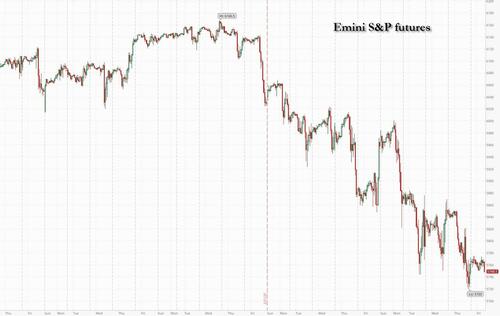

US equity futures erased a modest rebound from yesterday’s 1.8% rout ahead of today’s 8:30am jobs report and Powell’s 12:30pm speech. As of 8:00am ET, S&P futures were unchanged and well off session highs, while Nasdaq futures rose 0.1%, with Mag 7 names mixed, led by NVDA’s +1.4% pre-market gain after the bullish AVGO (+13%) earnings. Underscoring the growing risk aversion in the markets, stocks failed to stage a rebound even after Trump delayed levies on Mexican and Canadian goods covered by the North American trade deal. Europe’s Stoxx 600 falls 0.7% following a broadly weaker session for Asian stocks as Trump’s shifting approach to trade tariffs hampers risk sentiment. Bond yields are lower as is the USD, although off session lows. Commodities are actually higher for once led by oil (WTI +1.6%) and base metals (Aluminum +1.4%; Copper +1.6%). In crypto, Bitcoin slumped after Trump signed an executive order to create a strategic Bitcoin reserve that failed to meet market expectations. Today, we will hear the payroll data at 8:30am ET. Consensus looks for +160k vs. +120k whisper (143k prior); the UR is expected to remain at 4.0% vs. 4.0% prior and Hourly Earnings to print 0.3% vs. 0.5% prior.

In premarket trading, Broadcom (AVGO) shares jumped 11% after the chipmaker reported first-quarter results that beat expectations and gave an outlook that is seen as strong, reassuring investors about the demand prospects for AI-related infrastructure. In sympathy, chip stocks gained: Micron (MU) +1.3%, Applied Materials (AMAT) +1% and AMD +0.5%. Nvidia led gains among the Magnificent Seven stocks (Nvidia +1.4%, Apple -0.3%, Tesla -0.4%, Microsoft -0.3%; Meta, Amazon and Alphabet little changed). Here are other notable premarket movers:

- Hewlett Packard Enterprise shares sink 20% after the maker of servers gave an outlook that is weaker than expected. The company also said it would eliminate about 3,000 jobs

- Gap shares rise 18% after the retailer reported comparable sales in all brands that topped Wall Street expectations

- Walgreens Boots Alliance is trading 5.7% after the US drugstore chain agreed to be purchased by Sycamore Partners for $10 billion

- Intuitive Machines shares tumble 34%, extending losses after Thursday’s 20% selloff, as the space firm believes its second lander may be in the wrong orientation on the moon

- Bigbear.ai shares slide 13% after the software company reported fourth-quarter results that are weaker than expected

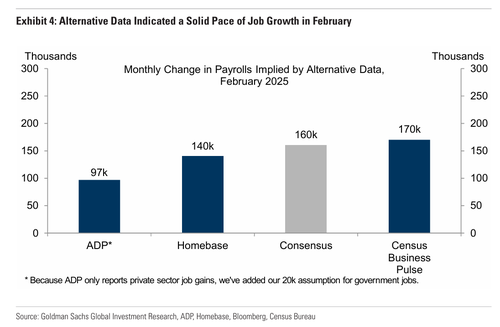

US employers likely added 160,000 jobs last month, showcasing a labor market holding steady in the face of mounting policy uncertainty, according to economists surveyed by Bloomberg, although as UBS notes, the whisper number is well lower, at around 122,000 (our full preview can be found here).

On Thursday, Wall Street failed to stage a rebound even after President Donald Trump delayed levies on Mexican and Canadian goods covered by the North American trade deal. The back-and-forth on tariffs “is creating a lot of uncertainty and that is showing up not only in markets, which have become quite volatile, but also in forward looking leading indicators, such as surveys and purchasing managers indexes,” said Florian Ielpo at Lombard Odier. “For now the hard data remains good, but the soft data is deteriorating, and the question is which one is correct.”

