Consumer shares led the overnight gains in China after officials announced plans to hold a press conference on Monday to discuss measures to boost consumption in the world’s second-largest economy.

“The press conference on boosting consumption fanned expectations on policy support,” said Shen Meng, a director at Beijing-based investment bank Chanson & Co., adding, “But if it falls short of providing details on increasing income, such optimism may weaken to some extent.”

Goldman’s Lindsay Matcham commented on the overnight gains:

“… risk on in Asia overnight with our China Humanoid Robot’s basket (+5.5%) and CSI 300 reaching the highest level this year in anticipation of Chinese officials holding a press conference on measures to boost consumption …”

On a separate note, Goldman’s Shubham Ghosh and Sean Navin provided more color on the gains:

“Consumption names helped to drive the strength today as China Liquor and Consumption baskets closed the day +5.79 and 4.10% respectively. It is worth noting that next week there will be a consumption presser on Monday (NDRC, MoF, MoCommerce, PBOC, SAFE and MoHRSS to host presser at 3 pm on Monday).”

Renewed optimism for policy support from Beijing sent the CSI 300 Index up 2.43%, the highest level this year.

KGI Securities analyst Ken Chen said authorities will likely unveil new policies to subsidize consumer trade-in programs and efforts to strengthen the social safety net, including better childcare and elderly-care services.

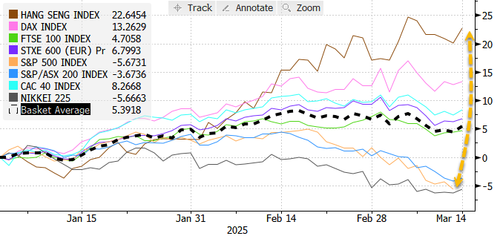

Hong Kong’s Han Seng Index continued to power into a bull market this week, while the S&P500 Index closed down 5% on the year.

Last week, China maintained its GDP growth target at “around 5%” for 2025. Beijing may need to unleash the monetary cannon this year to achieve this goal. At the same time, the country faces internal challenges of a persistent property market downturn and external challenges, such as a worsening trade war with the US.

Loading…