t as bad as feared. The payrolls growth surprised slightly to the downside and the unemployment rate ticked up, justifying the momentum that’s been building for a resumption in the Fed’s cutting cycle.”

Developing…

Loading…