After the jobs report there is another notable highlight: Fed Chair Jerome Powell is slated to speak at a monetary policy forum at 12:30pm.

Bitcoin, meanwhile, sank as much as 5.7% and four other digital tokens that had previously been highlighted by Trump fell at least 3%, as a potential lack of new buying weighed on the market. The executive order signed by Trump indicated that the government wouldn’t use taxpayer money to fund a strategic reserve of the largest digital asset. Instead, the reserve would be capitalized with Bitcoin already owned by the federal government. Here are some of the biggest movers on Friday:

- UMG shares rise as much as 6.3% as the music label reported higher-than-expected revenue from subscriptions, an important line that contributed to over one third of the firm’s sales.

- Elia shares jump as much as 19%, marking its biggest daily gain on record, after the electricity transmission company posted results and guidance that trumped expectations.

- Vivendi shares rise as much as 4.5% after the French media firm said its intention is to sell its stake in Telecom Italia when it gets good terms.

- Ferragamo shares slump as much as 19% after the Italian luxury goods maker reported a wider-than-expected loss for the full year and gave an outlook that analysts said was cautious, stoking worries over subdued demand.

- Just Group shares fall as much as 17%, the most since March 2020, after the UK financial services company’s adjusted earnings came in well below estimates.

- Zurich Airport shares fall as much as 6%, the most since August. The company gave cautious guidance, held back by lower retail revenues due to shop closures and higher labor costs, according to Stifel.

- SFS shares fall as much as 8.6% after the Swiss mechanical fastening systems and components maker reports results that were below expectations.

- Hensoldt shares fall as much as 8.2% after Kepler Cheuvreux downgraded the German defense company’s shares to reduce, saying the speed at which the share is discounting the future is “dangerous” and underplays execution risks.

Europe’s Stoxx 600 falls 0.7% following a broadly weaker session for Asian stocks as US President Donald Trump’s shifting approach to trade tariffs hampers risk sentiment. Consumer product and travel shares are leading declines in Europe as the euro extends its post-ECB rally, climbing 0.7% to ~$1.0860. While Europe’s stock benchmark retreated on Friday, Germany’s historic shift toward increased spending helped put the euro on track for its best week since 2009. The prospect of more debt issuance hoisted yields on German bonds by the most since 1990 earlier in the week. The rate on 10-year bunds was little changed on Friday at 2.83%.

Asian stocks fell after US President Donald Trump’s whipsaw tariff announcements added uncertainty to global markets, with Japan and Australia leading declines. The MSCI AC Asia Pacific Index slid as much as 1%. Still, the measure is on track to cap its best week since September on positive signals for China from the National People’s Congress. Japan and Australia’s benchmarks dropped the most in the region. Trump’s order to delay tariffs on Mexican and Canadian goods covered by the North American trade agreement is doing little to assuage investors’ concerns on increasing unpredictability in markets. Japan’s export-sensitive electronic stocks, Sony Group and Nintendo, were among the biggest drags on the regional gauge, while US-exposed Macquarie Group also slipped. “Further escalation of trade tensions – such as new tariffs or breakdowns in talks – could spur more market volatility and downside for trade-sensitive stocks,” said Josh Gilbert, a market analyst at eToro in Sydney. “Sectors like autos, aerospace, technology hardware, apparel, and agriculture are especially sensitive.”

In commodities, oil prices advance, with WTI rising 1.4% to $67.30. Spot gold gains $6 to around $2,918/oz. Bitcoin falls 1% to around $89,000 after Trump’s crypto executive order disappointed

Looking at the US event calendar, today’s data calendar includes February jobs report (8:30am) and January consumer credit (3pm). Fed speaker slate includes Bowman (10:15am), Williams (10:45am), Kugler (12:20pm, 1pm) and Powell giving keynote speech on the economic outlook (12:30pm).

