Donald Trump’s war on global commerce is just plain nuts, and not just the pure economic part of it either. With each passing day we hear from more wanna be MAGA big thinkers arguing that the Donald’s Trade Rampage is also about geopolitics and four dimensional Trumpian chess designed to restore America’s global leadership and technological dominance for years to come.

Well, no, true economic prosperity and technological advance comes from entrepreneurs, investors, inventors and risk-takers operating on the free market. They don’t need any help at all from loud-mouthed Washington politicians who generally have no idea what they are talking about and, more importantly, no skin in the game. That’s why the latter are both ineffectual and dangerous: To wit, the Washington pols are always happy to burden, block, batter and impair the honest enterprise of companies large and small if they get it in their minds that “national security” or “national greatness” require the heavy hand of bureaucrats, tax collector, regulators and pork dispensers.

That’s the essence of Trump-O-Nomics. It amounts to nothing more than a rightwing/populist appropriation of the normally leftist-led approach to mobilizing the state’s heavy-hand for the purpose of fixing problems that are either non-existent or badly misdiagnosed. In the case of the yawning US trade deficits and the hollowing out of America’s once vibrant industrial economy, the massive Trumpian Tariff maneuvers are about as far afield from the real issues as anything every dreamed up by FDR, LBJ or Barrack Obama; and these Trumpian misfires are already fostering immense collateral damage that’s breaking to the surface everywhere.

For instance, when we saw this missive from Goldman Sachs earlier today we initially presumed that its trading book was heavy with Boeing stock and that, as they are want to do, Goldman was putting out a sheep-shearing call to lighten its book at the expense of its customers. After all, how in the world could a 145% tariff on China not result in some retaliatory damage to the world’s leading commercial jet supplier by the folks in Beijing who control upwards of 25% of the total global commercial jet market?

We think the impact to Boeing is very small because China had already stopped taking Boeing deliveries and stopped ordering Boeing aircraft during the last Trump administration, such that there is no real reduction to implement,” Goldman wrote in a note to clients in the late afternoon hours of the cash session.

Needless to say, it was the bolded part of the sentence after the “because” point that changed our mind. It turns out that single-handedly the Donald has already wiped out the largest market of one of America’s premier exporters and aerospace powerhouses that consistently puts huge “winning” trade surplus scores on the board. Well, at least according to Trump’s way of splainin’ things.

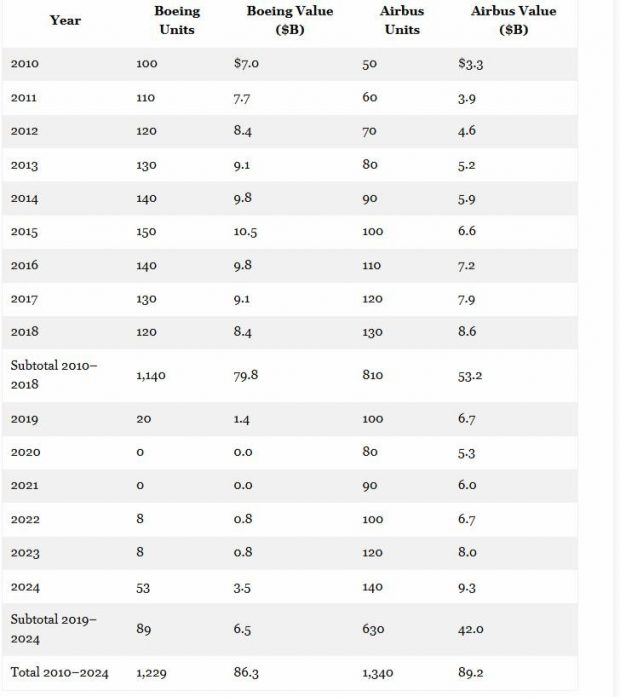

Thus, if you look back at 2014—a time before the Donald volunteered to come to Washington and help—Boeing shipped nearly $1o billion of civilian aircraft to China in a single year. Alas, after Trump launched his first trade war on China in 2018-2019, Boeing sold a total of only $6.5 billion of planes to China during the entirety of the five years over 2019-2024!

Stated differently, during the period 2010-2018, Boeing shipped $79.8 billion of planes to China, which accounted for 62% of the combined duopoly market with Airbus. During the last five years, however, Airbus shipped 630 planes to China versus a mere 89 by Boeing, causing Airbus’ $42 billion of sales to tower over Boeing’s $6.5 billion, That is to say, thanks to the Donald’s misguided trade meddling a company owned by a socialist consortium of European states has had handed to them on a platter a stunning 87% share of the global aircraft market!

You can’t get more destructive than this. And for what?

Well, apparently, to get even with China for scooping up US labor-intensive manufacturing jobs that the Fed had inflated right out of the global market.

