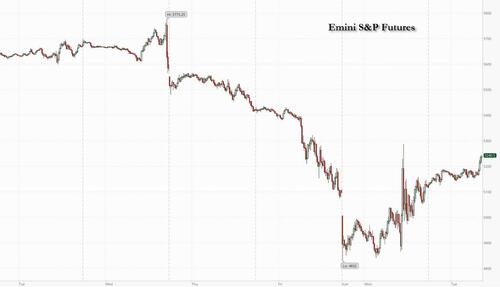

After three days of big losses and record-breaking volatility, equity futures are rebounding sharply following somewhat soothing comments from Treasury Secretary Bessent (although how long the relative calm lasts is anyone’s guess, given there’s little clarity about what Trump wants in exchange for cutting tariffs). As of 8:10am, S&P futures are 2.9% higher, a bounce which started around the time we informed readers that Goldman’s head of risk of risk had turned bullish yesterday afternoon; Nasdaq futures are up 2.7%, with all Mag7 names higher with Semis and Cyclicals also outperforming. European and Asian markets are also broadly higher. The VIX is down 10 vols below 40, while Chinese ADRs are mixed. Bond yields have reversed earlier losses and are up 1bp to 4.22% with the USD dropping. Todays’ macro data focus is the Small Business Optimism report which saw sentiment tumble to 97.4 from 100.7 the lowest since the Trump election (Hiring Plans also slumped; these tend to have a lagged but positive correlation to NFP).

In premarket trading, Nvidia is leading the Magnificent Seven higher (Nvidia +4%, Amazon +3.3%, Meta +3%, Tesla +3.0%, Alphabet +2.5%, Apple +1.6%, Microsoft little changed). Health insurance stocks are rallying after the Centers for Medicare & Medicaid Services finalized a 5.06% average increase in payments to Medicare Advantage plans from 2025 to 2026, an increase from its earlier projection (Humana +14%, Alignment Healthcare +10%, CVS +8.8%, UnitedHealth +7.2%, Centene +4.9%). Here are some other notable premarket movers:

- Agco Corp. (AGCO) rises 2% after Citi upgraded the agricultural equipment company to buy, saying that the company is “favorably positioned given its ~65% exposure to Europe and South America, which we anticipate recovering ahead” of North America.

- Blackstone (BX) rises 3% after the private equity firm is upgraded to market outperform from market perform at Citizens.

- Chegg (CHGG) falls 2% as JPMorgan downgrades its rating to underweight, saying the education technology company is facing secular headwinds.

- CME (CME) rises 2.5% and Charles Schwab (SCHW) gains 3.4% after Morgan Stanley upgrades its ratings across exchange operators and brokers in a hunt for more defensive exposure.

- El Pollo Loco (LOCO) rises 10% after receiving an unsolicited, non-binding indication of interest from Biglari Capital Corp.

- Eli Lilly & Co (LLY) climbs 2% after Goldman Sachs upgraded the obesity drugmaker to buy, citing a “compelling entry point into the sector’s premier topline grower” at current levels.

- Levi Strauss (LEVI) jumps 11% after the apparel retailer maintained its full-year outlook in the face of sweeping new US tariffs that are poised to significantly raise costs for multinational apparel companies.

- Marvell Technology (MRVL) climbs 4% after Infineon agreed to buy the chip designer’s automotive networking business for $2.5 billion. The deal makes sense given the firm’s strategic focus on artificial intelligence, analysts say.

- Nu Holdings (NU) rises 4% after JPMorgan upgraded the bank to overweight, saying “even in our more conservative estimates we see Nu growing earnings more than 30% in next 3 years, something hard to find.”

- Teradata Corp. (TDC) rises 4% after Morgan Stanley upgraded the database management company to overweight, saying “we acknowledge the company remains a model in transition with risk of extending sales cycles,” but at the current valuation, “we believe this is more than priced in.”