Market Snapshot

- S&P 500 futures up 0.4% to 5,768.75

- STOXX Europe 600 down 0.5% to 553.18

- MXAP down 0.8% to 188.13

- MXAPJ down 0.6% to 591.18

- Nikkei down 2.2% to 36,887.17

- Topix down 1.6% to 2,708.59

- Hang Seng Index down 0.6% to 24,231.30

- Shanghai Composite down 0.3% to 3,372.55

- Sensex little changed at 74,384.75

- Australia S&P/ASX 200 down 1.8% to 7,948.17

- Kospi down 0.5% to 2,563.48

- German 10Y yield little changed at 2.82%

- Euro up 0.7% to $1.0863

- Brent Futures up 1.4% to $70.42/bbl

- Gold spot up 0.3% to $2,921.77

- US Dollar Index down 0.45% to 103.60

Top Overnight News

- US President Trump will sign executive orders today at 14:30EST/19:30GMT and deliver remarks at the White House Digital Assets Summit at 15:00EST/20:00GMT

- US House Speaker Johnson aims to hold a CR vote on Tuesday and expects it will pass, while the CR text could be released as soon as Friday.

- The United States is planning to charge fees for docking at U.S. ports on any ship that is part of a fleet that includes Chinese-built or Chinese-flagged vessels and will push allies to act similarly or face retaliation, a draft executive order stated. RTRS

- Ontario Premier Doug Ford is steaming ahead with his pledge to impose 25 percent tariffs on electricity sent to the United States starting Monday, despite President Donald Trump’s decision to suspend most tariffs on Mexico and Canada Thursday afternoon. Politico

- US President Trump sent a letter to Iran urging negotiations: Fox Business

- The Trump administration believes that Ukrainian President Volodymyr Zelensky has apologized for his recent behavior, and top U.S. officials are prepared to meet with Ukrainian officials in Saudi Arabia next week to set the stage for potential peace talks between Kyiv and Moscow. WSJ

- Fed’s Bostic (2027 voter) said the economy is in incredible flux and hard to know where things will land, while he added that if they wait for trends to show up in national economic data before acting, they could be too late. Bostic also said he would be surprised if they get a lot of clarity on the impact of policies before late spring into summer and noted the decision at the May or June meeting will depend on how clear things get

- Mexico will review its levies on Chinese shipments, President Claudia Sheinbaum said — a possible win for Donald Trump’s “Fortress North America” push. BBG

- The Fed’s Raphael Bostic said it could take several months to understand how Trump’s policies will affect the economy, suggesting rates may remain steady until late spring. BBG

- China’s trade numbers fall short of expectations for the Jan/Feb period, w/exports rising 2.3% (vs. the Street +5.9%) while imports sink 8.4% (vs. the Street +1%). RTRS

- China’s exports hit a record $540 billion in the first two months of 2025 as tariffs drove the frontloading of shipments. Bloomberg Economics said a surprise drop in imports hints at domestic weakness. BBG

- BOJ officials will likely hold policy steady this month, but could discuss whether another rate hike is needed at the May meeting given continued upside inflation pressures. RTRS

Tariffs/Trade

- US President Trump posted on Truth “After speaking with President Sheinbaum of Mexico, I have agreed that Mexico will not be required to pay Tariffs on anything that falls under the USMCA Agreement. This Agreement is until April 2nd”. It was later reported that Trump signed the amendment to Mexico and Canada tariffs to make USMCA-compliant products exempt from levies until April 2nd.

- US President Trump said most tariffs are to start April 2nd and predominant tariffs will be reciprocal, while he said steel and aluminium tariffs will not be modified. Trump cited a little short-term interruption on tariffs and said tariffs are something the US has to do. Trump said he is not even looking at the market and noted the long-term economy is very strong. Furthermore, Trump said there is no USMCA exemption for auto tariffs next month, according to Reuters.

- White House said President Trump’s exemption on 25% tariffs on most goods from Canada and Mexico is not retroactive, while officials noted that some automakers think they will need to pay 25% tariffs on three days of imports.

- US President Trump sent a letter to Iran urging negotiations: Fox Business

- Fed’s Bostic (2027 voter) said the economy is in incredible flux and hard to know where things will land, while he added that if they wait for trends to show up in national economic data before acting, they could be too late.

- US House Speaker Johnson aims to hold a CR vote on Tuesday and expects it will pass, while the CR text could be released as soon as Friday.

- Canada’s Finance Minister said Canada will delay the second wave of tariffs on CAD 125bln of US products until April 2nd.

- US Commerce Secretary Lutnick informed Brazilian Vice President Alckmin in a call that the US could postpone tariffs on Brazilian goods, while Alckmin believes Brazil and the US could reach a good understanding on tariffs policy through dialogue and noted the sides agreed to hold further bilateral talks in the coming days.

