The key data release this week is be the global flash PMIs for April on Wednesday. In addition, in its preview of the week’s main events DB flags the Spring Meetings of the World Bank and the IMF will be held on April 21-26. In corporate earnings, highlights include Alphabet, Tesla and SAP.

Taking a closer look: the highlight in economic data be the April flash PMIs for the key economies due Wednesday. The impact of US tariffs will be the main focus, especially for European manufacturing gauges, which have been recovering in recent months. Among G7 countries, the manufacturing index was slightly above 50 (50.2) only in the US.

Other notable economic indicators out next week include March durable goods orders and housing market data in the US. DB economists see durable goods orders (Thursday) growth at +0.5% MoM (+1.0% in February). The Fed will also release its Beige Book on Wednesday.

In Europe, several other sentiment gauges are due, including the Ifo survey in Germany (Thursday) as well as consumer confidence indicators in the UK (Friday), the Eurozone (Tuesday) and France (Thursday).

In Asia, the focus in Japan will be on the Tokyo CPI for April out on Friday. 1-yr and 5-yr loan rates fixings are due in China on Monday.

Apart from economic data, notable events next week include the 2025 Spring Meetings of the World Bank and the IMF on April 21-26, in Washington, D.C. The IMF will release its full World Economic Outlook and Global Financial Stability reports on Tuesday.

Rounding out with corporate earnings, the spotlight next week will be on Alphabet (Thursday) and Tesla (Tuesday). Other tech reports due include Intel, IBM and ServiceNow. The focus will also be on consumer firms such as P&G, PepsiCo and Chipotle. Key US defence firms RTX, Lockheed Martin and Northrop Grumman will release earnings on Tuesday. In Europe, names to watch include SAP and Dassault Systemes.

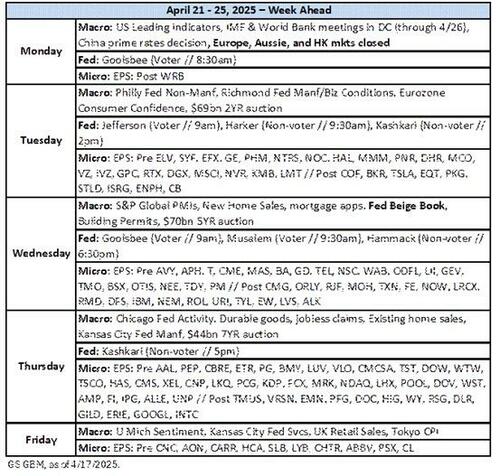

Courtesy of DB, here is a day by day calendar of events

Monday April 21

- Data: US March leading index, China 1-yr and 5-yr loan prime rates Central banks: ECB’s Centeno speaks

Tuesday April 22

- Data: US April Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index, business conditions, Eurozone April consumer confidence, 2024 debt to GDP, Canada March industrial product price index, raw materials price index

- Central banks: Fed’s Jefferson, Kashkari and Harker speak, ECB’s Survey of Professional Forecasters, ECB’s Knot speaks

- Earnings: Tesla, SAP, General Electric, Verizon, Intuitive Surgical, RTX, Danaher, Chubb, Lockheed Martin, Elevance Health, Northrop Grumman, Moody’s, MSCI, Baker Hughes, EQT, Equifax, Enphase Energy

- Auctions: US 2-yr Notes

Wednesday April 23

- Data: US, UK, Japan, Germany, France and Eurozone April PMIs, US March new home sales, UK March public finances, Eurozone February trade balance, construction output

- Central banks: Fed’s Beige Book, Fed’s Goolsbee, Musalem, Waller and Hammack speak, ECB’s Knot, Villeroy and Lane speak, BoE’s Bailey, Pill and Breeden speak

- Earnings: Philip Morris International, IBM, AT&T, ServiceNow, Thermo Fisher Scientific, Boston Scientific, NextEra Energy, Texas Instruments, Boeing, GE Vernova, Lam Research, O’Reilly Automotive, General Dynamics, Chipotle Mexican Grill, Newmont, Volvo

- Auctions: US 2-yr FRNs, 5-yr Notes

Thursday April 24

- Data: US March Chicago Fed national activity index, durable goods orders, existing home sales, April Kansas City Fed manufacturing activity, initial jobless claims, Japan March PPI services, Germany April Ifo survey, France April consumer confidence, EU27 March new car registrations

- Central banks: Fed’s Kashkari speaks, ECB’s Nagel, Simkus, Rehn and Lane speak, BoE’s Lombardelli speaks

- Earnings: Alphabet, P&G, T-Mobile US, Merck & Co, PepsiCo, Gilead Sciences, Union Pacific, Comcast, Sanofi, Fiserv, Bristol-Myers Squibb, BNP Paribas, SK Hynix, Intel, Dassault Systemes, Digital Realty Trust, Freeport-McMoRan, Keurig Dr Pepper, Eni, Nasdaq, L3Harris Technologies, Vale, PG&E, Orange, Valero Energy, Nokia, Dow

- Auctions: US 7-yr Notes

Friday April 25

- Data: US April Kansas City Fed services activity, UK April GfK consumer confidence, March retail sales, Japan April Tokyo CPI, France April business confidence, Canada February retail sales

- Central banks: BoE’s Greene speaks

- Earnings: AbbVie, Ping An Insurance Group, Keyence, HCA Healthcare, Colgate-Palmolive, Charter Communications, Schlumberger, Centene, Advantest, LyondellBasell

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Thursday and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week.

