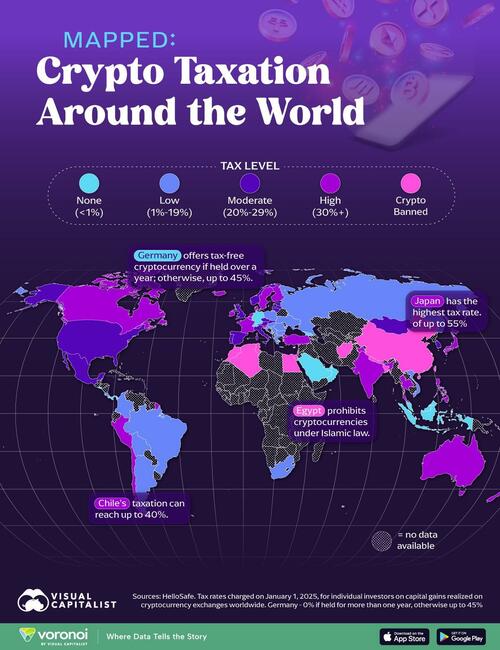

As cryptocurrency continues to gain global traction, tax policies vary widely across different jurisdictions. Some countries impose steep taxes on capital gains from crypto trading, while others exempt digital assets entirely. Meanwhile, several nations have outright banned cryptocurrency transactions.

This map, via Visual Capitalist’s Bruno Venditti, illustrates the crypto capital gains tax rates for individual investors as of January 1, 2025, based on data from HelloSafe.

Countries with the Highest Crypto Taxes

Japan applies a progressive tax rate ranging from 15% to 55%, making it one of the highest-taxing nations for cryptocurrency gains.

Similarly, Denmark taxes crypto profits at rates between 37% and 52%, depending on an individual’s income bracket.

Germany, while often considered crypto-friendly, applies a 45% tax rate if assets are sold within a year. However, cryptocurrency held for more than a year is entirely tax-free.

Crypto Tax-Free Havens

Several countries have chosen to exempt cryptocurrency from taxation. These include:

These jurisdictions either do not recognize cryptocurrency as taxable income or have policies designed to attract crypto investors and businesses.

Countries Where Crypto Is Banned

Despite its global adoption, some nations prohibit cryptocurrency transactions altogether. Often, these restrictions are based on regulatory concerns, financial stability, or religious considerations. For example, Egypt bans cryptocurrency under Islamic law.

Countries with outright crypto bans include:

-

Afghanistan

-

Algeria

-

Bangladesh

-

China

-

Egypt

-

Morocco

-

Nepal

-

Tunisia

If you liked this content, check out Dividing the World’s Gold Equally to see how much each person would get.

Loading…