Here we go again.

We won’t waste your time repeating virtually everything we have said in the past few days, suffice to say that we once again we find ourselves where we were on Tuesday morning, right just as the basis trade was disintegrating, as indicated by the sudden, rapid collapse in the 30Y Swap Spreads which are now where they were before Trump’s pivot on Wednesday…

… which is again slamming Treasuries and pushing the 10Y yield above the so-called Bessent “red line” above 4.45%, which on Tuesday prompted Trump to pivot on his tariff vows and spark a brief relief rally…

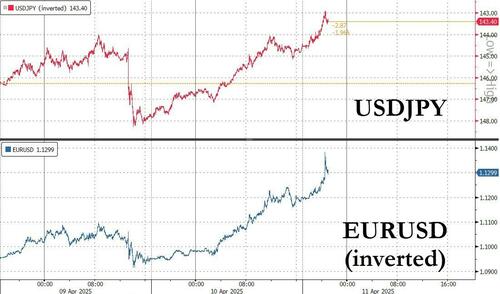

… but just as more importantly has sent the dollar crashing in a sudden jerk spasm which saw 100DXY stops triggered, sending the dollar to the weakest level since July 2023 (as a reminder a core pillar of the Mirant Mar-A-Lago plan is just this, to nuke the strong dollar from orbit)…

… while the currencies of such prominent exporters as EU and Japan are soaring, assuring exports flows grind to a halt and their economies slide into recession, forcing their central banks to panic ease by either cutting or injecting much more liquidity in the system.

Since both economies are in desperate need of exporting as much as they possible can at a time when the global economy is careening into a recession, we wonder if their central banks will huddle up tonight to announce emergency liquidity injections… or wait a day or two more when it will be too late.

BOJ and ECB should probably have an emergency phone call tonight

— zerohedge (@zerohedge) April 11, 2025

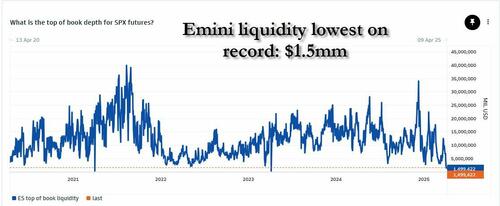

To be sure, equity futures are also slumping (we won’t show you the chart since everyone is now tired of seeing US stocks plunging), which brings to one conclusion: as we explained on Tuesday, the collapse of the basis trade is sucking up every last bit of oxygen from the market, a market where the Emini top of book hit a record low $1 million earlier (meaning it takes a laughable, oddlotish $1 million to move spoos by 1 point)…

… and this will continue to do so until the Fed, which refuses to see the deflationary maelstrom developing before its eyes and instead is stubbornly waiting for June until Trump’s tarrifs push CPI higher by 0.1%, steps in with a bailout facility. Although since said bailout will be of the hedge funds of some of the world’s richest men, this may be a problem… which brings us to what DB’s George Saravelos said two days ago: the only way to short-circuit the current funding crisis is to launch QE. Which of course would mean that Trump (and Bessent) win.

And now we wait to see who is the winner in the world’s biggest game of chicken.

Loading…