- US is to impose fees on any vessel entering US ports that are part of a fleet which includes vessels built or flagged in China and the US is to engage allies to impose similar measures or risk US retaliation, according to draft order.

- Chinese Foreign Minister Wang said the abuse of fentanyl is an issue that the US has to solve and noted regarding US-China relations that if one side exerts pressure, China will resolutely counter that. Furthermore, Wang Yi said China’s economy grew 5% last year despite the pressure of unilateral US sanctions.

- UK Business Secretary Jonathan Reynolds vowed to ‘stand up’ for British steel as US tariffs loom, according to FT.

A more detailed look at global markets courtesy of Newqsuawk

APAC stocks were mostly lower as the region followed suit to the losses stateside amid growth concerns, tech weakness and tariff uncertainty, while participants digested Chinese trade data and braced for US jobs data. ASX 200 retreated below the 8,000 level with the declines led by tech following the rout in US counterparts and with the top-weighted financial sector also suffering firm losses. Nikkei 225 underperformed and dipped to sub-37,000 territory in early trade with weakness in tech stocks dragging the index lower, while long-term Japanese yields continued to rise. Hang Seng and Shanghai Comp initially bucked the trend despite the weaker-than-expected Exports and Imports data from China, while there were recent support pledges by the nation’s central bank, finance and securities heads including PBoC Governor Pan who said they will study and establish new structural policy tools, as well as cut interest rates and banks’ RRR at the appropriate time. However, the benchmarks ultimately succumbed to the broader risk tone.

Top Asian News

- BoJ is seen keeping policy steady at this month’s meeting, although three sources familiar with its thinking said inflationary pressures from wage gains and prolonged food price rises could prompt discussion of another hike as soon as May.. Thereafter, BoJ is reportedly leaning towards holding the key rate at the March meeting, via Bloomberg citing sources; wishes to monitor the January hike and impact of US policies

- South Korean court cancelled the arrest of South Korea President Yoon although Yoon’s lawyer said he won’t immediately be released as prosecutors can appeal, while the Presidential Office said it hopes Yoon will return to work soon.

European bourses (STOXX 600 -0.8%) began the session entirely in the red, and continued to trundle lower in early morning trade; price action has been relatively choppy, with focus now on US NFP. European sectors hold a strong negative bias. Telecoms is leading today, albeit modestly so; newsflow for the industry has been light aside from EU Defence Commissioner Kubilius saying it is possible to replace Starlink in Ukraine quickly. Consumer Products is the clear underperformer today, with particular weakness in the Luxury after Chinese trade data and Ferragamo results. US equity futures are modestly firmer footing; the lift in sentiment today could be attributed to the strong Broadcom results; Co. shares are up 12% in pre-market trade after reporting strong AI-demand in Q1, where profits and sales topped expectations. The highlight of the day is the US jobs report for February, where the pace of payroll additions is seen at 160k (vs 143k in January), the jobless rate is seen unchanged at 4.0%, while average earnings are seen unchanged at 41% Y/Y. Tesla (TSLA) added to “best ideas list” at Wedbush.

Top European News

- EU is to explore long-term reform of fiscal rules for defence, while it was separately reported that Spanish PM Sanchez said Spain to bring forward the timeline to reach 2% of GDP defence spending.

- ECB’s Villeroy says we are winning the battle with inflation; ECB must be ready to act and react.

- ECB’s Muller says euro-area inflation is nearing the ECB’s 2% target, via Bloomberg. Too early to assess the potential impact of US tariffs. Trade restrictions would dampen growth and increase prices. Emphasizes increased caution regarding future rate cuts.

- UK Chancellor Reeves met with primary dealer firms in the Gilt market on 6th March; reiterated a commitment to fiscal rules and that growth is the number one priority for the government.

FX

- USD’s miserable run for the week has extended into Friday trade. DXY started the week off around the 107.56 mark but has since ripped through its 200DMA to the downside at 104.99 and printed a YTD trough at 103.56. Ahead, US NFP and of course any updates from President Trump regarding trade.

- This week’s monster rally in the EUR has continued into today’s session with the pair printing a fresh YTD Peak at 1.0871. Upside this week has stemmed from the recent spending pledges coming out of Germany, a hawkish tweak to ECB guidance and an ongoing slew of soft data releases out of the US. On the ECB, source reporting in the aftermath of the decision noted that some officials see an increasing chance of a rate in April with 2.5% unlikely to be the terminal rate. Others on the GC see a growing chance of a pause in their easing cycle at their next meeting before rates come down again. Attention is now on a test of 1.09; not breached since 6th Nov.

