After a year of modest, barely perceptible inflation, China’s CPI tumbled back far more than expected to fall below zero for the first time in 13 months, an assessment skewed by seasonal distortions but also a sign of deflationary pressures persisting in the economy. Here is the summary:

- CPI: -0.7% yoy (-3.5% mom annualized*) in February vs. Bloomberg consensus: -0.4% yoy; January: +0.5% yoy (-1.7% mom annualized).

- Food: -3.3% yoy in February (-13.1% mom annualized*) vs. +0.4% yoy in January.

- Non-food: -0.1% yoy in February (-2.1% mom annualized*) vs. +0.5% yoy in January.

- PPI: -2.2% yoy in February (-1.3% mom annualized*) vs. GS: -2.2% yoy, Bloomberg consensus: -2.1% yoy; January: -2.3% yoy (-0.8% mom annualized).

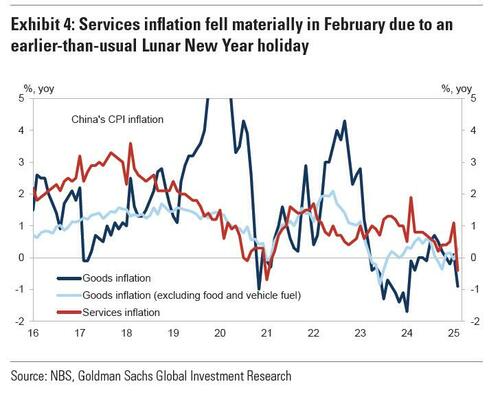

In February, China’s headline CPI inflation fell to -0.7% yoy from +0.5% yoy in January, driven by lower food prices and tourism-related services prices partly driven by an earlier-than-usual Lunar New Year holiday. Goldman estimates suggest the earlier holiday (January 29 vs. February 10 in 2024) reduced year-over-year headline CPI inflation by 0.7% in February. In month-on-month terms, headline CPI inflation fell to -3.5% (annualized, seasonally adjusted) in February (vs. -1.7% mom s.a. annualized in January).

Even when adjusted for the effect of an earlier-than-usual Lunar New Year holiday, consumer inflation slowed to among the weakest levels in months, according to a Goldman report (available to pro subscribers in the usual place). A decline in services prices, combined with a rare negative reading for core inflation, were among symptoms of sluggish consumption.

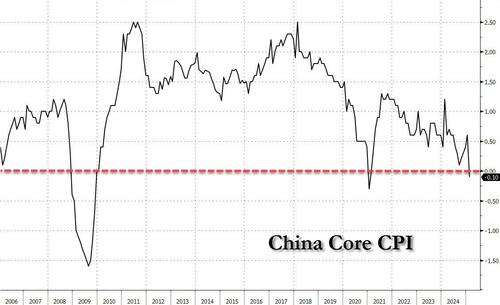

More shocking was that China’s core CPI, which excludes volatile items such as food and energy, decreased for the first time since 2021 with a drop of 0.1%, and only the second time the gauge has contracted over more than 15 years. Factory deflation extended into a 29th month.

“China’s economy still faces deflationary pressure,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “Domestic demand remains weak.”

The statistics bureau said a key factor for the decline in inflation was the effect of a high base from a year earlier, created by elevated prices caused by spending during the Lunar New Year. The festival is a moving holiday that fell entirely in February 2024 but ran from Jan. 28 to Feb. 4 this year.

When accounting for seasonality, the statistics bureau estimates consumer inflation actually rose 0.1% from a year earlier in February, according to a statement published on Sunday. Goldman economists estimate the earlier holiday brought year-over-year CPI inflation down by 0.7% in February, so roughly a wash.

Some more details courtesy of Goldman:

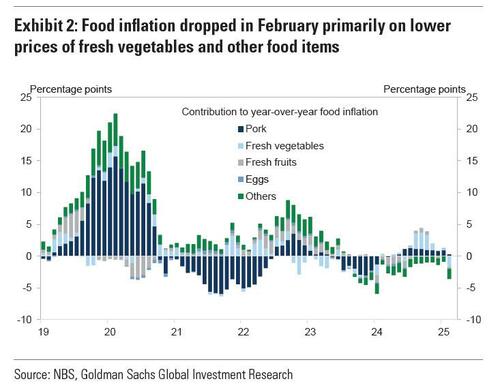

In year-over-year terms, food inflation dropped to -3.3% yoy in February from +0.4% yoy in January. The sharp decline of food inflation was mainly due to 1) lower food prices on decreased seasonal demand after the Lunar New Year holiday and 2) increased supply of fresh vegetables from warmer weather compared to a year ago.

Among major food items, pork prices rose by +4.1% yoy in February (vs. +13.8% yoy in January). Fresh vegetable prices fell by 12.6% yoy in February (vs. +2.4% yoy in January), and fresh fruit prices declined by 1.8% yoy in February (vs. +0.6% yoy in January).

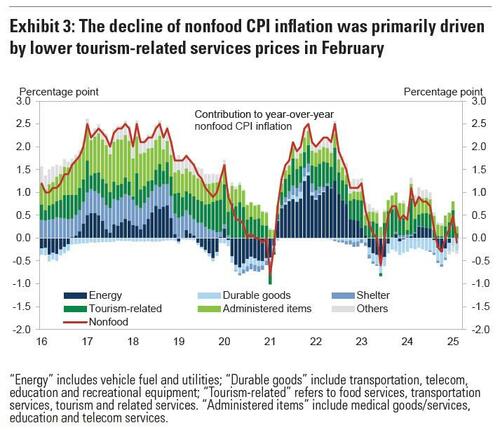

Non-food CPI inflation moderated to -0.1% yoy in February from +0.5% yoy in January. The fall of nonfood CPI inflation was mainly driven by lower tourism-related services prices in February, due to the distortions from timing of Lunar New year holiday.

For example, transportation services prices fell 3.9% yoy in February (vs. +2.9% yoy in January). Fuel costs fell by 1.2% yoy in February (vs. -0.6% yoy in January), on the falling crude oil prices. After excluding food and energy prices, core CPI inflation fell to -0.1% yoy in February (vs. +0.6% in January). Services inflation declined materially to -0.4% yoy in February from +1.1% in January.

Year-over-year PPI inflation edged up to -2.2% yoy in February (vs. -2.2% yoy in January). In month-over-month terms, PPI inflation declined to -1.3% (annualized, seasonally adjusted) in February (vs. -0.8% in January). PPI inflation in producer goods edged up to -2.5% yoy in February (vs. -2.6% yoy in January), and PPI inflation in consumer goods was flat at -1.2% yoy in February.

A clearer read on China’s inflation trajectory will emerge in March, as investors look for signs that the government’s stimulus is translating into stronger domestic demand. The country is on track for the longest streak of economy-wide price declines since the 1960s as a result of weak spending, while the property crash has yet to bottom out.

China has set its inflation target at the lowest level in over 20 years and now aims to bring consumer-price growth to around 2% in 2025 — down from the previous 3% target. It’s a signal top leaders are finally recognizing the deflationary pressures weighing on the world’s second-largest economy, with consumer inflation stuck at just 0.2% for the past two years.

Even so, it is unclear what miraculous stimulus China will unleash – monetary or fiscal – to send core inflation soaring to 2% in the coming 10 months.

Urgency has grown for the government to reflate the economy. At the annual parliament session Wednesday, China announced an ambitious economic growth goal of about 5% for 2025, despite the threat of an intensifying trade war with the US. Beijing also laid out plans to boost fiscal stimulus and domestic consumption.

More in the full Goldman note available to pro subs.

Loading…