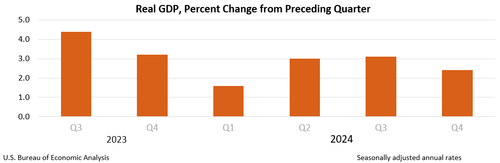

While it is as stale as 3 month old milk, and therefor completely useless especially ahead of tomorrow’s personal income/core PCE report, moments ago the BLS reported its 2nd revision to Q4 GDP which was revised up to 2.4% compared to the second est. of 2.3%, and above the median consensus of 2.3% (+2.2% to +2.6%) from 55 economists. The final Q4 print was down from 3.1% in Q3. The increase, however, wasn’t due to stronger consumption (this declined from 4.2% to 4.0%, below the 4.2% estimate) but mostly due to trade and downward revised imports. Additionally, inflation prints were more muted, with 4Q GDP price index rising 2.3% vs second est. of +2.4%, and the 4Q core PCE q/q rising 2.6%, also below the second est. of +2.7%.

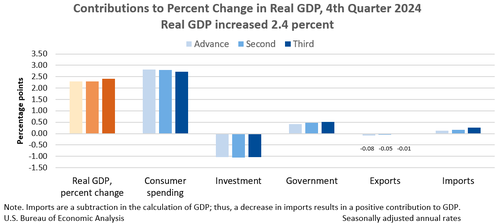

According to the BEA, the increase in real GDP in the fourth quarter primarily reflected increases in consumer spending and government spending that were partly offset by a decrease in investment. Imports, which are a subtraction in the calculation of GDP, decreased.

As shown in the chart below, GDP was revised up 0.1% point from the second estimate, primarily reflecting a downward revision to imports.

Specifically, here is the breakdown of the 2.4% print by component:

- Personal Consumption: 2.70%

- Fixed Investment: -0.2%

- Change in private inventories: -0.84%

- Exports: -0.01%

- Imports: 0.27%

- Government consumption: 0.52%

For a grand total of 2.440%

Compared to the third quarter, the deceleration in real GDP in the fourth quarter primarily reflected downturns in investment and exports that were partly offset by an acceleration in consumer spending. Imports turned down.

From an industry perspective, the increase in real GDP reflected an increase of 2.3 percent in real value added for private goods-producing industries, an increase of 2.4 percent for private services-producing industries, and an increase of 2.7 percent for government.

Real gross output increased 1.7 percent in the fourth quarter, reflecting an increase of 0.3 percent for private goods-producing industries, an increase of 2.0 percent for private services-producing industries, and an increase of 3.1 percent for government.

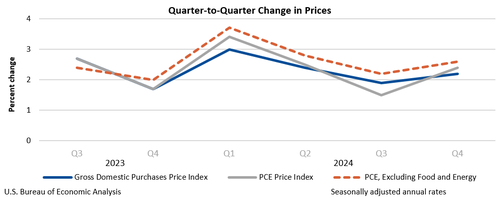

The price index for gross domestic purchases increased 2.2 percent in the fourth quarter, revised down 0.1 percentage point from the previous estimate. The personal consumption expenditures (PCE) price index increased 2.4 percent, the same as previously estimated. Excluding food and energy prices, the PCE price index increased 2.6 percent, revised down 0.1 percentage point from the previous estimate.

Bottom line: this was just another meaningless print, not just because it is beyond stale now – when the entire market looks ahead to the consequences of trade war – but also because a much more updated version of the core PCE data will come in exactly 24 hours.

Loading…