- Overnight, USD/JPY traded on both sides of the 148.00 level before ultimately moving lower alongside the risk-off mood in APAC. In terms of domestic newsflow, source reporting via Bloomberg noted that the BoJ is reportedly leaning towards holding the key rate at the March meeting as it wishes to monitor the January hike and impact of US policies. Furthermore, it sees recent wage developments as being within expectations. The downside in USD/JPY has led to another YTD trough for the pair at 147.20.

- GBP is on the front foot vs. the USD once again and has printed another YTD peak at 1.2925. As has been the case throughout the week, fresh macro drivers for the UK have been lacking and therefore it is the USD leg of the equation that has been the primary driver for Cable. The pair has soared from the 1.2577 opening price on Monday, clearing its 200DMA at 1.2785 and made its way onto a 1.29 handle.

- Antipodeans are both bucking the trend of other majors and are on the backfoot vs. the USD. Price action takes place in the context of the risk-off mood in APAC trade and as participants digested the latest trade figures from Australia and New Zealand’s largest trading partner, China which showed a surprise contraction in imports and a miss on exports.

- CAD is flat vs. the USD following a heavy day of tariff-related newsflow yesterday. To recap, Trump signed an amendment to Mexico and Canada tariffs to make USMCA-compliant products exempt from levies until April 2nd. However, there will be no USMCA exemption for auto tariffs next month, steel and aluminium tariffs will not be modified and April 2nd reciprocal tariffs will still go ahead. On net, the announcements have provided some reprieve for CAD. Ahead, the region’s own jobs data.

- PBoC set USD/CNY mid-point at 7.1705 vs exp. 7.2406 (prev. 7.1692).

Fixed Income

- Bunds are firmer in a modest bounce from recent significant pressure. At best, Bunds have been to a 128.18 peak with gains of 116 ticks at best. A move which is likely a modest paring of recent extensive downside and also a function of the downbeat European equity risk tone. Bunds in the morning got hit by a very soft Industrial Output report for January which printed outside of the forecast range and sparked immediate pressure of around 30 ticks in Bunds to the eventual 127.54 trough. A move which was potentially spurred by the soft Industrial data justifying the fiscal measures outlined by incoming Chancellor Merz earlier in the week.

- USTs are firmer but in a narrower 110-25 to 111-03 band. Benchmarks benefitting from the uptick in Bunds as discussed above, more sources pointing to the BoJ potentially remaining on hold in March (pricing has a 96% chance of no move implied) and mainly waiting for Payrolls & Powell. That aside, following the concessions on tariffs by Trump on Thursday we are keenly awaiting any fresh updates to this for/from Canada and Mexico in addition to and perhaps more pertinently anything relating to China.

- Gilts find themselves following suit with broader price action but caught between USTs and Bunds in terms of magnitudes. Currently back below the 92.00 mark but has been above the figure in a 91.73-92.13 band. Specifics for the region light with the initial bias a bullish one on account of the above and indeed Gilts opened higher by around 33 ticks.

Commodities

- Crude is on a firmer footing and currently trade just off session highs, with both WTI currently higher by circa USD 0.98/bbl thus far; support today lacks a clear driver, but with upside coinciding with strength at the European cash open. Brent’May currently trading at the top end of USD 69.30-70.50/bbl range. Russian Deputy PM Novak said OPEC+ is to raise oil output from April, but might reverse that decision afterwards if there are imbalances in the market. This sparked little move in the complex.

- Natgas prices began the morning softer, but jumped on news that a Russian attack “significantly” damaged Ukraine’s gas production facilities; which caused operations to cease. Dutch TTF currently higher by around 4%.

- Spot gold traded sideways overnight, but picked up a touch in European trade, fuelled by the weaker dollar, and ahead of the US NFP report. The yellow metal is firmer by 0.3%, above the USD 2900/oz mark, and within a USD 2,896.83-2,923.06/oz range on the session.

- Copper futures are subdued amid the mostly negative risk tone, with its biggest buyer, China, printing weaker-than-expected trade data.