Boeing Versus Airbus Sales To China in Units And Dollar Value, 2010 to 2024

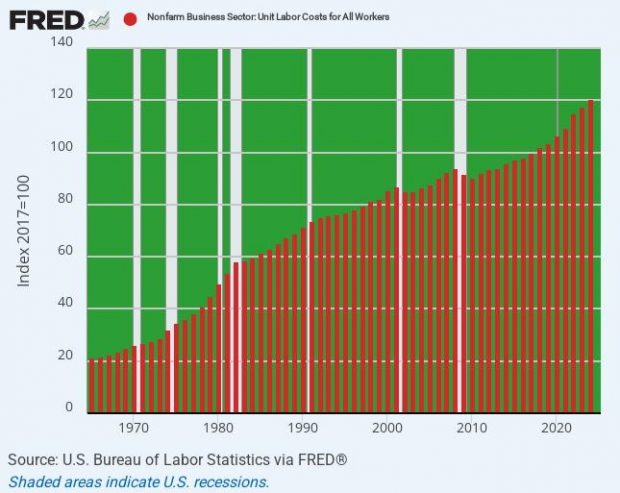

To repeat from Part 3, US unit labor costs by 2024 stood 470% higher than they had been in 1965 when the US was still running balanced accounts with the world, and when the Fed understood “sound money” to require o.o% inflation.

Stated differently, under a regime of sound money the urgently required deflationary purge demanded by the rise of the low-cost exporting economies would have caused the red bars in the chart to fall after 1992, not continue to climb skyward as it actually did. Accordingly, the solution to America’s unsustainable trade deficits lies in root and branch reform at the Eccles Building a few blocks from the White House rather than a madcap eruption of global trade wars over tariffs and NTBs, which have virtually nothing to do with the trade deficit problem.

Nonfarm Unit Labor Cost Index, 1965 to 2024

Again, just consider the US/China trade balance in 2023 for the top 50 US imports from China which was hideously lop-sided. Yet it is not remotely possible that this 18:1 ratio between imports and exports was caused by trade barriers to US exports or other kinds of cheating by China’s trade bureaucrats. To the contrary, it was due to a vast gap between labor and other production costs in the two economies, pure and simple.

Trade Balance in 2023 for Top 50 US Imports From China:

- Imports: $397 billion.

- Exports: $22 billion.

- Balance: -$375 billion.

- Import/Export Ratio: 18:1

As it happens, tariffs self-evidently have little if anything to do with this extreme imbalance. Thus, among the top 50 US imports, the actual US weighted average tariff on these goods from China was 23.0% versus China’s 26.2% tariff on the same 50 categories of US exports in 2023.

Obviously, this trivial 320 basis point tariff differential on this common group of 50 four-digit HS categories does not remotely explain a 18X trade imbalance in favor of China. Nor is there any evidence that so-called NTBs (nontariff barriers) to US exports explain it, either.

The fact is, labor intensive manufacture of shoes, shirts, furniture and industrial commodities account for the imbalance. Even iPhones, desk tops and commodity semi-conductors were moved to China by Apple Inc. and other Silicon Valley based US companies in order to capture the labor cost arbitrage, as we elaborate below.

Moreover, the relatively high dueling tariffs imposed by both sides as of 2023 (23% vs. 26%) were entirely due to the trade wars that the Donald started during his first term in the Oval Office. Again, China’s tariff on these 50 categories of goods was just 7.5% on a MFN basis in 2017 before the Trump tariffing rampage started. So what has been gained, unfortunately, is not a reduction in US imports from China, but just higher off-setting duties on US export sales to China.

The lopsided imbalance of imports from China has not changed despite the Trumpian tariffs because, as indicated above, since 1992 the US price level has risen by 131%. Not surprisingly, the American market soon became flooded with labor-intensive Chinese shirts, shoes, sheets, toys and furniture at first; and then electronics, iPads, iPhones and computers in an even greater flood as time went on and Chinese manufacturing moved up the value chain.

As we also indicated previously, the nominal wage gap in USD was already large in 1992, but has steadily expanded ever since. In fact, in nominal USD terms the US/China manufacturing wage gap of $16.50 per hour in 1992 has more than doubled to $34.25. The figures below for both countries were supplied by Grok 3 and include both hourly pay plus full-loaded benefits absorbed by employers.

Hourly Wages: US-China=labor gap:

- 1992: $16.80-$0.33=$16.50.

- 2007: $29.81-$1.36=$28.45.

- 2024: $43.46-9.35=$34.14

In short, the Fed has inflated its way into a flood of imports from China and other low labor cost exporters. For example, the footwear and apparel category generated $41.7 billion of US imports from China in 2023 versus just $0.5 billion of US exports to China. That was due to the $34/hour wage gap, not trade barriers or intellectual property theft or any of the other risible claims made by the Trumpites

Likewise, the imbalance in toys and video games was $34.6 billion of imports from China versus $0.3 billion of US exports to China. And in this case, the duty rate is 0.0% on both ends of the two-way trade. So perforce, unfair trade barriers were not an issue in this market.

