As DB’s Jim Reid writes this morning, “if this year so far was a movie then I’m sure the script would have been thrown out as being too unbelievable, even for Hollywood.” What sparked Reid’s shock were events in the past week, which he describes as follows: “we just lived through one of the more dramatic weeks in living memory, especially in Germany, where 10yr Bunds saw their largest weekly yield sell-off since reunification in 1990. The Euro (+4.41%) saw its biggest weekly gain since March 2009 while the S&P 500 (-3.10%) saw its largest weekly fall in 6 months.”

And as we continue to catch our breath, this coming week is relatively quiet for data even if it won’t be for news flow. The data highlight is US CPI on Wednesday but the reality is that there are bigger fish for the market to fry at the moment than a monthly inflation report.

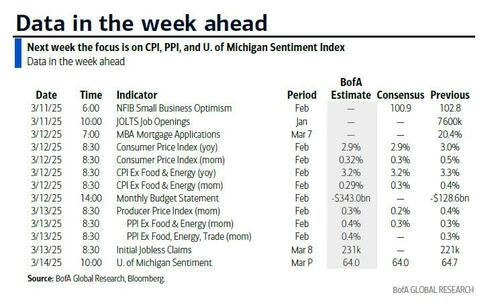

Briefly going through the rest of the week’s main highlights. Today we get the NY Fed 1-yr US inflation expectations and German IP; tomorrow sees the US JOLTS and the NFIB small business optimism; Wednesday the BoC decision (-25bps expected) and a 10yr UST auction; Thursday sees US PPI and a 30yr UST auction; and Friday sees the UoM consumer sentiment survey. The fuller day-by-day week ahead is at the end as usual.

In terms of US CPI, DB economists expect headline (+0.27% vs. +0.47% previously), and core (+0.26% vs. +0.45%) should ease from the previous month which would allow the YoY rate to fall a tenth and two tenths respectively to 2.9% and 3.1%. For US PPI the next day, we will likely see a similar +0.3% gain for headline and core but it’ll be the sub components that feed into core PCE that will be the most important as usual.

Staying with US inflation, Friday’s University of Michigan preliminary consumer sentiment (63.0 expected vs 64.7 last) reading will also contain the fascinating long-run inflation expectations series, which rose three-tenths to 3.5% last month, an almost 30-year high. The most fascinating thing here will be the split by political party as the expectations gap between Republicans and Democrats are at crazy wide levels.

Although the weekend was relatively quiet we did hear from both Bessant and Trump (as discussed here) and they seem to be telling us that they are prepared for some pain to reorientate the economy. Bessent said, “Could we be seeing that this economy that we inherited starting to roll a bit? Sure. And look, there’s going to be a natural adjustment as we move away from public spending to private spending,” “The market and the economy have just become hooked. We’ve become addicted to this government spending, and there’s going to be a detox period.” Meanwhile Trump told Fox that “There is a period of transition, because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing.” “What I have to do is build a strong country. You can’t really watch the stock market,” “If you look at China they have a hundred-year perspective”. So taken at face value these quote suggest that their pain level is higher than most would have believed a few weeks ago.

Also over the weekend the House Republicans proposed a stopgap funding bill taking us to the end of September, attempting to avert a shutdown on March 15th (this Saturday). There will be a vote tomorrow with some House Republicans not that keen to vote for a stopgap that doesn’t contain permanent spending cuts. However the tougher challenge will be when the bill hits the Senate as it will require moderate Democrats to support it for it to pass. One of the issues is that the bill explicitly gives DOGE the licence to carry on what’s it’s doing which may be a struggle for Democrats to support. So one to watch.

We also saw the conservatives and Social Democrats in Germany agree to deepen talks around a coalition on Saturday. So things seem to be moving in the right direction which is helpful as in parallel Merz has two weeks to approve the legislation around the EU500bn infrastructure fund and the associated open ended defence fund. In reality this is the biggest global event over the next two weeks outside of anything the US administration might do.

