Treasury Secretary Scott Bessent is right when he says that the economy needs a “detox.” To fix the problems created by decades of artificially-low interest rates, soaring deficits, out-of-control spending, a dying manufacturing base, and central bank meddling, there has to be a little bit (or a lot) of pain.

Economic pain contributed to the rise of Trump, and at some point, a much more powerful reckoning is unavoidable before our economy can be cleansed of its sins. But can the American people tolerate even a small dose of bitter medicine, and will the Trump Administration be able to prevent an all-out meltdown in the process?

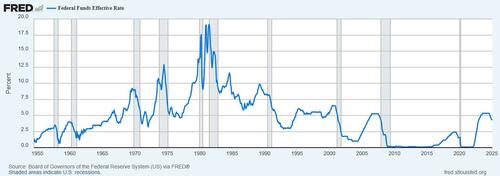

Sky-high deficits are only getting higher under his administration, with Trump embracing expansionary fiscal policy that increases the debt ceiling and relies on tariffs, a tax on consumers, for revenue. And the U.S. economy has been hooked on cheap money for far too long. Since the Federal Reserve slashed rates to near-zero during the 2008 financial crisis, we’ve seen interest rates hover at historically low levels, with the federal funds rate averaging just 0.8% from 2009 to 2015. Even after a modest tightening cycle, the Fed pivoted again in 2019, and by 2020, rates were back near zero to combat the pandemic fallout. This prolonged period of artificial stimulus has distorted markets, inflated asset bubbles, and left the economy addicted to a drug it can no longer afford.

Bessent’s recent comments frame this addiction as a systemic issue and acknowledge out-of-control spending, but he downplayed the idea of an oncoming recession, saying that it can be avoided (spoiler alert: It can’t).

No administration wants to be in office during an economic downturn, as low-information and high time preference voters will inevitably blame the current president and party for problems that were likely created by decades of bad policy and state intervention.

The Trump administration is trying, basically at all costs, to lower 10-year Treasury yields to reduce borrowing costs through fiscal discipline and energy policy.

It sounds noble, but it’s a fantasy that ignores the underlying rot. The 10-year yield, currently around 4.2% as of early March, per Bloomberg data, reflects market skepticism, not confidence in the grand plan. After all, you can’t “detox” an addict without withdrawal symptoms, and when it comes to some substances, the process can even kill the addict.

U.S. federal debt has ballooned from $10 trillion in 2008 to an utterly mind-boggling $34 trillion, according to the Treasury Department. Annual deficits have averaged over $1 trillion since 2018, fueled by tax cuts and spending sprees that low rates made palatable. Corporations, too, gorged on cheap debt—non-financial corporate debt hit $12.1 trillion in 2024, according to the Fed. Homebuyers joined the party, with mortgage debt climbing to $13 trillion as 30-year fixed rates lingered below 4% for years. Artificially low rates didn’t just enable borrowing—they became the economy’s lifeblood.

Federal Funds Rate, 1955 to Present

Like all addictions, this one has consequences. Manufacturing, once a backbone of American prosperity, has withered under the weight of cheap imports, globalization, and misallocated capital. The U.S. trade deficit surpassed one trillion in 2024 as firms chased financial engineering over producing real goods on factory floors. Meanwhile, savers—especially retirees—have been punished. The average yield on a 1-year CD fell from 5% in 2007 to under 1% by 2020, per Bankrate, eroding real returns as inflation crept up.

The Fed’s own data shows CPI inflation averaging 3.2% annually since 2021, with the price of just about everything outpacing wage growth and leaving households squeezed. The only real exception is tech, which is nearly always deflationary, and why you can get a 4K TV for less today than you could when they first came out.

Bessent’s detox rhetoric suggests a reckoning—higher rates to force discipline, paired with spending cuts via the Department of Government Efficiency (DOGE). But the economy can’t handle it. Raising rates meaningfully—say, to even a 5% or 6% federal funds rate—would spike borrowing costs, crater housing, and tank the stock market. And yet, the interest rates would be much higher if they were being set by the free market.

The S&P 500 owes much of its climb to low-rate liquidity, and most growth on major indices can be attributed to a small basket of companies. A 2023 Fed study estimated that a 2% rate hike could slash GDP growth by 1.5% within two years. Pain? Try agony. And, predictably, Bessent more or less blames the Biden administration, saying Trump inherited the ill-effects of Bidenomics. The reality is that this sour potion has been brewing for a long time, transcending party lines.

But the Trump Administration faces a Catch-22. Bessent wants yields down to ease debt burdens. Yet Trump’s growth agenda—tariffs, tax cuts, infrastructure—requires borrowing and risks inflation, pushing yields up. The bond market’s recent wobble, with yields dipping then rebounding, signals confusion. Stagflation is inevitable. As Peter Schiff recently said on X (formerly Twitter) about the dollar index, consumer prices, and bond yields:

“The U.S. Dollar Index has now lost all of its post-Trump victory gains, trading at its lowest level since Oct. 2024. I expect another 10% – 15% drop by year-end, with even more downside in 2026. This, plus tariffs, will put substantial upward pressure on the CPI and bond yields.”

Japan tried low rates for decades, only to stagnate with a debt-to-GDP ratio over 250% and a yen gone mad. The U.S., at 125% debt-to-GDP, isn’t far behind. Europe’s post-2008 austerity experiments triggered recessions without curing deficits. Detox sounds good until the patient flatlines.

Can Americans stomach such a bitter pill? Probably not. And yet, the pill still isn’t bitter enough. Decades of easy money have bred entitlement—homeowners expect cheap mortgages, CEOs demand stock buybacks, and politicians crave pork-barrel projects. A 2024 Gallup poll found that most Americans oppose spending cuts to Social Security or Medicare. Politically, Trump can’t afford a revolt. Economically, he can’t avoid one.

Meanwhile, the Fed’s balance sheet, around $7 trillion per its latest report, signals no rush to unwind. Bessent’s “responsible” yield drop won’t come from markets—it’ll come from more Fed tinkering, prolonging the addiction. The real detox—letting rates rise, deficits shrink, and bubbles pop—would spark a depression few could endure, and would all but crush any incumbent’s reelection prospects.

In the end, Bessent’s right about the diagnosis, but wrong about the fix. The economy’s hooked, weak, and desperate, and the Trump team’s plan is just a milder dose of the same poison. True recovery means cold turkey—higher rates, real austerity, and a rebuilt industrial base.

Until then, we’re just delaying the crash, ensuring more pain when the day finally comes.

Loading…