- Russia Deputy PM Novak says OPEC+ is to raise oil output from April, but might reverse that decision afterwards if there are imbalances in the market. OPEC+ decision to raise output due to seasonal rise in demand. Oil flows via CPC are at reduced volumes after recent drone attacks, pumping will depend on production level. Russia’s oil output is well below OPEC+ quota in February, will be taken into account within the deal. Russia aims to fully comply with OPEC+ deal. Says parties subject to the deal will analyse possibility to speed up compensation for previous overproduction.

- Qatar set April Marine Crude OSP at Oman/Dubai plus USD 2.10/bbl April Land Crude OSP at Oman/Dubai plus USD 1.85/bbl.

- Saudi Arabia has set the April Arab light crude oil OSP at Asia at plus USD 3.50bbl vs. Oman/Dubai average, according to documentation cited by Reuters

- UBS sees price level of USD 1000/oz for Palladium in 2025; expects a deficit of around 300k/oz, or 3% demand in 2025; expects it to remain a laggard in the precious metals space.

- China Feb Foreign reserves USD 3.227tln (exp. USD 3.229tln); gold reserves USD 208.6bln (prev. USD 296.5bln).

- Ukraine’s Energy firm DTEK says Russian attack significantly damaged its gas production facilities in Ukraine’s Poltava region; these facilities have ceased operations after the attack.

- Kazakhstan ships 100k T of oil to Germany via Druzhba pipeline in Feb, according to IFAX citing Kaztransoil.

- Kazakhstan Energy Minister says their oil output is above OPEC+ quotas; has tasked oil majors to cut oil production. Intend to optimise oil output in March. To cut oil export via the CPC. Consultations will be held next week in the US with the CEOs of major shareholders in big oil projects in Kazakhstan. Told major oilfield shareholders, ExxonMobil (XOM), Shell (SHEL LN), TotalEnergies (TTE FP) to cut March volumes, was received well.

- UBS sees price level of USD 1000/oz for Palladium in 2025; expects a deficit of around 300k/oz, or 3% demand in 2025; expects it to remain a laggard in the precious metals space.

- Saudi Arabia has set the April Arab light crude oil OSP at Asia at plus USD 3.50bbl vs. Oman/Dubai average, according to documentation cited by Reuters.

- Bank of America reiterates its unchanged USD 60-80/bbl medium-term forecast range for Brent.

Geopolitics: Ukraine

- Russia’s Kremlin say they are closely monitoring EU defence initiatives and warn they may need to implement necessary countermeasures to safeguard Russian national securitySays Trump’s call for denuclearisation is on the agenda. Dialogue with the US on arms control is essential.

- Ukrainian President Zelensky said Ukraine and the US are to have a meaningful meeting next week and that Ukraine seeks a truce for air strikes and sea operations, while he added that Russia needs to release POWs to establish trust. Zelensky also said he will meet with the Saudi Crown Prince next week, and then the Ukraine team will remain in Saudi for a meeting with US officials.

Geopolitics: Other

- French President Macron said he was approached all day by other EU leaders to discuss the nuclear deterrence offer and technical talks will start on nuclear deterrence with EU leaders in which he hopes to see new cooperation by the end of the first half of 2025. Furthermore, Macron said Russia reacted the way it did to his speech because what he said is true and that Putin was piqued because they know his game, while he said he will talk with Putin once it is decided it is the right time.

- Chinese Foreign Minister Wang Yi said the international situation in 2025 remains full of challenges, while he added that China and Russia have established a new model of major-country relations and their relationship will not be disturbed by third parties. Wang also stated that Taiwan has never been a country and it never will be, as well as noted they should realise the complete ‘reunification’ of the motherland.