Traders are dipping back into risk assets after one of the most brutal selloffs in years, with some taking hints that President Donald Trump might be willing to ease his position on trade terms after Japan pushed ahead with talks. That sent the Nikkei 225 index to a 6% surge. Goldman traders are turning outright bullish anticipating a big bounce in stocks here, with many citing expectations that Trump will cut trade deals.

“The Trump administration is signaling his openness to trade deals,” said Elias Haddad, a strategist at Brown Brothers Harriman. “Regardless, the pervasive uncertainty created by continuously changing US tariff threats and the scope of potential retaliatory measures remain a major blow to the global economy. Bottom line: relief rallies in risk assets will likely be short-lived.”

Trump made a string of comments Monday about his planned duties, yet he offered little clarity about what he is seeking in exchange for lowering levies — or whether he’s willing to offer relief at all. He rejected a European Union proposal to drop tariffs on all bilateral trade in industrial goods with the US, and threatened to slap China with an additional 50% import tax.

“The markets have come very far, very fast,” said Michael Kelly, global head of multi asset at PineBridge Investments. “It’s time for them to stabilize and figure out what the next turn of events is: up because the tariffs are coming down or down because the global economy is going down.”

Still, warnings are piling up on the bleak outlook for stocks. BlackRock strategists downgraded US equities on Monday to neutral from overweight, while a team at Goldman Sachs Group Inc. said the equity selloff could well turn into a longer-lasting cyclical bear market as recession risks mount.

UBS’s chief strategist said tariffs could hammer consumer demand, resulting in zero earnings growth for US companies this year. And Citadel founder and Republican mega-donor Ken Griffin said Trump’s tariffs amount to a hefty tax on families and are a “huge policy mistake.”

Amid the growing trade war, China stepped up efforts to support its market and vowed to “fight to the end” over tariffs — this could include levies on American farm goods and a ban on Hollywood movies, according to local bloggers.

“Markets have somewhat stabilized after a couple of dizzying trading days,” said Elias Haddad, senior markets strategist at Brown Brothers Harriman. “Regardless, the pervasive uncertainty created by continuously changing US tariff threats and the scope of potential retaliatory measures remain a major blow to the global economy. Bottom line: relief rallies in risk assets will likely be short-lived.”

Europe’s Stoxx 600 benchmark rose for the first time in five days, adding more than 2% even as President Trump rejected a European Union proposal to drop tariffs on all bilateral trade in industrial goods with the US. The travel and leisure and industrial sectors led the gains, while telecom shares were the biggest laggards. Here are the biggest movers Tuesday:

- Saab shares gain as much as 8.2%, the most since March 3, after the Swedish defense company was raised to hold from sell at Danske Bank, only three weeks after double-downgrading to sell

- Lonza shares rise as much as 6.1%, the most in almost four months, after analysts said the Swiss maker of drug ingredients was largely protected from the impact of US tariffs, citing a call with Chief Financial Officer Philippe Deecke on Monday afternoon

- Opus Global shares soar as much as 11%, the most since September 2023, after the Hungarian investment firm announced a new HUF 8 billion share buyback program

- Novo Nordisk shares drop as much as 2.2%, underperforming European pharma peers on Tuesday. Berenberg analysts say the “obesity fever has unwound significantly” via the Danish weight-loss drugmaker’s stock performance

- Infineon shares fall as much as 3.1%, underperforming Europe’s tech sector, after the company agreed to buy Marvell Technology’s automotive networking business for $2.5b

- Repsol shares decline as much as 1.6% after its 1Q upstream production missed analyst estimates on lower refining margin, weaker utilization rates amid maintenance works. Analysts expect a cut to consensus

- JTC shares slide as much as 4.8%, hitting their lowest level in over a year, after the financial firm’s annual results were slightly light versus expectations, according to analysts at RBC Capital Markets