In the case of furniture, lighting and plastic products, the imbalance was similar at $29.3 billion of imports from China versus $1.0 billion of US exports to China. But the current Chinese import duties on US exports in these categories tell you all you need to know. Prior to 2018, China’s MFN tariff on these products averaged just 5.3%, which is hardly a roadblock to a competitive foreign producer.

But in his wisdom, the Donald raised the US tariff on furniture, lighting and plastic products to 25% during his first term, causing the Chinese to retaliate by raising their tariff from the MFN average of 5.3% to an average of 30.5% on these products in 2023. Of course, high-cost US exporters of these products were not very competitive in China anyway, but the Donald’s tit-for-tat on tariffs during his first term closed the door entirely. And, now, his latest 125% tariff is transparently a tax grab that can’t possibly help close a 29:1 import/export ratio.

The story is similar in the case of flat-screen TVs. Here the figures were $13.8 billion of imports from China and only $0.1 billion of US exports to China. That’s a 138:1 import/export ratio but its clearly not due to tariffs or other NTBs. In this case, China’s MFN tariff was just 3%, but when the Donald raised the US rate on flat-screen TV imports to 25% during this first term, the Chinese countered with a 28% rate as of 2023.

Again, what’s the point? The 138:1 import/export ratio in this product category was due to China’s superior cost structure and production infrastructure. Trade barriers had nothing to do with it.

In the case of solar panels, electric motors and air conditioners, the US imported $22.5 billion from China versus exports in these categories of just $1.2 billion. Again, the MFN tariff in China was just an average of 7%, but by 2023 stood at an average of 24% owing to the Donald’s raising the US tariff on China-made goods in these categories to 25% the first time around.

Even in the case of so-called high tech products, the fully rational move by Apple Inc and others to source iPhones, laptops, AirPods and semiconductors from China was driven by yawning labor and other cost differentials. Consequently, the three product categories which encompass these Silicon Valley designed and engineered products showed imports of $136 billion versus exports of just $7.3 billion in 2023.

Again, that was a 19:1 import/export ratio. Moreover, the resulting $129 billion deficit in these three notionally “high tech” categories accounted for 46% of the entire US trade deficit with China of $279 billion in 2023.

Then again, this huge imbalance wasn’t owing to tariff or other kinds of trade cheating. In fact, China’s normal MFN duty on the US exports of $7.3 billion in these three high tech categories was just 1.5% on a weighted average basis. And even after the first round of Trump trade wars it was only 9.7% under the retaliation rates China imposed on bilateral trade with the US in 2023.

By contrast, the actual US tariff on imports of these high tech products from China in 2023 was nearly $27 billion or 25%. And until the weekend reprieve, which was subsequently clarified to be not a reprieve but another short-term “pause”, it would have been $154 billion or 145%!

As we indicated previously, these massive imbalances in even high tech products are owing to yawning differences between the inflated US cost structure and that of China’s freshly minted factories and just-out-of-the-rice-paddies industrial labor force.

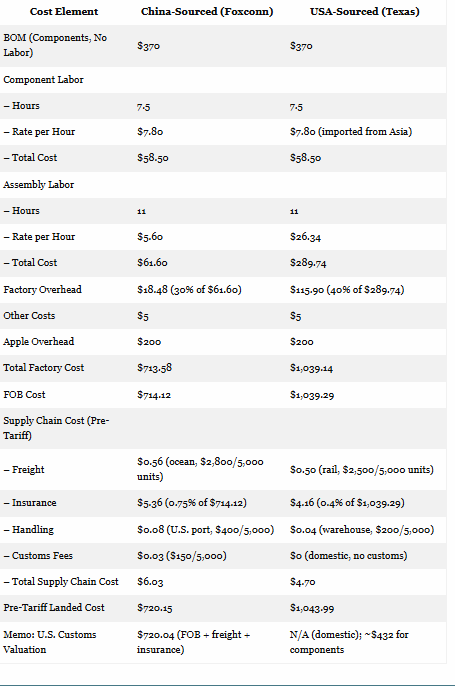

For want of doubt, we requested Grok 3 to build up a bill of production costs for the Apple iPhone X based on actual production costs incurred by its supplier, Foxconn, in its world-scale plants versus the comparable costs of building the components and assembling the final product in a plant based in Austin, Texas.

The table speaks for itself. US labor and other production costs would be 45% higher ($1,043 versus $720 per unit), and that includes the supply chain costs of getting the product from China to a US distribution warehouse on the west coast.