In geopolitics, EU finance ministers meet today in Brussels for more talks on defence spending. On Wednesday the US is set to impose steel and aluminium tariffs of 25% on the EU. There will also be a G-7 foreign ministers meeting in Canada on Wednesday to Friday

Courtesy of DB, here is the day-by-day calendar of events

Monday March 10

- Data: US February NY Fed 1-yr inflation expectations, Japan February Economy Watchers survey, M2, M3, January household spending, leading index, coincident index, Germany January industrial production, trade balance, Italy January PPI, Sweden January GDP indicator, Denmark and Norway February CPI

- Central banks: ECB’s Nagel speaks

- Earnings: Oracle

Tuesday March 11

- Data: US February NFIB small business optimism, January JOLTS report, Japan February machine tool orders, PPI

- Central banks: ECB’s Rehn speaks

- Earnings: Volkswagen, Partners Group

- Auctions: US 3-yr Notes ($58bn)

Wednesday March 12

- Data: US February CPI, federal budget balance

- Central banks: BoC decision, ECB’s Lagarde, Villeroy, Escriva, Nagel and Lane speak

- Earnings: Adobe, Rheinmetall, Porsche, Inditex, Puma

- Auctions: US 10-yr Notes (reopening, $39bn)

Thursday March 13

- Data: US February PPI, initial jobless claims, Q4 household change in net worth, UK February RICS house price balance, Italy Q4 unemployment rate, Canada January building permits

- Central banks: ECB’s Guindos, Holzmann, Villeroy and Nagel speak

- Earnings: Enel, Generali, Dollar General

- Auctions: US 30-yr Bonds (reopening, $22bn)

Friday March 14

- Data: US March University of Michigan survey, UK January monthly GDP, Germany January current account balance, Italy January industrial production, general government debt, Canada January manufacturing sales

- Central banks: ECB’s Cipollone speaks

- Earnings: BMW, Daimler Truck Holding

Finally, looking at just the US, Goldman writes that the key economic data release this week is the CPI report on Wednesday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period ahead of the March FOMC meeting. Oh, and the current spending law will expire on March 14, and Congress will need to pass a new funding bill before this deadline to avoid a government shutdown.

Monday, March 10

- 11:00 AM New York Fed 1-year inflation expectations, February (last 3.0%): The New York Fed will release its measures of inflation expectations for February. The University of Michigan’s 12-month measure of inflation expectations increased by 0.5pp in January and by an additional 1.0pp in February, partly reflecting the expected impact of tariffs.

Tuesday, March 11

- 06:00 AM NFIB small business optimism, February (consensus 101.0, last 102.8)

- 10:00 AM JOLTS job openings, January (GS 7,600k, consensus 7,665k, last 7,600k): We estimate that JOLTS job openings were roughly unchanged at 7.6mn in January based on the signal from online job postings.

Wednesday, March 12

- 08:30 AM CPI (MoM), February (GS +0.27%, consensus +0.3%, last +0.5%); Core CPI (MoM), February (GS +0.29%, consensus +0.3%, last +0.4%); CPI (YoY), February (GS +2.87%, consensus +2.9%, last +3.0%); Core CPI (YoY), February (GS +3.21%, consensus +3.2%, last +3.3%): We estimate a 0.29% increase in February core CPI (month-over-month SA), which would lower the year-over-year rate on a rounded basis by 0.1pp to 3.2%. Our forecast reflects an increase in used car prices (+0.6%) reflecting an increase in auction prices, an increase in new car prices (+0.3%) reflecting a decline in incentives, and another large increase in the car insurance category (+1.0%) based on premiums in our online dataset. We expect seasonal distortions to boost the communications (+0.3%) and airfares (+2.5%) categories. We expect the shelter components to moderate slightly on net (OER +0.29%; primary rent +0.27%) and for the lodging away from home component to reverse a portion of the prior month’s jump (-0.5% vs. +1.4% in January). We estimate a 0.27% rise in headline CPI, reflecting higher food (+0.2%) and energy (+0.2%) prices. Our forecast is consistent with a 0.25% increase in core PCE in February. We will update our core PCE forecast after the CPI is released.

Thursday, March 13

- 08:30 AM PPI final demand, February (GS +0.3%, consensus +0.2%, last +0.4%); PPI ex-food and energy, February (GS +0.3%, consensus +0.3%, last +0.3%); PPI ex-food, energy, and trade, February (GS +0.2%, consensus +0.2%, last +0.3%)

- 08:30 AM Initial jobless claims, week ended March 8 (GS 220k, consensus 227k, last 221k); Continuing jobless claims, week ended March 1 (consensus 1,890k, last 1,897k)

Friday, March 14

- 10:00 AM University of Michigan consumer sentiment, March preliminary (GS 63.4, consensus 63.5, last 64.7); University of Michigan 1-year inflation expectations, March preliminary (consensus 4.2%, last 4.3%); University of Michigan 5-10-year inflation expectations, March preliminary (GS 3.6%, consensus 3.4%, last 3.5%)

Source: DB, Goldman

Loading…