- Impax Asset Management shares plunge as much as 20%, to the lowest since September 2017, after the specialist investor warned that full-year profits will be below expectations

Earlier in the session, Asian stocks also rebounded from the worst selloff on record. Japanese shares surged on hopes of a tariff deal with the US, while equities in China rallied as authorities stepped in to support the market. The MSCI Asia Pacific Index rose 2.4% and is poised for its biggest gain since September, following an 8.7% slump on Monday amid fears of an intensifying US-China trade war. The gauge was boosted Tuesday by Japanese shares including Mitsubishi, Toyota, and Hitachi. Stocks in Indonesia and Thailand tumbled as traders rushed to exit after the countries reopened from a long holiday. Equities in Hong Kong and mainland China gained, while Taiwan’s benchmark extended a slide. The rebound’s sustainability will largely depend on further moves by the world’s two largest economies. US President Donald Trump’s threat to hit China with an additional 50% tariff was met by Beijing pledging a “fight to the end.”

“As far as US and China goes, we are well and truly into the game of chicken,” Peter S. Kim, an investment strategist at KB Securities, said in a Bloomberg TV interview. “Trump has made his move and China has retaliated rather than choosing the path of compromise. It’s now up to which country’s going to blink first, and that’s very dangerous.”

In FX, the Bloomberg Dollar Spot Index has pared an earlier fall to just 0.1%. The Aussie dollar is the best G-10 performer, rising 0.9% against the greenback. The Swiss franc, euro and pound underperform as they trade little changed. Currency fluctuations are at the highest in two years, and the VIX index of equity volatility has hit an eight-month high.

In rates, yields on 10-year US bonds reversed an earlier losses and rose 2 basis points to 4.22%, after a volatile start to the week that saw yields whip between gains and losses. German rates remained higher, while UK gilts recouped some gains after long-end yields surged on Monday by the most since former Prime Minister Liz Truss’ 2022 mini-budget. The relative lull came as a relief to traders after a fraught day of trading in the US. With little clarity on whether President Donald Trump is willing to offer relief on his tariffs, a gauge of Treasuries implied volatility has soared to its most extreme level since October 2023. Bunds underperform, with shorter-dated maturities under pressure as traders pare their ECB interest-rate cut bets. German two-year yields rise 7 bps. Short-end bonds outperform in the UK meanwhile as traders add to their BOE rate cut bets. UK two-year yields fall 4 bps.

Traders threw out a number of possible reasons for Monday’s yield whiplash: a market primed for a pullback after such a sharp rally; lurking concerns about tariffs stirring inflation or necessitating government stimulus; liquidations in favor of cash-like instruments; or even rumors that foreign owners, including China, were selling.

In commodities, oil prices are steady with WTI near $60.70 a barrel. Spot gold rises $13 although has slipped back below $3,000/oz in recent trading. Bitcoin is up near $80,000.

Looking at today’s calendar, earnings due premarket include Walgreens Boots Alliance (WBA US) and two specialty chemicals companies — RPM International (RPM US) and WD-40 (WDFC US). For Walgreens, which is set to go private later this year, retail performance is the wild card as it is accelerating plans to close 500 stores in 2025. In economic data, NFIB small business optimism for March is released at 6am ET; the number tumbled to 97.4, below expectations of 99, easing from 100.7 the prior month. San Francisco Fed chief Daly is speaking at 2pm ET.

Market Snapshot

- SPX +2.7%

- NDX +2.7%

- RTY +3.1%

- WTI +8bps at $60.75

- NatGas -30bps to $3.64

- UK NatGas -249bps to £0.8851

- Gold +72bps to $3,005,

- Silver +42bps to $30.21

- 10Y @ 4.172%

- VIX @ 42.99.

