Goldman data shows that the Las Vegas Sphere (officially the MSG Sphere) continues to attract sizable crowds in downtown Vegas.

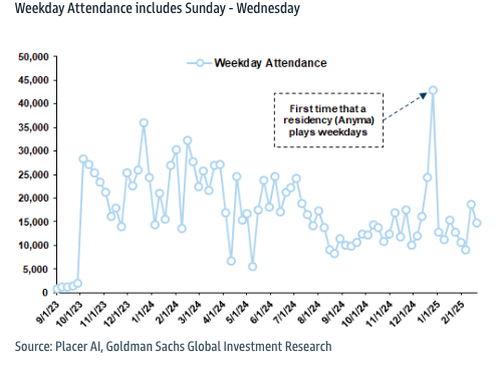

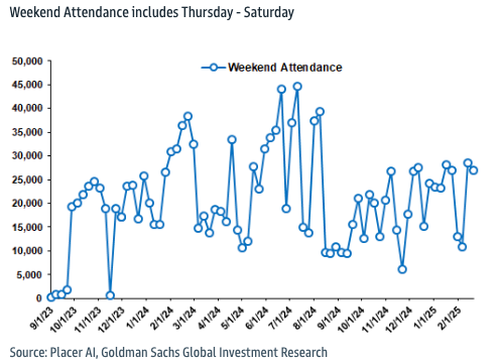

“At The Sphere, we continue to see solid demand for music residencies as evidenced by weekend attendance trends,” Goldman analysts Stephen Laszczyk and Antares Tobelem penned in a recent note to clients, adding, “Weekday attendance at ‘The Sphere’ remained near historical levels after coming off a spike in December driven by a residency (e.g. Anyma) playing on weekdays for the first time.”

The Anyma x Rezz collab at the Sphere.

Absolutely insane @anyma_eva x @OfficialRezz

(🎥 via @anyma_eva) pic.twitter.com/bII4xuWMyK

— Dancing Astronaut (@dancingastro) February 28, 2025

Laszczyk cited location analytics and foot traffic data via Placer.AI that showed the Las Vegas Sphere continued to see solid demand at the world’s largest spherical structure—equipped with a 16K resolution LED screen that wraps around the audience for a fully immersive visual experience.

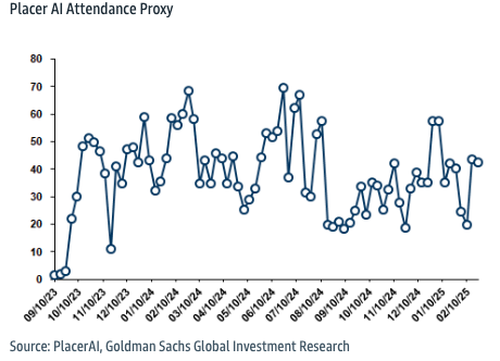

Exhibit 36: The Sphere Las Vegas Weekly Attendance

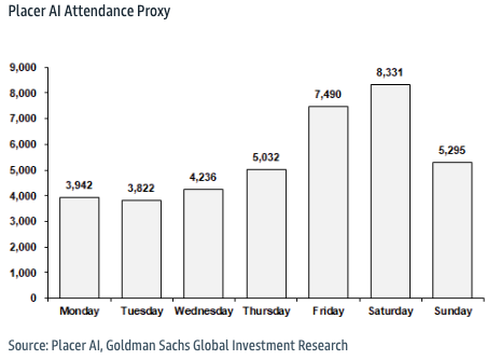

Exhibit 37: The Sphere Las Vegas Average Attendance by Day

Exhibit 38: Weekday attendance at “The Sphere” has remained near historical levels after coming off a spike when a residency played on weekdays in December

Exhibit 39: We continue to see strong demand from music residencies at The Sphere (currently Anyma/Eagles), as evidenced by strong weekend attendance

Robust demand for The Sphere comes as its owner, Sphere Entertainment, has seen its shares in New York plunge 35% in recent weeks due to concerns that one of its subsidiaries, MSG Networks—a regional sports network—is at risk of bankruptcy.

Here’s more from Sphere Entertainment’s most recent earnings report:

The forbearance period has been extended multiple times, with a current expiration date of March 26, 2025. As of today, MSG Networks has approximately $804.1 million of principal amount outstanding under its credit facilities, following a principal repayment of $25 million on February 4, 2025 using MSG Networks’ cash on hand.

If MSG Networks is not successful in negotiating a refinancing or work-out of its indebtedness, the Company believes it is probable that MSG Networks and/or its subsidiaries would seek bankruptcy protection or the lenders would foreclose on the MSG Networks collateral securing the credit facilities.

MSG Networks appears to be in dire straits with bankruptcy risks elevated, weighing on Sphere Entertainment shares. Perhaps merging legacy regional sports networks with a next-generation music venue wasn’t the best idea after all?

Remember what happened to Sinclair Broadcast Group’s subsidiary, Diamond Sports Group…

Loading…