Accordingly, there is no mystery to the entire trade deficit story. Even in the case of high tech products where US producers have overwhelming technological and intellectual property superiority, US producers have gone off-shore to manufacture their products because over the last five decades the Fed has inflated the bejesus out of the American economy.

iPhone X Cost Build-Up (China vs. USA, 2023, Pre-Tariff)

So, enough already! What the Donald in his “wisdom” is actually saying is that the free people and businesses of America are not permitted under his writ to buy low-cost goods from China because the red capitalists of Beijing have not sufficiently inflated their own cost structure to catch up to the relentless US inflation generated by the Fed.

When all else fails, of course, the Trumpites resort to sputtering about the great China threat to America’s place of world leadership. On the military front, however, China doesn’t have the GDP heft to even think about landing on the California shores, notwithstanding Wall Street’s endless kowtowing to the China Boom.

Indeed, when it comes to the threat of a conventional military invasion the vast Atlantic and Pacific moats are even greater barriers to foreign military assault in the 21st century than they so successfully proved to be in the 19th century. That’s because today’s advanced surveillance technology and anti-ship missiles would consign a Chinese naval armada to Davy Jones’ Locker nearly as soon as it steamed out of its own territorial waters.

Likewise, neocon knuckleheads have been jabbering about China’s growing Navy, which numbers 400 hulls compared to 305 ships in the US Navy’s fleet. But what they don’t say is that most of these Chinese units are coastal patrol boats, which likely couldn’t even make it to the coast of California, anyway.

In terms of Naval power projection capability, the proper measure of lethality is not the number of hulls; it’s the total displacement tonnage. In this connection, the US Navy has 4.6 million tons of displacement, averaging 15,000 tons per ship. By contrast, China’s Navy has but 2.0 million tons of displacement, averaging only 5,000 tons per boat. That is to say, the Chinese Navy is totally visible, assessable and trackable, and is not remotely of the size and lethality that would make an invasion of America remotely plausible.

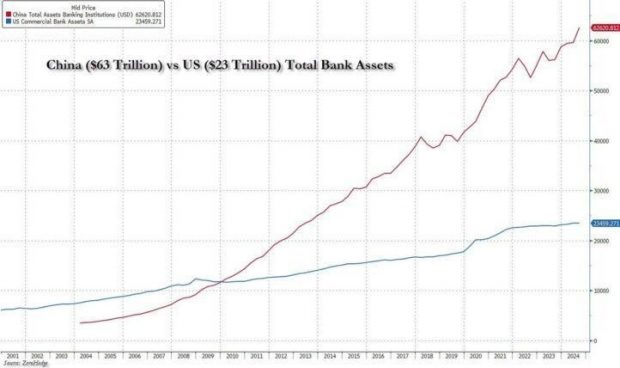

At the end of the day, however, what really debunks the China Threat nonsense is its jerry-built, debt-entombed economy.The fact is, China has accumulated in excess of $70 trillion of debt in barely two decades, and is therefore not some kind of sustainable economic giant that will conqueror the global economy. In fact, it is a Ponzi living on borrowed time and borrowed money.

As shown in the chart below, its bank debt alone now totals $63 trillion, which is up by 13X from the $5 trillion outstanding just 20 years ago in 2004. Owing to this madcap debt explosion, much of which built unused infrastructure and empty apartment buildings, the debt of China’s state-run banking system is nearly three times the footings of the US banking system.

Stated differently, China didn’t grow organically in the historic capitalist mode; it printed, borrowed, spent and built like there was no tomorrow. The resulting simulacrum of prosperity would not last a year if its $3.6 trillion global export market—-the source of the hard cash that keeps its Ponzi upright—were to crash, which is exactly what would happen if it tried to invade America.

To be sure, China’s totalitarian leaders are immensely misguided and downright evil from the perspective of their oppressed population. But they are not stupid. They stay in power by keeping the people relatively fat and happy and couldn’t possibly wish to risk destabilizing a towering economic house of cards that has not even a vague approximation in human history.

Despite this, we never want for round-house claims that China’s economic house of cards doesn’t matter because it is hell-bent on dominating a battlefield that is “asymmetric, economic and digital” according to one critic we read today.

But to the contrary, Red Capitalism is the greatest economic Ponzi in world history, and is neither stable nor sustainable. It will ultimately tip-over under its own weight of excess debt and sweeping malinvestment—just like the Soviet Union did for different reasons.

Washington simple needs to mind its own business, let free enterprise flourish at home, allow freedom of commerce abroad for American companies and entrepreneurs, slash the defense budget by 50%, balance the Federal budget, eliminate 75% of Federal regulations and get out of the way.

There is nothing “national” or geostrategic about this. It’s just beltway bullshit made up by Washington lobbies, think tanks, NGOs and busy-bodies trying to justify their own illicit claims on budgets and power. And now they have captured the Trumpite trade howlers, as well.

Reprinted with permission from David Stockton’s Contra Corner.