US Event Calendar

- 08:30: Feb. Change in Nonfarm Payrolls, est. 160,000, prior 143,000

- Feb. Change in Private Payrolls, est. 146,000, prior 111,000

- Feb. Change in Manufact. Payrolls, est. 2,000, prior 3,000

- Feb. Unemployment Rate, est. 4.0%, prior 4.0%

- Feb. Underemployment Rate, prior 7.5%

- Feb. Labor Force Participation Rate, est. 62.6%, prior 62.6%

- Feb. Average Hourly Earnings MoM, est. 0.3%, prior 0.5%

- Feb. Average Hourly Earnings YoY, est. 4.1%, prior 4.1%

- Feb. Average Weekly Hours All Emplo, est. 34.2, prior 34.1

- 15:00: Jan. Consumer Credit, est. $14.9b, prior $40.8b

Central Banks

- 10:15: Fed’s Bowman Speaks on Policy Transmission

- 10:45: Fed’s Williams Speaks on Panel on Policy Transmission

- 12:20: Fed’s Kugler Speaks on Rebalancing Labor Markets

- 12:30: Fed’s Powell Speaks on the Economic Outlook

- 13:00: Fed’s Kugler Appears on Panel Discussion

DB’s Jim Reid concludes the overnight wrap

Welcome to the end of what has been a tumultuous week for markets, as I step in for Jim who should be in the air just south of Greenland when this hits your mailboxes. Fierce cold winds were again blowing in US equity markets yesterday, with ongoing trade policy volatility sending the S&P 500 (-1.78%) to its worst day of 2025 for a second time this week. This came even as President Trump announced a tariff delay for USMCA-compliant goods coming from Mexico and then, later in the day, from Canada. Over in Europe, it was a quieter session, with the ECB delivering its fifth consecutive 25bps cut, but leaving open the possibility of a pause, while longer-dated yields continued to grind higher after their historical rise the previous day.

Kicking off with tariffs, yesterday President Trump signed orders delaying until April 2 tariffs on goods from Mexico and Canada that meet USMCA requirements, which should exempt about half of the goods affected by the new 25% tariffs. So a sizeable but partial rollback, though the share of exempt goods might rise as companies seek to adjust to the new rules. The coverage under USMCA trade agreement, which was renegotiated in President Trump’s first term, relates mostly to rules of origin requirements, so the partial exemption could be seen as addressing concerns over re-imports from third countries. Still, with this being a delay rather than a lasting exemption and with reciprocal tariffs also expected to be announced after April 2, this leaves plenty of lingering tariff uncertainty. The trade rhetoric remained tense vis-à-vis Canada in particular, with Canada’s outgoing Prime Minister Trudeau saying earlier in the day that we will be “in a trade war that was launched by the United States for the foreseeable future.” By contrast, President Trump made more conciliatory comments towards Mexico President Sheinbaum, who said later on that her country would “review the tariffs that we have with China”.

The ongoing uncertainty dragged on equities, as the S&P 500 (-1.78%) fell back to levels seen before the US election. In another volatile session, the index traded -1.65% lower early on before recovering to only -0.5% after comments from Commerce Secretary Lutnick that a USMCA-compliant delay was likely, but sentiment then soured again after the move was confirmed as the noisy policy signals seemed to add to the risk-off tone. In fact, yesterday marked the sixth session in a row that the S&P 500 moved more than 1% in either direction, the longest such run since November 2020. Reflecting this volatility, the VIX rose to a new YTD high (+2.94pts to 24.87). Underperformance by tech stocks saw the NASDAQ (-2.64%) join the Magnificent 7 (-2.89%) in technical correction territory, with the index down -10.43% from its mid-December high. For the Mag-7 the decline was led by slumps for Nvidia (-5.74%) and Tesla (-5.61%), with the two companies now down -26% and -45% from their recent peaks.

Amid the risk-off tone, rates markets moved to again price a full three Fed cuts by the December meeting (+5.9bps to 76bps). In turn, short-dated Treasuries rallied, with 2yr yield down -4.6bps to 3.96%, while the 10yr yield (-0.1bps) was little changed at 4.28%. These rate moves came despite mostly patient commentary from Fed officials. Philadelphia Fed President Harker said he is growing more concerned that the slowing in inflation “is at risk”. Fed Governor Waller viewed a March cut as unlikely but saw room for two, or possibly three, rate cuts this year. And later on, Atlanta Fed President Bostic said that when it comes to policy of the new administration he would be “surprised if we got a lot of clarity before the late spring into summer”. Treasury yields are trading another 2-3bps lower overnight as I type.

Looking forward to today, the main event is the US jobs report, which should get even greater attention given the recent softening in US data. Our US economists expect payrolls to gain +160k in February, up from 143k in January. They see the unemployment rate staying at 4.0% but hourly earnings growth returning to +0.3% from +0.5% in January. Ahead of the payrolls print, yesterday weekly jobless claims sent a fairly upbeat signal on the US labour market. Initial claims fell to 221k (vs 233k expected) in the week ending March 1, reversing an earlier spike, though continuing claims for the prior week surprised to the upside (1897k vs 1874k expected).

