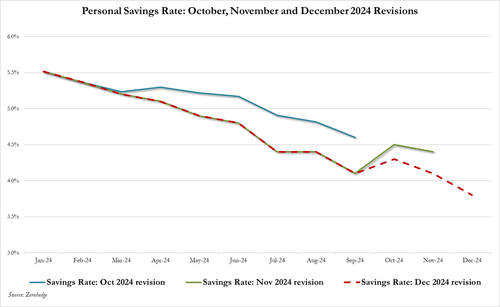

We have repeatedly warned that with their savings – and especially “emergency covid savings” – gone or nearly gone, Biden admin’s residual savings data manipulation notwithstanding…

… US consumers had no choice but to max out their credit cards in order to “extend and pretend” their moment of purchasing greatness, or as we called it three months ago, their last hurrah (see In “Last Hurrah”, Credit Card Debt Explodes Higher Despite Record High APRs As Savings Rate Craters), a hurrah that would last very briefly as it was only a matter of months if not weeks before said cards were denied.

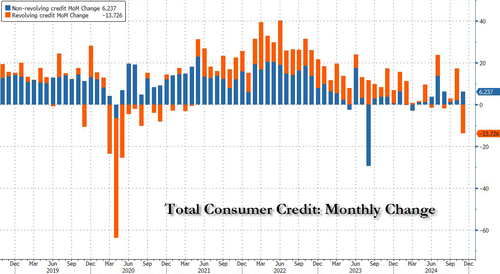

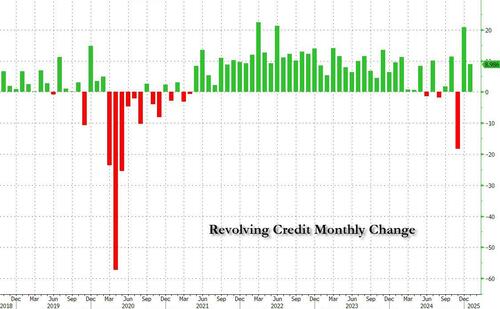

One month later, that’s exactly what happened, when to our surprise, revolving credit cratered at the fastest pace since the covid crash, contracting a whopping $13 billion, an event which for a country that lives on debt – literally – is unheard of outside of a recession.

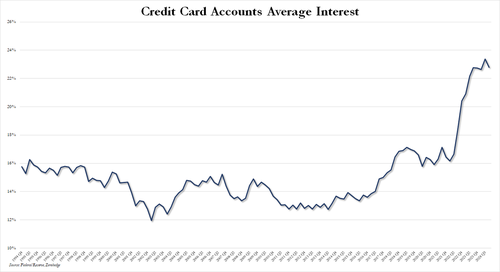

Commenting on the plunge, we said that “we don’t know what sparked this sudden reversal in the favorite American pastime – i.e., to buy stuff one can’t afford and hope to pay it back some time in the future for a modest 29.95% APR – but we know what didn’t: falling rates… because they didn’t.” We then proceeded to show that the average interest rate on credit card balances were at the second highest on record ever though the Fed had already cut rates by 100 bps.

And while it would have been normal, if not expected, for credit card balances to continue declining with savings rates near record lows and with credit card rates at record highs, trust the US economy to do precisely the opposite of what is logical and according to the latest just released consumer credit data, US consumers exited 2024 with a bang after Consumer credit soared by a record $40.8 billion in December, a complete reversal of the November drop, and a month that sticks out like a sore thumb in the history of consumer credit as shown below.

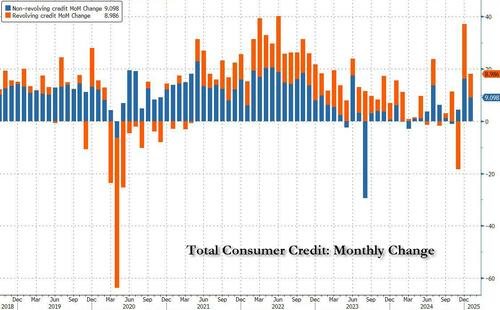

And while one would expect that the record December surge in credit would quickly reverse at the start of the year amid the ongoing drawdown in savings – and the lack of holiday spending – the US consumer has a habit of doing just the opposite of what is expected, and according to the latest NY Fed data, in January consumer credit surged again, rising by $18.084 billion (from a downward revised $37.1 billion vs $40.8 billion previously), and the third highest monthly increase since June 2023…

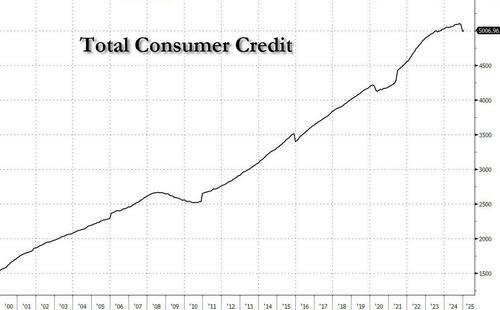

… which sent the total back over $5 trillion.

Taking a closer look at the number, revolving credit – i.e., credit card debt – increased by $9 billion or roughly half of the near record $21 billion surge in December.

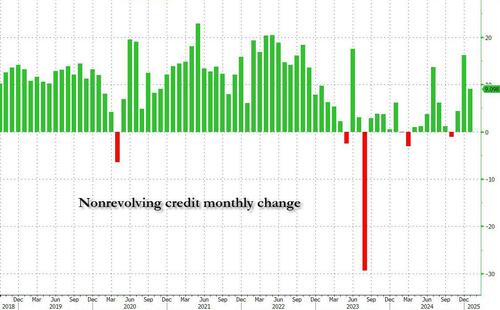

Non-revolving debt (i.e. student and auto loans) rose almost by the same amount, up $9.1 billion and also down from the $16.2 billion the previous month.

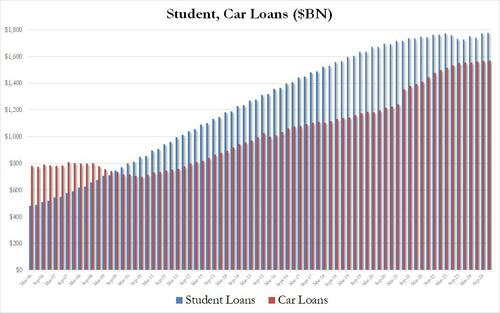

Looking at the composition of nonrevolving credit, the Fed reported that in Q4 student loans rose by $4.2 billion, well below the $31.8 billion increase in Q3, though still enough to push the total amount to a new record high of $1.777 trillion, while auto loans posted a more modest $2.1 billion increase to $1.569 trillion.

To be sure, while a drop in consumer credit could have been explained with the fact that credit card APRs were at all time highs (currently 23% up almost 10% from a decade again), the fact that APRs remained just shy of a record high – half a year into the Fed’s easing cycle – certainly does not explain why US consumers scrambled to max out their credit cards both at the end of 2024 and at the start of 2025, just as their savings accounts hit the lowest level in years.

And as we warned last month, “while the recent surge in credit card usage may explain the burst in spending to end the year, there is only so far that an economy can be pushed with maxed out credit cards”, something which the market is finally starting to realize today.

Loading…