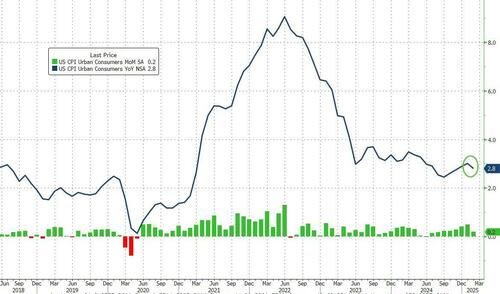

With four times as many data points skewing towards higher February consumer prices than lower ones, whisper numbers into this morning’s CPI print (expected to rise 0.3% MoM) were to the upside. However, headline and core CPI both printed below expectations (+0.2% MoM) which dragged the headline CPI down to +2.8% YoY…

Source: Bloomberg

The miss also pulled Core CPI YoY down to +3.1% – its lowest since April 2021

Source: Bloomberg

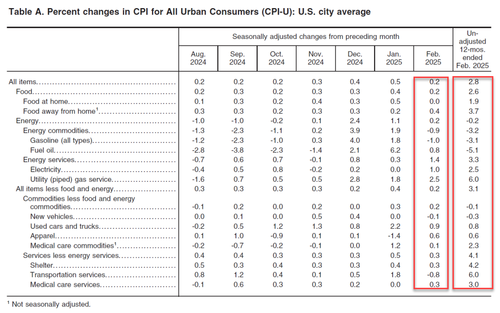

Goods ‘inflation’ is basically negligible currently while Services cost inflation is continuing to fall rapidly…

Source: Bloomberg

Energy and Transportation costs are tumbling (Drill baby drill?)

The so-called SuperCore CPI (Services ex-Shelter) also fell to its slowest rate since Oct 2023…

Source: Bloomberg

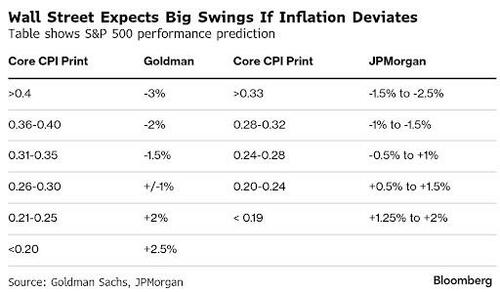

So what happens next?

Is this just the ammo needed to spark a huge short squeeze higher?

Loading…