German conservative leader Friedrich Merz has reportedly reached a tentative agreement with the Green party on the giant debt-funded spending package for defense and infrastructure.

As a reminder, Merz’s Christian Democratic-led bloc and the SPD are rushing to secure a supermajority in parliament to approve sweeping constitutional amendments that would release defense spending from debt restrictions and set up a €500 billion ($542 billion) fund for infrastructure investment.

The agreement on Friday spelled out that the infrastructure funding would be earmarked for new projects – and that €100 billion will be channeled to the government’s existing climate and transformation fund, according to news organization RND, which appears to have been the bargain that Merz offered to get the Greens on board.

Handelsblatt reported earlier that an agreement had been reached.

The deal needs to be approved by party lawmakers.

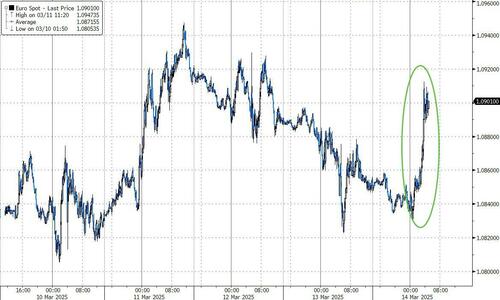

The result of all this is a stronger euro (for now)…

“Game on again for the euro,” said Brad Bechtel, head of FX at Jefferies, adding that peace talks for Ukraine are adding to the currency’s momentum. “The market is cautiously optimistic that we are progressing in the right direction.”

…but bund yields are also spiking to recent highs…

Merz said late Thursday that he’s “very optimistic” that the landmark debt-spending package will be approved after a parliamentary debate on Thursday laid bare a deep rift with the Greens.

“What more do you want than what we have proposed to you?” Merz asked, prompting jeers from the party.

“The headlines are providing some comfort that the Greens are on board with the proposals,” said Evelyne Gomez-Liechti, a strategist at Mizuho International Plc, adding that markets had been pricing some chance of the agreement not passing through.

As Goldman Sachs Alberto Bacis notes, the narrative prevailing over the last 10 days is the following:

Germany has pivoted towards a fiscal expansionary stance > they have plenty of room > defense and infrastructure spending will generate a massive growth turnaround for Germany and rest of the block, bringing the following externalities:

1/ ECB must remain restrictive

2/ Inflation will fly

3/ Sky is the limit for investments

Bank of America’s sentiment survey published earlier Friday showed investors turned underweight on core euro-area fixed income for the first time since 2023.

“Core Europe duration longs collapsed as future economic growth and bond supply get priced in,” BofA strategist Ralf Preusser and colleagues wrote in a note earlier.

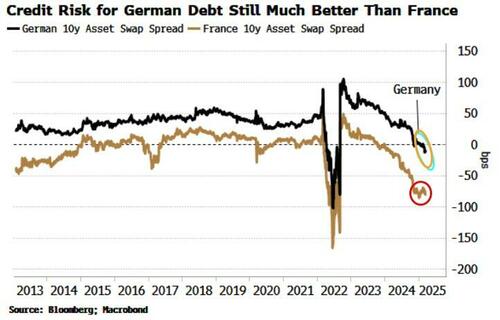

Finally, we note that while the agreement in Germany for a potentially huge debt package is predictably pushing German and other European bond yields higher.

Bloomberg’s Simon White notes that the asset swap’s fall has been modest this year, indicating there is no significant marking down of German credit risk.

The asset swap-spread is a gauge of credit risk for government bonds. The spread for Germany has been falling as sovereign yields rise, but the move this year has been relatively contained, and is only marginally negative.

That’s in stark contrast to France, where the asset swap-spread has fallen by much more, suggesting considerable more reluctance for bond holders to own French debt given that country’s budget troubles.

Germany, the market is saying, is still good for it.

Reuters reports that the German debt deal will exempt defense spending from the debt brake above 1% of GDP.

In other words, “defense against Russia” is just a pretext to flood the economy with a new debt-funded fiscal stimulus, just like COVID.

Loading…