There are lots of current sources of economic uncertainty. The next steps of DOGE are one source. So, I think, is the rapid advance of artificial intelligence.

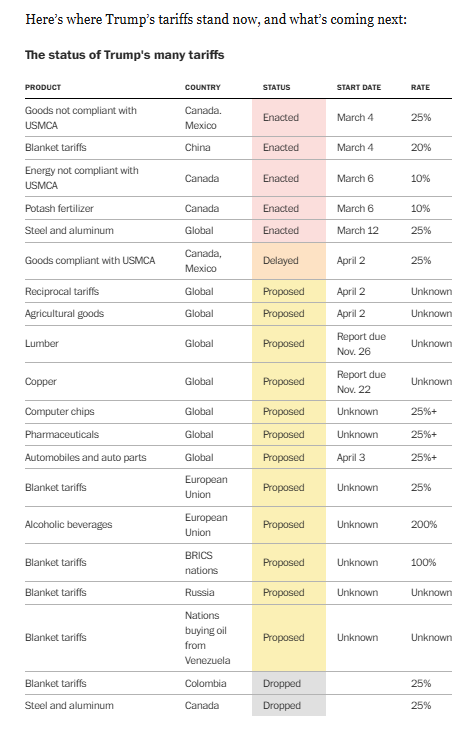

But right now it’s hard to top trade policy—or even keep track of it, as exemplified by a handy chart from the story “See all the tariffs Trump has enacted, threatened and canceled” in The Washington Post:

Why does uncertain trade policy matter? It’s for the simple reason that if CEOs don’t know what the next evolution of US tariff policy will be, they may respond by keeping their corporate wallets firmly shut. And as tariff threats multiply during Trump 2.0, economists are dusting off models that link policy uncertainty to investment paralysis.

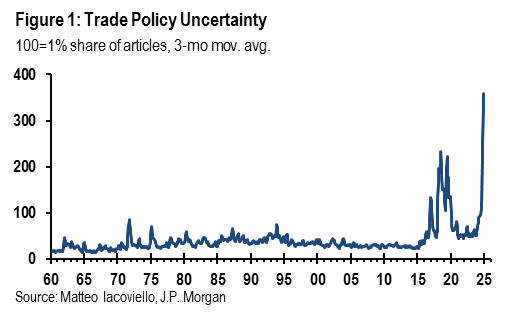

As explained in a new research note by the economics team at JPMorgan, the theoretical underpinnings of the relationship between uncertainty and investment trace back to former Federal Reserve boss Ben Bernanke’s 1983 doctoral dissertation, in which he elegantly framed investment projects as options, “and when uncertainty increases it also increases the option value of waiting for the resolution of the uncertainty,” as explained by the bank. This framework gained fresh reinforcement in the 2010s when economists developed indexes measuring policy uncertainty through news analysis.

The first Trump administration provides a telling case study, according to JPM. When trade tensions flared in 2018, Federal Reserve researchers developed a specific trade policy uncertainty index:

The authors who developed that model find trade uncertainty to be a useful predictor of capital spending, though we caution that there are not many historical episodes when trade uncertainty was as high as it was in 2018-19 or now. In any event, after that measure began to move higher in 2018, capital spending began to move lower in 2019.

The pattern identified by the Fed is ominously repeating itself:

- Trade policy uncertainty has now surpassed even 2018–19 levels, according to the Fed’s measures.

- Regional Fed surveys reveal a particularly worrying trend: Capital expenditure intentions strengthened briefly after January’s inauguration, only to deteriorate markedly in February and March.

- The Philadelphia Fed’s manufacturing survey shows the proportion of firms planning to boost investment in 2025 plummeting from 51 percent in October to a mere 23 percent in March.

- In the Atlanta Fed’s National Survey, eight percent of firms cited trade/tariffs as their top concern—a category entirely absent from the previous year’s results. (“The survey was done Jan 14-24, so came before some of the President’s recent proposals.”)

- The Duke CFO survey conducted in February-March found trade concerns had surged to become executives’ predominant worry at 15 percent, up from just four percent a quarter earlier.

Again, JPM: “Trade policy uncertainty should be a headwind to capex growth this year. This effect will be hard to distinguish from implemented trade barriers, or from weaker global growth, though these may be distinctions without practical differences.”

The post How Uncertainty Undermines Business Investment appeared first on American Enterprise Institute – AEI.