Previously we explained that the US-China trade war has been unique in that the US was hit fast and hard, mostly through capital markets and financial linkages, which travel instantaneously with acute consequences (the recent dump of US treasuries by China and subsequent purchases of the yuan and perhaps gold took effect in milliseconds, and prompted a cottage industry of narratives how the US dollar is losing its reserve currency status). At the same time, the impact to the Chinese economy takes a while to propagate, as supply chains take weeks if not months to normalize to a new status quo; the period is even longer when the frontrunning of tariffs meant China would overproduce in the days leading up to the outbreak of the trade war, and keep economic output artificially inflated, as demonstrated by the paradoxically strong Q1 GDP numbers out of Beijing. Yet once the slowdown hits, as it inevitably will, the consequences for China – which unlike the US has no social safety net – will be far more dire. It also means that the trade war with China will apex only once Beijing suffers max pain, at which point Xi will be far more amenable to talks with Trump. The only question is when will said max pain moment hit.

We don’t know yet, although we are keeping a close eye on alternative Chinese economic indicators (one can’t trust official Chinese data in normal times, and one certainly can’t trust any local “data” at a time when gepolitical leverage is measured in growth basis points, even if they are completely fabricated) for the tipping point.

Until then, however, there are growing signs that the first wave of pain has already landed, and as Bloomberg reports, Chinese plastics factories that depend on a gas they mainly import from the US are contending with the prospect of widespread shutdowns as the world’s two largest economies bunker down for a prolonged trade war.

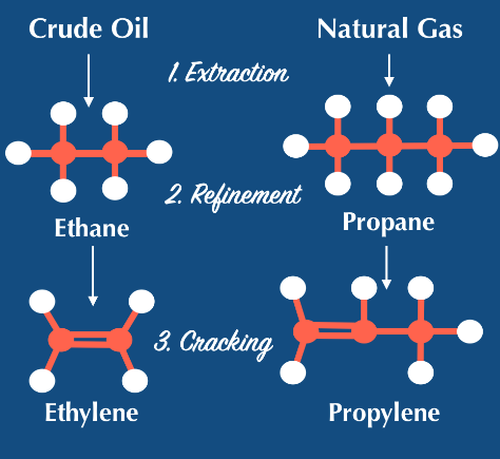

The world’s dominant plastics manufacturer gets almost all its ethane, a petrochemical feedstock that is also a component of natural gas, from the US. But eye-watering tariffs on American goods mean plants that cannot process substitute raw materials will bleed money; their only alternative is to mothball production for the near (or not so near) future.

“The situation is dire for China’s ethane crackers as they have no alternative to US supply,” said Manish Sejwal, an analyst at Rystad Energy AS, using an industry term for such facilities. “Unless they are granted tariff exemptions, they may have to stop production or close shop.”

Needless to say, that would be catastrophic for China’s plastics industy.

Most so-called crackers in China use naphtha as a feedstock, with processors that solely use ethane as raw material for petrochemicals making up is less than 10% of the total at about 4 million tons, according to Rystad. China is by far the biggest buyer of American supply, according to the US Energy Department.

But with 125% tariffs in place, factories would have lost $184 for every ton of US ethane they processed in the week ending April 11, according to Rystad data. That compares with more than $100 they would have made in profits if there were no tariffs.

According to Bloomberg, the extra costs are another blow for China’s plastics sector, which is already dealing with a glut as the growth in production capacity exceeds demand. The tussle is also threatening other feedstocks, including natural gas liquids and propane, and has led to sharp drops in US prices, hardly the inflationary shock so many have predicted.

Across China, domestic ethane production won’t be able to plug the gap, with the nation producing around 120,000 tons in 2024, according to industry consultancy JLC International.

Furthermore, the ethane market “is marked by long-term contracts, with little to no opportunity to resell cargoes on the spot market,” Rystad said April 10, making it tough for the Chinese to obtain alternative supplies from non-US sources.

While China has so far avoid widespread closures of production across sectors, it appears likely that the plastics industry in general, and the ethane and propane supply chains in particular, will be among those hit first and hardest. So for those seeking to time the moment of max pain, and greatest malleability of Beijing, keep an eye on Chinese plastic prices and/or labor strikes in the region.

The lower the former goes, the higher the latter will move, and the faster the trade war will come to an end. And come to an end it will, because as even Goldman forecast in its latest China forecast (available to pro subs here), the country’s GDP is about to fall off a cliff: the bank now expects China’s Q2 GDP growth to crater to just 0.8% QoQ from 4.9% in Q1. And that’s just the start, if China is unable to unleash a stimulus similar in size to what it did during covid.

Loading…