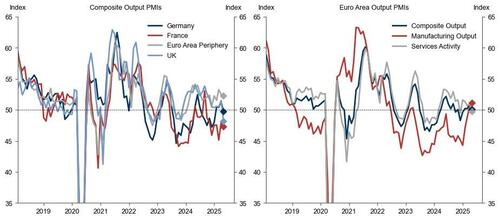

European flash April PMIs were ugly this morning with the Euro-area-wide headline composite measure -0.8 to 50.1, and with weakness concentrated in French and German services activity.

-

Euro Area Composite PMI (Apr, Flash): 50.1, consensus 50.2, last 50.9

-

Euro Area Manufacturing PMI (Apr, Flash): 48.7, consensus 47.4, last 48.6

-

Euro Area Services PMI (Apr, Flash): 49.7, consensus 50.5, last 51.0

-

-

France Composite PMI (Apr, Flash): 47.3, consensus 47.8, last 48.0

-

Germany Composite PMI (Apr, Flash): 49.7, consensus 50.5, last 51.3.

-

UK Composite PMI (Apr, Flash): 48.2, consensus 50.4, last 51.5.

The manufacturing sector displayed surprising signs of resilience despite the imposition of US tariffs earlier this month (stock of purchases (+0.5pt to 45.6), quantity of purchases (+1.3pt to 47.4), and stock of finished goods (+1.4pt to 47.8) all improved). The details of the manufacturing print and commentary provided in the press release suggest that activity in the sector was likely supported by front-loading (possibly reflecting strategic shipments during the 90-day pause on the country-specific component of the US reciprocal tariffs) and restocking.

However, there was a clear drop-off in the forward-looking business expectations measures.

The responses for today’s flash PMI reports were collected between the 9th and 22nd of April, implying that the majority of the responses should reflect both the reciprocal tariff announcement and implementation of 10% baseline and critical industry tariffs, as well as the 90-day reciprocal tariff delay on April 9th.

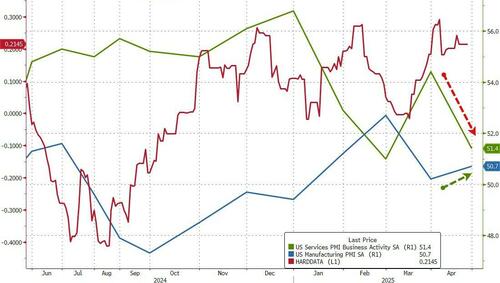

In the US, expectations were for weakness in both Services and Manufacturing surveys, following a slew of dismal ‘soft’ data from Regional Fed surveys.

However, reflecting similar trajectories to Europe, US Manufacturing PMI beat expectations, rising to 50.7 from 50.2 (better than the 49.0 contraction expected) while Services disappointed, dropping from 54.4 to 51.4 (below the 52.6 expected)…

The tariff front-running that was seen in Europe appears to have been echoed in the US Manufacturing sector.

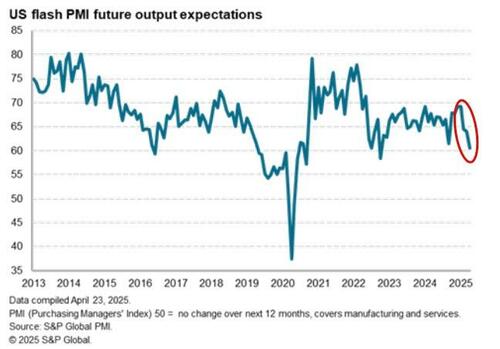

However, just as in Europe, forward-looking expectations for output tumbled… The latest reading was the joint-second lowest since September 2020, surpassed only by October 2022.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

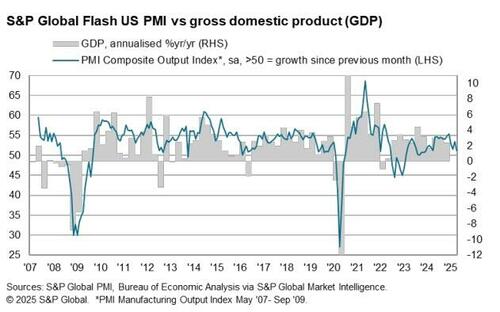

“The early flash PMI data for April point to a marked slowing of business activity growth at the start of the second quarter, accompanied by a slump in optimism about the outlook. At the same time, price pressures intensified, creating a headache for a central bank which is coming under increasing pressure to shore up a weakening economy just as inflation looks set to rise.

“Output rose in April at its slowest pace since December 2023, indicating that the US economy is growing at a modest annualized rate of just 1.0%. Manufacturing is broadly stagnating as any beneficial effect of tariffs are offset by heightened economic uncertainty, supply chain concerns and falling exports, while the services economy is slowing amid weakened demand growth, notably in terms of exports such as travel and tourism.

“Confidence about business conditions in the year ahead has meanwhile deteriorated sharply, worsening among manufacturers and service providers alike, largely thanks to growing concerns about the impact of recent government policy announcements.

“Tariffs are meanwhile being cited as the key cause of higher prices, though labor costs are also reportedly continuing to rise, causing companies to hike their selling prices at a pace not seen for over a year. In manufacturing, the rate of price increase is the steepest for nearly two-and-a-half years. These higher prices will inevitably feed through to higher consumer inflation, potentially limiting the scope for the Federal Reserve to reduce interest rates at a time when a slowing economy looks in need of a boost.”

Loading…