Top Overnight News

- Scott Bessent told CNBC that tariff negotiations are result of massive inbound calls, not the market: CNBC interview

- Scott Bessent told Fox that “everything is on the table” in tariff talks, but deals probably won’t be reached before the April 9 start date. He said Japan would get priority after swiftly reaching out to the US, but he noted that has not seen a trade offer from Japan; he added that maybe 70 countries have approached the US by now on trade and that Japan’s non-tariff trade barriers are quite high, according to an FBN interview. Furthermore, Bessent said tariffs depend on negotiations which will be tough and the US will not likely have any trade deals in place by April 9th to avoid the retaliatory tariffs going into place, as well as commented that China has chosen to isolate itself by retaliating and doubling down on previous negative behavior.

- Bessent having some success steering the White House tariff messaging away from permanence and toward negotiations after warning Trump of further market losses. Politico

- White House considers withdrawing 10K US troops from Eastern Europe, a move sparking alarms in the region given Russia’s aggression. NBC News

- US President Trump’s order tonight reportedly seeks to tap coal power in a bid to dominate AI, according to Bloomberg.

- US President Trump posted on Truth “The Budget Plan just passed by the United States Senate has my Complete and Total Endorsement and Support. All of the elements we need to secure the Border, enact Historic Spending Cuts, and make Tax Cuts PERMANENT, and much more, are strongly covered and represented in the Bill.”

- US tariffs reportedly threaten almost USD 2tln of investment pledges by global companies: FT.

- Republicans increasingly embrace the idea of raising upper-income individual tax rates as they scramble to find revenue for their reconciliation bill. BBG

- Report commissioned by US Chamber of Commerce Foundation showed that many of the ~200 US firms surveyed in the past couple of years plan to hold onto or increase ties with China:WSJ.

- US Secretary of State Rubio discussed US reciprocal tariffs on India and how to make progress towards a fair trade relationship in a call with his Indian counterpart: State Department.

- US Department of Homeland Security employees on Monday evening were asked to consider voluntarily resigning, retiring or taking a buyout: Bloomberg.

- China vowed to fight the trade war “to the end” and took steps to prop up its markets. The PBOC eased yuan controls — signaling tolerance for currency depreciation — while a group of state-linked funds scooped up equities. BBG

- China increases measures aimed at stabilizing the stock market – the PBOC will provide more liquidity to back purchases by the country’s SWF while insurers will be allowed to dedicate more funds to the equity market. SCMP

- Japan emerged on Tuesday as the first major economy to secure priority tariff negotiations with Donald Trump, highlighting its status as Washington’s biggest creditor and investor and triggering a 7 per cent surge in Tokyo-listed stocks. FT

- Business leaders are worried tariffs may reignite inflation and supply disruptions, the Chicago Fed’s Austan Goolsbee told CNN. Any massive retaliation could send the economy back to the conditions of 2021-22, when inflation was “raging out of control.” BBG

Trade/Tariffs

- US Treasury Secretary Bessent said he has not seen a trade offer from Japan and expects Japan to get priority in negotiations because they came forward early, while he added that maybe 70 countries have approached the US by now on trade and that Japan’s non-tariff trade barriers are quite high, according to an FBN interview. Furthermore, Bessent said tariffs depend on negotiations which will be tough and the US will not likely have any trade deals in place by April 9th to avoid the retaliatory tariffs going into place, as well as commented that China has chosen to isolate itself by retaliating and doubling down on previous negative behavior.

- US Treasury Secretary Bessent flew to Florida Sunday to encourage President Donald Trump to focus his message on negotiating favourable trade deals. Otherwise, Trump would risk the stock market cratering further, according to Politico.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as markets regained some composure and bounced back from the recent tariff turmoil. ASX 200 advanced with tech and energy leading the broad-based gains across sectors which helped participants shrug off the weaker-than-previous consumer sentiment and business confidence surveys. Nikkei 225 surged at the open and reclaimed the 33,000 level after the recent aggressive selling and with Japan said to get priority in trade talks following a call between Japanese PM Ishiba and US President Trump. Hang Seng and Shanghai Comp conformed to the improved risk appetite as Chinese state-owned funds and regulators announced efforts to stabilise markets, although gains were capped after US President Trump threatened an additional 50% tariff on China if it doesn’t withdraw its 34% tariff increase against the US by today.

