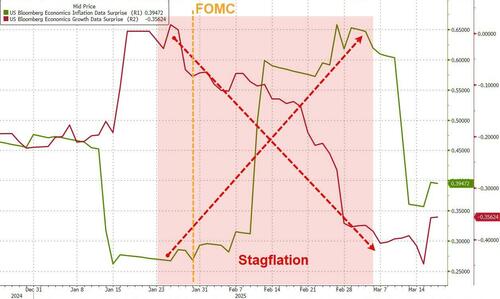

Since the last FOMC meeting, on Jan 29th, a lot has changed…

From an economic perspective, growth expectations have plunged and inflation prints have been wildly noisy…

Source: Bloomberg

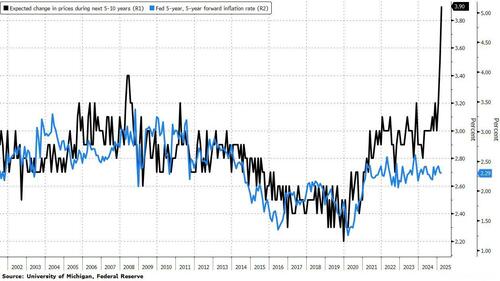

… (especially the idiotically partisan UMich inflation expectations)…

Source: Bloomberg

Gold has been the dramatic winner since the last FOMC meeting while oil and stocks have been clubbed like a baby seal. Bonds are bid but the dollar has been dumped…

Source: Bloomberg

Interestingly, as stocks have tumbled in the last two weeks, so have rate-cut expectations, back more in line with where they were after the last FOMC meeting (just 56bps now, from almost 100bps two weeks ago!)…

Source: Bloomberg

On the bright side, mortgage rates have plunged since the last FOMC meeting…

Source: Bloomberg

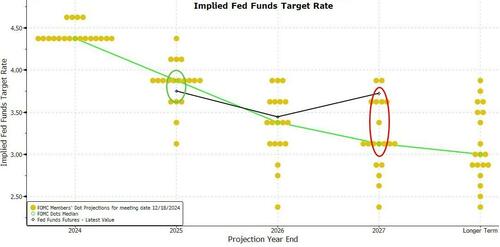

Finally, before everything goes just a little bit turbo, we note that the market is currently significantly more dovish than The Fed’s dots this year and dramatically more hawkish in 2027…

Source: Bloomberg

Rates are expected to be a nothingburger today.

So will today’s fresh Dot-Plot adjust to the market?

More importantly, what will The Fed do about its QT program?

Key Headlines:

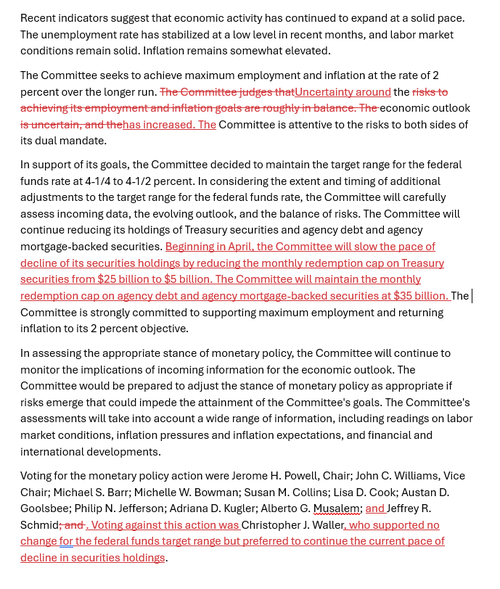

As expected, no change in rates:

- *FED HOLDS BENCHMARK RATE IN 4.25%-4.50% TARGET RANGE

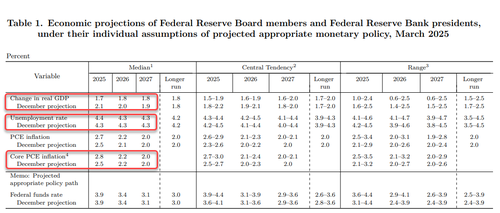

But, the economic projections are not pretty:

-

*FED SHARPLY REDUCES 2025 GROWTH PROJECTION, MARKS UP INFLATION

-

Fed cuts year-end GDP forecast from 2.1% to 1.7%

-

Fed raises year-end core PCE forecast from 2.5% to 2.8%

-

Fed raises year-end unemployment forecast from 4.3% to 4.4%

Perhaps of most note:

Fed removes language that “risks to inflation and employment are roughly in balance”

Trump’s fault:

- *FED SAYS UNCERTAINTY AROUND ECONOMIC OUTLOOK HAS INCREASED

And finally, the QT Taper is on…

- *FED TO SLOW BALANCE-SHEET RUNOFF STARTING APRIL 1

Read the full redline of the FOMC statement below:

Loading…