Back to yesterday and in Europe, the main story was the ECB rates decision, which delivered another 25bps cut bringing the deposit rate to 2.50%, with 150bps of cuts now delivered since last June. But the cut was accompanied by a few hawkish tweaks. The policy statement noted that the policy stance has become “meaningfully less restrictive”, with President Lagarde no longer emphasizing a lower “direction of travel” on rates and acknowledging that a pause at the next meeting in late April was an option. More generally, uncertainty was the dominant word of the day, with Lagarde stressing a data-dependent meeting-by-meeting policy approach. Later on, Bloomberg reported that ECB officials were preparing for tough talks over whether to cut at the next meeting. Our European economists see another rate cut in April as more likely than not, based on an assumption of a shock from US tariffs on Europe in early April. Notably, even as the ECB’s GDP projections were downgraded yesterday, they have not yet incorporated any US tariffs on Europe. See our economists’ full reaction here.

Rates markets initially took a hawkish read on the ECB’s decision, with overnight index swaps for end-2025 rising by around +7bps by the end of Largarde’s press conference but this move reversed later on, with December OIS pricing down -1.7bps on the day by the close. European government bond curves steepened. 2yr bund yields were largely stable (-0.4bps) but 10yr bund yields (+4.1bps) continued to grind higher after Wednesday’s historic sell-off, reaching their highest level since October 2023. 10yr OATs (+4.9bps) and BTPs (+5.8bps) underperformed, but in the UK 10yr gilts rallied (-2.7bps).

European equities had a mixed session with the Stoxx 600 trading lower for most of the day but largely recovering by the close (-0.03%). In Germany, the DAX (+1.47%) continued Wednesday’s rebound to close at a new all-time high, with the more friendly tariff headlines also helping the Stoxx Automobiles & Parts index rise +2.13% on the day. Italy’s FTSE MIB (+0.68%) and France CAC (+0.29%) posted more modest gains, while in the UK the FTSE 100 (-0.83%) saw a third consecutive decline.

The other major event in Europe was an EU summit on defence and Ukraine. EU leaders endorsed Commission proposals to temporarily exempt defence spending from fiscal rules, to work on a proposed EUR 150bn fund for defence loans for member states and to explore long-term reform of fiscal rules that had been proposed by Germany.However, Hungary’s Orban blocked a full EU-27 statement on Ukraine and the summit failed to deliver a new military aid package for Ukraine that had been floated earlier. Separately, we saw reports that senior US officials plan to meet Ukrainian counterparts in Saudi Arabia next week, with Bloomberg reporting that Washington wants to link the proposed US-Ukraine minerals deal to demands for Kyiv to commit to a quick ceasefire with Russia.

This morning in Asia equity markets are mirroring Wall Street’s overnight slump. Across the region, the Nikkei (-2.22%) is leading the losses, with the KOSPI (-0.31%) seeing a more modest decline, while the Hang Seng (+0.85%) is bucking the negative trend. Outside of Asia, US equity futures for both the S&P 500 (+0.26%) and NASDAQ 100 (+0.45%) are higher overnight. In FX, the Japanese yen (+0.26%) remains on the front foot trading at 147.60, its lowest level since early October against a broadly weaker US dollar and supported by increasing expectations for more BOJ rate hikes.

Early morning data showed China’s export growth slowing more than expected, increasing by just +2.3% y/y (vs +5.9% expected) in the January-February period, marking the slowest growth since April last year. At the same time, imports surprised markets by declining -8.4% y/y in the first two months of 2025 (vs +1.0% expected), the sharpest fall since July 2023.

In other overnight news, cryptocurrencies are lower amid news that a Strategic Bitcoin Reserve and a stockpile of other digital assets established by President Trump’s executive order yesterday evening will be capitalized by forfeited assets already owned by the federal government rather than any new government funding. As I type, Bitcoin is down -1.83%, though it has narrowed its losses after trading -5.7% lower.

Turning to the day ahead, the US payrolls release for February will be the main event on the data side, with Canada also releasing its own jobs report. In Europe, Germany January factory order and France January trade balance data are due. An array of Fed speakers scheduled, including Chair Powell on the economic outlook, as well as speeches by including Bowman, Williams and Kugler.

Loading…