Top Asian News

- Citi cuts China’s 2025 GDP growth forecast to 4.2% (prev. 4.7%)

- China’s Social Security Fund says it has actively increased holdings of domestic stocks and plans to further increase investments in the near term.

- PBoC said it will provide lending support to China state fund Huijin if needed and it firmly supports Huijin increasing its holdings in stock market index funds, while Huijin said it will play its role as a market stabiliser and act decisively when needed, as well noted it has healthy balance sheets, ample liquidity and smooth funding channels.

- China’s financial regulator said it will increase the proportion of insurance funds invested in the stock market and raise the upper limit of equity asset allocation ratio, while it will optimise the regulatory policy on the proportion of insurance funds.

- China state holding company China Guoxin said it will buy CNY 80bln of stocks and ETFs. It was also reported that state investment firm China Chengtong will increase holdings in stocks and ETFs to safeguard market stability and will buy CNY 80bln of stocks and ETFs.

- China Electronics Technology Group said it will step up share buybacks to bolster investor confidence.

APAC Remarks

- Chinese Foreign Ministry says US acts did not show willingness for serious talks; if US wants to talk, it should show attitude for equality and respect

- China’s MOFCOM said China strongly opposes 50% additional tariffs and urges resolution of disputes with the US via dialogue, while it said it will fight to the end if the US insists on measures and that China will never accept the “blackmail nature” of the US. Furthermore, China urged the US to immediately rectify its ‘wrong practice’ and cancel all unilateral tariff measures against China.

- Japan will reportedly send Economy Minister Akazawa to the US for tariff talks with US Treasury Secretary Bessent soon, according to Mainichi. However, Akazawa earlier stated that he was not aware of a report that he would be appointed by PM Ishiba as negotiator for trade talks with the US and has not been approached by PM Ishiba when asked about if he would be appointed as Japan’s negotiator with the US on trade.

- Japan’s Chief Cabinet Secretary Hayashi says PM Ishiba is considering visiting the US to meet with US President Trump while watching ministers’ talks.

European bourses (STOXX 600 +1.5%) opened entirely in the green but some slight downward pressure has been seen in early morning trade with a couple of indices falling into negative territory. European sectors hold a strong positive bias, in-fitting with the risk tone. Industrials takes the top spot, followed closely by Travel & Leisure which continues to benefit from the lower oil prices and better risk appetite. Telecoms is lagging today; Banks and Real Estate also find themselves in the red.

Top European News

- ECB’s Simkus says a 25bps cut is needed in April, via Econostream; US Tariff announcement warrants a more accommodative monetary policy, and “we need to move to a less restrictive stance”.

- ECB’s de Guindos says he is optimistic that the US tariffs are a wake up call for Europe

- ECB’s Stournaras says negative impact from Trump tariffs on Greek economy will be limited.

- UBS Global Research cuts 2025 EZ GDP forecast to 0.5% (vs prior forecast 0.9%)

- UBS Global Research cuts UK 2025 GDP growth forecast by 0.4ppts to 0.7%

FX

- USD is currently softer vs. all peers after benefiting on Monday from a jump in US yields. The trade narrative remains at the forefront of investor sentiment after US President Trump showed no signs of easing up on his aggressive approach to trade as he threatened an additional 50% tariff on China. Furthermore, Trump added that the US is not looking at pausing tariffs; tariffs could be permanent and there could also be talks. DXY sits towards the top end of Monday’s 102.18-103.54 range, ahead of US NFIB small business optimism and Fed’s Daly.

