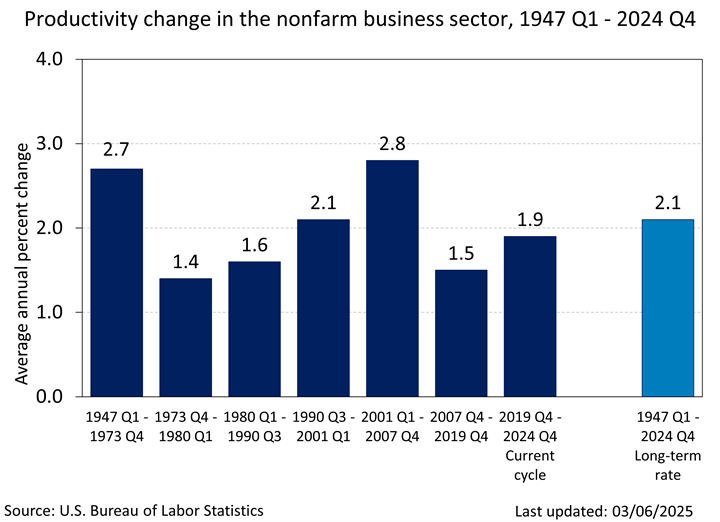

You love to see it. After a lengthy spell of sluggish growth, America’s productivity figures have turned decidedly rosier of late. New revisions from the Bureau of Labor Statistics show nonfarm business sector labor productivity now exceeds pre-pandemic forecasts, rising at an annual clip of 1.9 percent during the current economic cycle, according to an analysis by Harvard University economist Jason Furman, a former economic adviser to President Barack Obama.

This pace has held steady at two percent over the past four quarters. Though hardly comparable to the tech-fueled boom of 1995–2005, it represents a meaningful step-up from the anemic growth of recent years.

The quarterly pattern raises the possibility that this is no mere post-pandemic rebound, one reflecting the more efficient reallocation of resources after an economic shock. Perhaps we’re seeing a more durable trend, though data volatility suggests caution.

Intriguingly, artificial intelligence—despite lots of investment and even more hype—has likely contributed little thus far. Furman posits that AI’s productivity-enhancing effects are still largely offset by the resources firms are deploying to implement it. It’s a phenomenon called the J-curve effect: New technologies can initially decrease productivity while firms develop complementary organizational capabilities, only later yielding higher productivity and profits.

From the paper “The Productivity J-Curve: How Intangibles Complement General Purpose Technologies” by Erik Brynjolfsson, Daniel Rock, and Chad Syverson, “General purpose technologies (GPTs) such as AI enable and require significant complementary investments, including co-invention of new processes, products, business models and human capital.” What’s more, rapid technological advancement may even freeze investment as firms delay decisions anticipating better versions.

(A side note: A new research note from Goldman Sachs tries to sleuth out why revenue for public companies exposed to the build-out of AI infrastructure increased by over $340 billion since 2022 and yet real investment in AI-related categories in the US GDP accounts has only risen by $42 billion. The bank’s explanation: First, a significant portion of the gap reflects simple cost inflation, particularly in semiconductors. Second, fatter profit margins and overseas sales boost corporate revenues but not domestic output. Third, America’s statistical machinery likely undervalues AI’s contribution by $100 billion, as crucial semiconductors and cloud services are recorded as intermediate inputs rather than final investment.)

For the world’s largest economy, this productivity revival could scarcely be more welcome. Furman notes, it remains “the most important factor” for long-term economic prospects. Let’s hope the upturn isn’t undermined by new US trade policy.

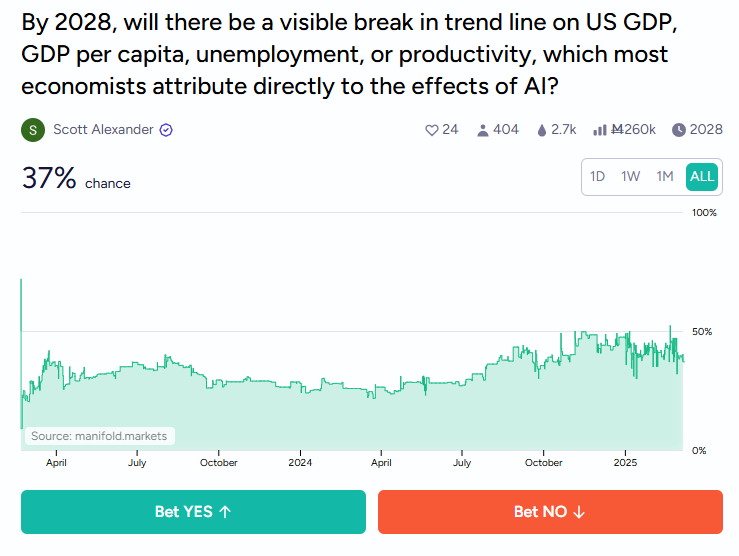

It would be awesome if advances in AI could add half a percentage point to productivity growth, if not more—and sooner rather than later. Let’s hope AI capabilities keep improving and businesses are able to put them to work in a timely fashion. I will be keeping an eye on this Manifold Markets contract:

The post America’s Productivity Pop appeared first on American Enterprise Institute – AEI.