President Trump’s executive order establishing a US Strategic Bitcoin Reserve and a National Digital Asset Stockpile is expected to be a catalyst for wider Bitcoin adoption, according to investment analysts and crypto industry leaders.

On March 6, Trump acknowledged the need to “harness” the power of digital assets while signing the executive order for crypto assets, which states:

“Because there is a fixed supply of BTC, there is a strategic advantage to being among the first nations to create a strategic Bitcoin reserve.”

Standard Chartered’s Geoffrey Kendrick sees the main points here as:

-

BTC currently held will be added to the reserve. Nothing in the reserve will be sold

-

Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick are also authorized to develop budget-neutral strategies for acquiring additional bitcoin, provided that those strategies have no incremental costs on American taxpayers

-

The non-BTC coins held will be added to the Stockpile. No more will be bought. Treasury Secretary could sell them. Arkham data show the government’s current holdings, of 198,109 BTC, 56,035 ETH, 122mn USDT etc U.S. Government (arkm.com)

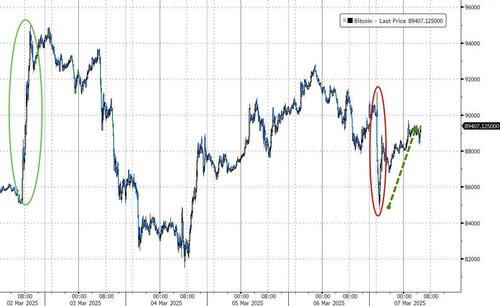

Bitcoin prices have recovered most of the kneejerk decline on last night’s EO signing…

As CoinTelegraph reports, Ryan Rasmussen, the head of research at Bitwise, anticipates a cascading effect where other countries and private investors will invest in Bitcoin with renewed confidence.

“The end game was never ‘the US government buys all of the world’s Bitcoin,’” he said.

Source: Ryan Rasmussen

Large institutional investors, such as wealth managers, financial institutions and pension schemes, now have “no excuse” for not increasing exposure to Bitcoin and other crypto assets endorsed by the Trump administration.

With the sell pressure reduced, the probability of the US government and individual states procuring Bitcoin has increased, Rasmussen said, adding:

“Probability the government outlaws Bitcoin is definitively zero.”

Andrew O’Neill, digital assets managing director at S&P Global Ratings, noted that the Bitcoin reserve would only include BTC already owned by the US government, specifically assets forfeited through criminal or civil procedures.

The presidential order to hold Bitcoin “is mainly symbolic” for Bitcoin to be formally recognized as a reserve asset, O’Neill said. It also created a clear distinction between Bitcoin and other crypto assets:

“The order does contemplate the possibility of acquiring additional Bitcoin for the reserve, provided it can be done in a budget-neutral manner.”

Speaking to Cointelegraph, Ryan Lee, chief analyst at Bitget Research, said he anticipated Trump unveiling more details about the strategic crypto reserve on March 7 at the White House crypto summit.

According to Lee, the summit’s outcome may significantly influence the regulatory landscape and institutional sentiment toward digital assets, shifting toward clarity on token classification, tax incentives and reduced enforcement actions, possibly dismantling barriers for banks and funds.

“A successful summit could see Bitcoin reclaim $100,000 and crypto assets like Ether, XRP, and Solana soar, cementing US leadership in global crypto markets. Conversely, a lack of actionable steps might disappoint investors, underscoring the high stakes of this event.”

So, what next for bitcoin?

Standard Chartered’s Geoffrey Kendrick is positive…

The next question is what could constitute budget-neutral strategies.

In theory, the following:

-

Sell gold, buy BTC. The US government holds USD760bn of gold

-

The Treasury can use the Exchange Stabilisation Fund (ESF), which has USD39bn net assets. This would be a clear change of direction for the ESF which is mostly used to shore up liquidity in extreme events

-

The Bitcoin Act 2024 (sponsored by Senator Lummis) could be passed and worked into a budget neutral way (possibly). Buy 200k BTC a year for 5 years

President Trump is expected to deliver remarks at today’s White House Digital Assets Summit at 3pm EST. In reality I cannot see any of these 3 solutions being delivered today. Rather they would all require Treasury Secretary Bessent to propose something (given the importance placed on Bessent in the executive order).

So it is difficult to see today’s 3pm EST Trump comments driving BTC prices higher.

But how low should they fall?

I have written previously about how a US strategic reserve, whatever it looks like, can embolden other sovereigns.

At the end of December Abu Dhabi held 4.7k BTC equivalent of IBIT. Other sovereigns will now surely join the buying.

We previously noted the potential for buying by the Czech National Bank, which is considering investing as much as 5% of its EUR 140bn of reserves (EUR 7bn) in Bitcoin. The Swiss National Bank (SNB) is also in the early stages of Bitcoin ownership

An official strategic reserve may also embolden others in the US, like the states and/or long term pension money.

While BTC remains in a 80-95k range it is probably choppy an there’s not a lot to do. But I think the next move is out the top of this range.

Buy weekend dip caused by lack of news from Trump tonight, look for a break out of the top of this range soon (especially if the tariff noise can slow down for a while).

Loading…