- EUR is firmer vs. the USD but to a lesser extent than some peers. Monday saw EUR/USD close higher but a long way off the earlier session peak at 1.1050 with the pair dragged lower by upside in US yields. ING posits that the EUR remains underpinned by its liquidity premium. Today’s EZ docket is light in terms of data and as such, broader macro conditions and developments on the trade front will likely remain the focus for the pair. EUR/USD is currently contained on a 1.09 handle within a 1.0905-91 range.

- JPY is firmer vs. the USD despite the pick-up in risk sentiment we have seen thus far (albeit stocks have pulled away from best levels). In terms of updates out of Japan, Chief Cabinet Secretary Hayashi says PM Ishiba is considering visiting the US to meet with US President Trump. Additionally, US Treasury Secretary Bessent said he has not seen a trade offer from Japan and expects Japan to get priority in negotiations because they came forward early. Updates which explain some of the modest strength vs the Dollar. USD/JPY has delved as low as 146.98 but is some way off Monday’s low at 144.82.

- GBP is firmer vs. the broadly softer USD but once again to a lesser extent than the EUR on account of the Euro’s greater liquidity premium. UK specific drivers for the UK are on the light side. As we mentioned yesterday, desks are looking to see how the UK positions itself between the US and EU with Starmer noting last week that discussions on an economic deal with the US are “well advanced”. BoE’s Lombardelli is due later.

- Antipodeans firmer vs. the USD and top of the G10 leaderboard on account of the pick-up seen in risk sentiment. This comes despite both nation’s exposure to China and the threat by US President Trump on Monday over an additional 50% tariff on the name. The CNY has come under particularly attention today after the PBoC set its daily fixing above 7.20 for the first time since September 2023.

- PBoC set USD/CNY mid-point at 7.2038 vs exp. 7.3321 (Prev. 7.1980); weakest fix since September 2023.

Fixed Income

- USTs are relatively contained after a blockbuster Monday. Thus far, USTs are in relatively narrow 111-21+ to 112-08 parameters and entirely within, but at the lower-end of, Monday’s standout 111-15+ to 114-10 band. As it stands, markets are essentially just waiting for the next major update with the risk tone taking a slight breather from Monday’s marked pressure. Focus primarily on how Trump responds to China. Docket ahead includes US NFIB small business optimism and Fed’s Daly.

- Bunds began firmer, at the top-end of a 129.81 to 130.58 band which is entirely within but at the lower end of Monday’s chunky 129.11 to 132.03 range. As the morning progressed and the European tone remained relatively robust the benchmark slipped into the red and back below 130.00. A German 2035 Green outing garnered quite weak demand which fuelled some modest pressure in German paper.

- Gilts are outperforming and towards the top-end of a 91.81 to 92.63 band. Strength is a function of the relative underperformance seen in Gilts on Monday rather than any specific factor underpinning it and with no real concession emerging into strong DMO supply that seemingly sparked a c. 15 tick bounce in Gilts. While firmer, today’s 92.63 high point is just under 200 ticks shy of Monday’s 94.50 high and leaves the benchmark lower by over 150 ticks WTD.

- UK sells GBP 2.25bln 4.375% 2054 Gilt: b/c 3.04x (prev. 2.85x), average yield 5.357% (prev. 5.104%) & tail 0.2bps (prev. 0.2bps)

- Netherlands sells EUR 2.095bln vs exp. EUR 2.0-2.5bln 0.50% 2032 DSL: average yield 2.567%

- Germany sells EUR 2.386bln vs exp. EUR 3bln 2.50% 2035 Green Bund: b/c 1.3x, average yield 2.62% & retention 20.47%

Commodities

- Crude is choppy and currently around the unchanged mark. Overnight the complex was boosted by the improvement in risk appetite, but some of this optimism has dissipated a touch within the complex. Around the cash open the complex was towards the day’s peak at USD 61.75/bbl, before venturing to a fresh low at USD 60.17/bbl vs current USD 60.85/bbl. Energy specific updates have been light thus far.

