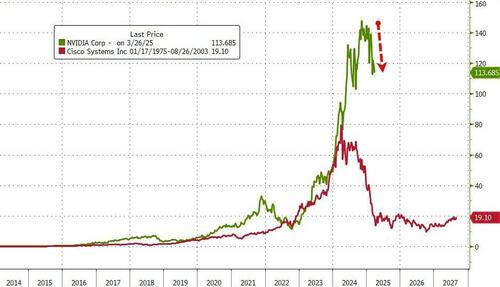

If ever there was a canary in the coalmine for signs of peak bubbliciousness, it is/was the CoreWeave IPO.

The spinoff from Nvidia is a specialized cloud computing company that provides high-performance, GPU-accelerated infrastructure tailored for AI and machine learning workloads, operating a growing network of data centers across the United States and Europe to support its services.

In other words, it’s right at the heart of the supposed CapEx boom.

But, Semafor’s Liz Hofman reports this morning that the IPO valuation has been drastically downsized:

Scoop: CoreWeave is planning to downsize its IPO and cut the price — I’m hearing closer to the $23B valuation it had in the private market a year ago than the ~$30B it wanted.

— Liz Hoffman (@lizrhoffman) March 27, 2025

Additionally, they have reduced the IPO size to around $1.5 billion (from around $3 billion).

Here’s the potential problem:

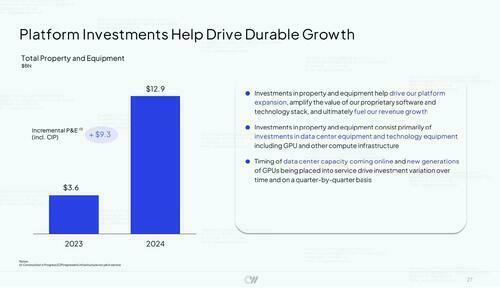

CoreWeave has been compared to WeWork because its tremendous revenue growth has come at the expense of unsustainable capex and cash burn, which in turn require tremendous constant outside investment (or debt): CoreWeave burned nearly $6 billion of cash in 2024 and $1.1 billion the previous year, because of the massive capex to build out its AI infrastructure.

Not surprisingly, CoreWeave – which also counts Microsoft as its largest customer – has been frequently rumored to be a core spoke in revenue roundtripping schemes involving Microsoft, Nvidia and OpenAi.

I hope this helps to understand how Microsoft and Nvidia used CoreWeave (and many other start-ups the pair invested in) to round-trip revenues and inflate their business performances$MSFT $NVDA https://t.co/SVsq5SxxkF pic.twitter.com/plH5DE1vkI

— JustDario 🏊♂️ (@DarioCpx) March 4, 2025

As Semafor writes, CoreWeave’s public-market debut isn’t just a closely watched bellwether for AI, but for the IPO market overall, which has been in a deep freeze.

For now, NVDA shares are unmoved by the report (did everyone know yesterday?)

Tick tock on this AI bubble?

Loading…