Monday, April 21

- There are no major economic data releases scheduled.

- 08:30 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee is scheduled to appear on CNBC. On April 11, Goolsbee said, “It makes the Fed’s job harder if you get what is clearly a stagflationary shock. When both sides of our mandate start getting worse at the same time, there’s not a generic playbook that you turn to.” He also added, “How we respond to a stagflationary shock depends on which one’s worse, how long are they going to last, are higher prices transitory or permanent, on the growth side, is this a response to uncertainty or is this spiraling more into recession.”

Tuesday, April 22

- There are no major economic data releases scheduled.

- 09:00 AM Fed Vice Chair Jefferson speaks: Fed Vice Chair Phillip Jefferson will give a speech on economic mobility and the dual mandate at the Economic Mobility Summit hosted by the Philadelphia Fed. Speech text is expected. On April 3, Jefferson said, “Labor market conditions have remained stable through February, and progress on inflation has eased, but the outlook is uncertain.” He also added, “These conditions led me to favor holding the policy rate constant at what I view as a moderately restrictive level.”

- 09:30 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patric Harker will participate in a fireside chat about how economic mobility impacts regional economies.

- 01:30 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a moderated discussion at the US Chamber of Commerce Global Summit in Washington DC. Q&A is expected. On March 26, Kashkari said, “It’s conceivable that the hit to confidence could be a bigger effect than the tariffs themselves, and that makes me nervous, but the good news is the hit to confidence could be restored quickly if there are resolutions of these trade uncertainties.”

- 02:30 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will participate in a fireside chat at the RVA Big Dipper Innovation Summit in Richmond, Virginia. Q&A is expected. On April 1, Barkin said, “So far, the tariffs that have been announced have been revised. I plan to give it some time to see if we can figure out what a stable policy regime is [for tariffs] and then we can start thinking more about monetary policy.”

- 04:00 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will speak on the transmission of monetary policy at the University of Minnesota School of Public Affairs. Q&A is expected. On April 2, Kugler said, “Given the recent lack of progress on inflation, recent increases in inflation expectations, and upside risks associated with announced and prospective policy changes… I will support maintaining the current policy rate for as long as these upside risks to inflation continue, while economic activity and employment remain stable.”

Wednesday, April 23

- Fed Governor Kugler speaks: Fed Governor Adriana Kugler will attend and give brief introductory remarks at a Mille Lacs tribal meeting. The exact meeting time is TBD.

- 09:00 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will give opening remarks at the Economic Mobility Summit hosted by the Philadelphia Fed.

- 09:30 AM St. Louis Fed President Musalem (FOMC voter): St. Louis Fed President Alberto Musalem will give opening remarks at a Fed Listens event. On April 11, Musalem said, “Changes in tariffs can have various direct and indirect effects on prices and economic activity, depending on how they are implemented and the extent of retaliation by trading partners.” He also noted, “The direct effects might have only a brief and limited impact on inflation, [but] indirect and second-round effects could have a more persistent impact.”

- 09:35 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will give opening remarks at a Fed Listens event. On April 14, Waller said, “With large tariff increases, I would expect the U.S. economy to slow significantly later this year and this slower pace to continue into next year.” He also added, “If the slowdown is significant and even threatens a recession, then I would expect to favor cutting the FOMC’s policy rate sooner, and to a greater extent than I had previously thought.”

- 09:45 AM S&P Global US manufacturing PMI, April preliminary (consensus 49.3, last 50.2): S&P Global US services PMI, April preliminary (consensus 53.0, last 54.4)

- 10:00 AM New home sales, March (GS +1.0%, consensus +0.7%, last +1.8%)

- 04:30 PM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak at the Money Marketeers forum in New York about the Fed balance sheet. Speech text and Q&A are expected. On April 16, Hammack said, “Given the economy’s starting point, and with both sides of our mandate expected to be under pressure, there is a strong case to hold monetary policy steady in order to balance the risks coming from further elevated inflation and a slowing labor market.”

Thursday, April 24

- 08:30 AM Durable goods orders, March preliminary (GS +5.0%, consensus +1.5%, last +1.0%); Durable goods orders ex-transportation, March preliminary (GS flat, consensus +0.3%, last +0.7%); Core capital goods orders, March preliminary (GS -0.2%, consensus +0.1%, last -0.2%); Core capital goods shipments, March preliminary (GS -0.2%, consensus +0.2%, last +0.8%): We estimate that durable goods orders increased 5.0% in the preliminary March report (month-over-month, seasonally adjusted), reflecting a sharp increase in commercial aircraft orders. We forecast 0.2% declines in core capital goods orders and shipments, reflecting declines in the new orders and shipments components of manufacturing surveys in March.

- 08:30 AM Initial jobless claims, week ended April 19 (GS 210k, last 215k); Continuing jobless claims, week ended April 12 (last 1,885k)

- 10:00 AM Existing home sales, March (GS -3.0%, consensus -2.8%, last +4.2%)

- 05:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a moderated conversation at the University of Minnesota College of Science and Engineering. Q&A is expected.

Friday, April 25

- 10:00 AM University of Michigan consumer sentiment, April final (GS 50.2, consensus 50.7, last 50.8); University of Michigan 5-10-year inflation expectations, April final (GS 4.4%, last 4.4%)

Source: DB, Goldman

Loading…