- Precious metals are on a firmer footing today. Spot gold is higher by around a percent, having clambered above the USD 3,000/oz mark in overnight trade. The upside continued into the European session, taking the yellow metal to a fresh high of USD 3,015.91/oz. Bloomberg reported that gold held in London vaults increased by 372,000 ounces in March, marking the first monthly rise since October. It comes as the lucrative arbitrage trade, which had moved billions of dollars’ worth of bullion to the US, ended after precious metals were exempted from recent tariffs.

- Base metals hold a positive bias amid the recovery in risk appetite. 3M LME Copper gains by around 0.6% and currently trades in a USD 8,734.1-8,846/t range.

Geopolitics: Middle East

- Israel received Egypt’s new proposal, which involves the release of 8 hostages in exchange for a 40- to 70-day ceasefire although a source said it will be difficult to accept the proposal, according to Jerusalem Post.

- Iran’s Foreign Minister Araqchi confirmed Iran and the US will meet in Oman on Saturday for indirect high-level talks, while official media reported Iran’s Foreign Minister Araqchi and US envoy Witkoff will lead the US-Iran talks in Oman.

- Iran’s Nournews said the latest statements by US President Trump regarding holding direct talks with Iran is a complex and designed psychological operation to influence domestic and international public opinion.

- Houthi-affiliated media reported US raids on Hodeidah and Sanaa governorates in Yemen, according to Sky News Arabia.

Geopolitics: Ukraine

- Senior US Defense Department officials are considering withdrawing as many as 10k troops from Eastern Europe, according to NBC officials.

- US President Trump said they are meeting with Russia and Ukraine, and are getting sort of close, while he is not happy with Russia’s bombing.

Top Overnight News

- 6:00 am: Mar NFIB Small Business Optimism, est. 99, prior 100.7

Central Bank Speakers

- 2:00 pm: Fed’s Daly Speaks in Discussion on Economic Outlook

DB’s Jim Reid concludes the overnight wrap

As we go to press this morning, the market selloff has shown some initial signs of stabilising after the incredible rout over recent days. For instance, the S&P 500 was “only” down -0.23% yesterday, and futures this morning are up +1.32%, which would be the first positive day since the reciprocal tariffs were announced. That pattern has been evident globally, and in Asia this morning, the Nikkei (+4.99%) is on course for its best day since the summer turmoil, surging back after Treasury Secretary Bessent said that “I would expect that Japan is going to get priority”. Other indices are recovering too, including the Shanghai Comp (+0.91%), the Hang Seng (+1.58%), and the S&P/ASX 200 (+1.73%), and in Europe, futures on the DAX (+1.93%) and the FTSE 100 (+1.77%) are also positive.

Yet despite this morning’s recovery, markets are hardly in a good place right now, with an incredible amount of volatility still happening across different asset classes. Bear in mind that the S&P 500 is now down -10.73% since the tariff announcements, making it the worst 3-day performance since March 2020 at the height of the pandemic turmoil. And what was particularly striking yesterday was that sovereign bonds also witnessed a heavy selloff, with the 30yr Treasury yield (+21.0bps) posting its biggest daily spike since March 2020. That marked a big shift with recent sessions, when investors had moved into sovereign bonds amidst the risk-off move, and it spoke to broader concerns about the safety of US assets and their capacity to act as a haven in times of market stress.

All that came as President Trump showed no sign of reversing course on the reciprocal tariffs, which are still due to take effect from tomorrow. If anything, Trump’s rhetoric pointed towards further escalation, and he said yesterday that “if China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th.” He also added that meetings with China would be “terminated”. So that led to a fresh risk-off move, and later on the Chinese Ministry of Commerce said in a statement that “If the US insists on its own way, China will fight to the end.”

