The normally crucial consumer price index measure of inflation printing today for March is likely to take a back seat to the next red flashing headline on tariffs on everyone’s Bloomberg terminal, but under the hood – with the Trump Put now exposed – can a cooler than expected CPI print raise the Powell Put strike enough to enable a true tradable bottom here?

Having dipped lower in the previous month (following a few straight months of re-acceleration), expectations were for both headline and core measures to continue trending lower on a YoY basis… and they were.

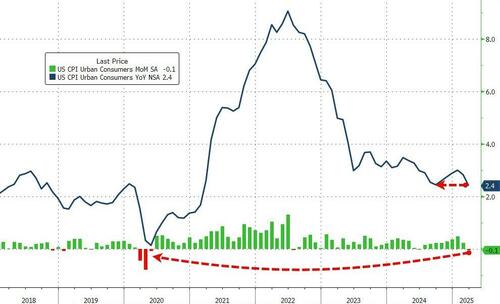

Headline CPI FELL 0.1% MoM (vs +0.1% exp), which dragged the YoY CPI to +2.4%, matching the September lows…

Source: Bloomberg

That is the weakest MoM print since May 2020.

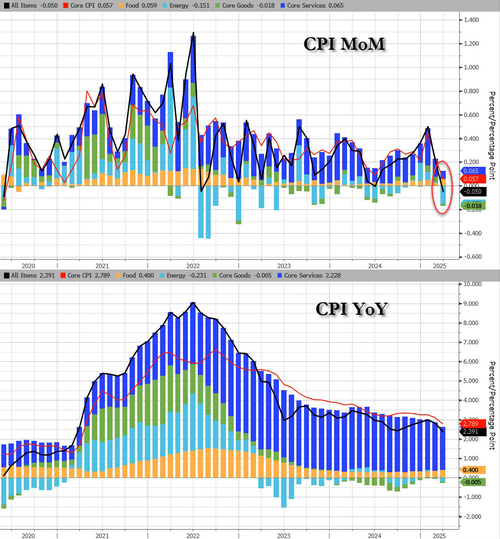

Core CPI also printed cooler than expected (+0.1% MoM vs +0.3% MoM exp), pulling the YoY print down t0 +2.8% YoY – the lowest since March 2021…

Source: Bloomberg

Services inflation tumbled…

Source: Bloomberg

CPI breakdown:

Headline:

-

CPI decreased 0.1% after rising 0.2% in February, and below the +0.1% estimate. Over the last 12 months, CPI rose 2.4%, below the 2.5% estimate.

-

Energy CPI fell 2.4% in March, as a 6.3% decline in the index for gasoline more than offset increases in the indexes for electricity and natural gas.

-

Food CPI rose 0.4% in March as the food at home index increased 0.5% and the food away from home index rose 0.4 percent over the month.

Core CPI:

Core CPI details (MoM increase):

-

The shelter index increased 0.2% over the month.

-

The personal care index rose 1.0%in March.

-

The index for education rose 0.4% over the month, as did the index for apparel.

-

The new vehicles index also increased over the month, rising 0.1%.

-

The index for airline fares fell 5.3% in March, after declining 4.0% in February.

-

The indexes for motor vehicle insurance, used cars and trucks, and recreation also fell over the month.

-

The household furnishings and operations index was unchanged in March.

-

The medical care index increased 0.2% over the month.

-

The index for hospital services increased 1.1% in March and the index for physicians’ services rose 0.3% over the month. In contrast, the prescription drugs index fell 2.0% in March.

Core CPI details (YoY increase):

-

The index for all items less food and energy rose 2.8 percent over the past 12 months.

-

The shelter index increased 4.0 percent over the last year, the smallest 12-month increase since November 2021.

-

Other indexes with notable increases over the last year include motor vehicle insurance (+7.5 percent), medical care (+2.6 percent), recreation (+1.9 percent), and education (+3.9 percent).

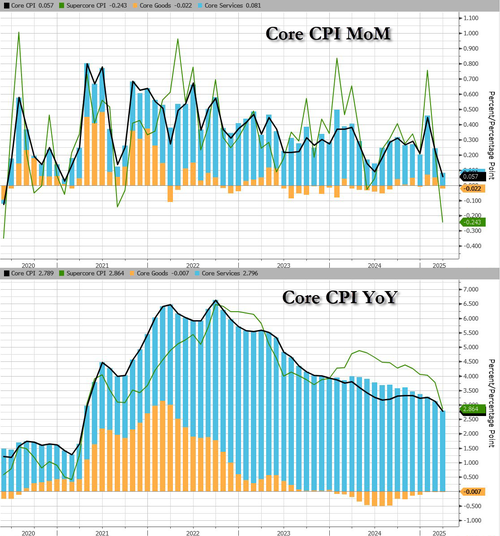

While goods inflation is flat (zero-ish), services cost inflation is fading fast…

Source: Bloomberg

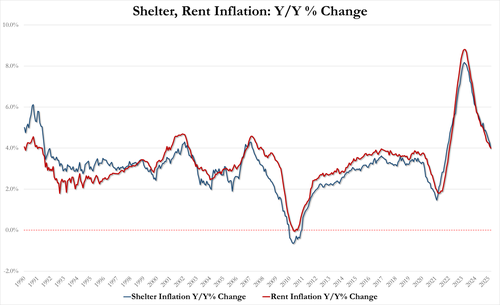

Shelter and Rent inflation is slowing fast:

-

Shelter inflation +0.3% MoM, +3.99% YoY, down from 4.25% in February (lowest since Nov 2021)

-

Rent inflation +0.3% MoM, +3.99% YoY, down from 4.09% in February (lowest since Jan 2022)

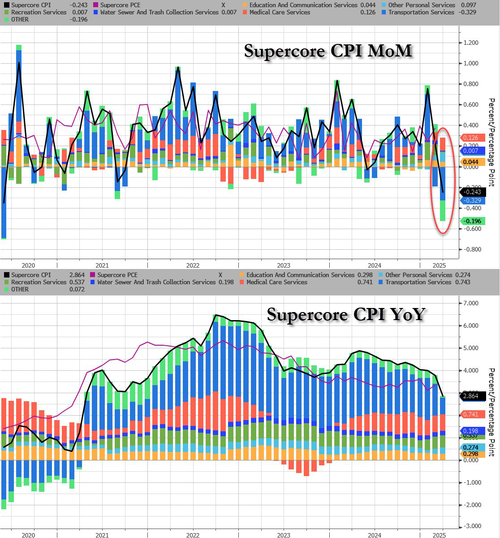

The so-called SuperCore CPI – Services Ex-Shelter – dropped 0.1% MoM dragging it down to +3.22% YoY – the lowest since Dec 2021…

Source: Bloomberg

Source: Bloomberg

Drill Baby Drill (and tariffs recession fears) have dragged energy prices lower and pulled CPI lower with it…

Source: Bloomberg

But, but, but… Democrats at UMich said inflation would explode because Orange Man Bad?

Loading…