Nick Gerli, CEO and Founder of real estate analytics firm Reventure Consulting, has issued another troubling update on Florida’s housing market—this time sounding the alarm about a collapse in demand across the Miami metro area. He described the plunge in sales as “breathtaking.”

For the last few years, we’ve tracked the post-Covid surge in inventory hitting Sun Belt states, including this note from last summer:

This was followed by Gerli’s report in late January: “My Favorite Housing Market Graph Right Now“…

“My Favorite Housing Market Graph Right Now” https://t.co/yzvc1WIyKM

— zerohedge (@zerohedge) January 30, 2025

Now Gerli has offered more color on the deteriorating housing market in Miami:

The collapse in demand in Miami’s housing market is breathtaking. Sales are down 50% from pandemic peak, and are 30% below the long-term average for March. There’s a narrative building in Florida that somehow Miami won’t be impacted by this housing downturn. And that narrative is likely wrong.

The collapse in demand in Miami’s housing market is breathtaking.

Sales are down 50% from pandemic peak, and are 30% below the long-term average for March.

There’s a narrative building in Florida that somehow Miami won’t be impacted by this housing downturn.

And that narrative… pic.twitter.com/JS9iHEfNYb

— Nick Gerli (@nickgerli1) April 19, 2025

Gerli debunked some misconceptions about the downturn, with some individuals saying this is “West Coast only.”

1) What I’m starting to hear here on the ground in Florida is that this is a “west coast only” downturn. And that it’s purely the hurricanes that hit Tampa last year that are causing issues.

But in reality – everywhere in Florida’s housing market is negatively impacted,…

— Nick Gerli (@nickgerli1) April 19, 2025

Inventory in Miami has surged to 51,000 homes – the second highest on record.

2) Inventory in the Miami metro is up to 51,000 homes, which is the 2nd highest level on record for March according to Realtor’s inventory data set. pic.twitter.com/JHV6g08dYW

— Nick Gerli (@nickgerli1) April 19, 2025

Meanwhile.

3) Meanwhile, price growth in the 3-county metro is now shifting down.

Values are already dropping in Palm Beach (-2.5%) and Broward (-1.1%) YoY.

While they’re still up slightly in Miami-Dade (+1.8%). pic.twitter.com/aZXcn7AtpP

— Nick Gerli (@nickgerli1) April 19, 2025

“In some ways, it’s surprising prices haven’t dropped by more already due to the demand collapse. And resulting inventory spike. but in the end housing downturns can take time to play out. And the whole Miami area is at a big risk if the current trends in the market continue,” Gerli noted.

According to the Reventure app, prices across Miami-Dade County are 20.3% overvalued.

5) In particular, prices in Miami-Dade county are 20.3% overvalued compared to the long-run norms, indicating some major downside risk. pic.twitter.com/Gwboa5av7y

— Nick Gerli (@nickgerli1) April 19, 2025

He warned: “The more overvalued prices are, the greater the risk of downturns.”

6) The more overvalued prices are, the greater the risk of downturns.

You can see Miami went through an epic downturn in the last crash, when prices actually became 33% undervalued.

This is when a lot of people in Miami real estate made their money. pic.twitter.com/vLeaP6vqB9

— Nick Gerli (@nickgerli1) April 19, 2025

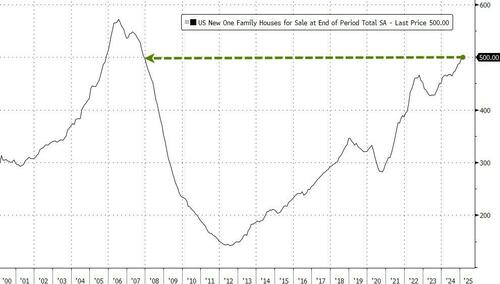

Separately, and more broadly, the US housing inventory for new homes has hit its highest level since 2007.

What could possibly go wrong in an oversupplied housing market, with 30-year fixed mortgage rates hovering around 7%?

Loading…