Admittedly, Trump did sound open to reaching deals with other countries, saying in his message on China tariffs that “Negotiations with other countries, which have also requested meetings, will begin taking place immediately.” Later on, he also said that “There can be permanent tariffs and there can also be negotiations because there are things that we need beyond tariffs”. But administration officials have struck quite different tones on this issue, with White House adviser Peter Navarro writing “This is not a negotiation” in an FT op-ed, while Treasury Secretary Bessent said that “everything is on the table” when asked about the possibility of tariffs being lowered.

Although markets are facing incredibly stressed conditions right now, one of the most interesting features of yesterday’s session was a brief surge of more than +5% intraday for the S&P 500, shortly after the US open. That followed a headline suggesting that Kevin Hassett, the Director of the National Economic Council, had said that President Trump was considering a 90-day pause in the tariffs for all countries except China. But as questions arose about where this headline had come from, with no source available, the market quickly gave up most of those gains again, with the S&P 500 reversing back into negative territory. So it was a clear indication that markets are very sensitive to any policy shifts here, given that even an unsubstantiated headline was capable of driving a huge market reaction.

When it came to the market moves, global equities continued to lose ground across the world yesterday. While the S&P 500 recovered from -4.71% shortly after the open to only close -0.23% lower, the wild swings still saw the VIX index of volatility (+1.67pts) up to 46.98pts by the close, marking its highest closing level since the pandemic turmoil. Meanwhile in Europe, the slump was much more aggressive, with the STOXX 600 (-4.50%) having now shed -15.83% since its all-time high in early March. More broadly, financial conditions continued to tighten, with US HY spreads widening another +22bps yesterday to 449bps. So that means HY spreads have widened by more than +100bps over the last 3 sessions, making it the fastest spread widening since March 2020. Meanwhile US IG spreads were up +7bps yesterday and +23bps in the last 3 sessions, the fastest spread widening since the regional bank turmoil of March 2023.

But even as risk assets remained under pressure, it was notable that sovereign bonds were also selling off at the same time. For instance, the 10yr Treasury yield (+18.9bps) rebounded to 4.19% yesterday, which was its biggest jump since September 2022, during the global selloff after the UK’s mini-budget under PM Liz Truss. The 10yr yield had traded as low as 3.88% early in the European session so it was a huge intraday move. The losses were particularly clear at the long end of the curve, but they happened across the board, and even the 2yr yield (+11.1bps) moved up to 3.77%. And it was also notable that real rates drove the rise in yields, with the 10yr real rate (+17.9bps) posting its biggest daily rise since September 2022, moving back up to 1.98%.

That shift came as investors dialled back their expectations for rate cuts this year, with 93bps priced in by the December meeting, down -6.5bps on the day. So it was interesting that despite a broad risk-off move, investors are concerned that the Fed might not be able to cut aggressively in this environment, not least because of the threat of inflation rising even further above target. Indeed, Fed speakers haven’t sounded as though they’re in a hurry to cut rates, and Governor Kugler said yesterday that “We want to keep inflation expectations well anchored”, and that “It should be a priority to make sure inflation doesn’t move up and doesn’t move up in a very negative way.”

Over in Europe, there was also an aggressive bond selloff, with UK gilts particularly affected. In fact, the 30yr gilt yield (+20.4bps) saw its biggest daily jump since October 2022, back when Liz Truss was still Prime Minister, taking it back up to 5.24%. Other parts of the curve were also affected, with the 10yr gilt yield (+16.3bps) also seeing its biggest daily jump in over a year. And elsewhere in Europe, there was also a decent move higher for yields, with those on 10yr bunds (+3.5bps), OATs (+6.6bps) and BTPs (+9.8bps) all rising on the day. That also pushed the Franco-German 10yr spread back up to 78.7bps, its widest level since mid-January.

To the day ahead now, and US data releases include the NFIB’s small business optimism index. Meanwhile from central banks, we’ll hear from the Fed’s Daly, ECB Vice President de Guindos, the ECB’s Holzmann and Cipollone, and the BoE’s Lombardelli.

Loading…