Dan McCrum, best known for his investigative journalism that exposed the Wirecard scandal, one of the biggest financial frauds in European history, is starting to ask critical questions of another company. This time it’s Canada’s Brookfield, an investment manager with nearly $1 trillion in assets.

McCrum’s latest longform piece notes that Brookfield has drawn scrutiny for its complex financial practices, including internal transactions that bolster its reported earnings.

He notes that the company sells property to itself, potentially inflating earnings, and has recycled $2.8 billion into its real estate arm, obscuring financial health. Its insurers hold $7.7 billion in affiliated assets, including loans to Brookfield’s businesses and a stake in a music royalty firm—which the report indicates is unusual for an insurer.

Property valuations remain high despite market declines, and American National’s surplus has shrunk from $4 billion to $2.3 billion, raising fears that Brookfield is prioritizing its own stability over policyholders.

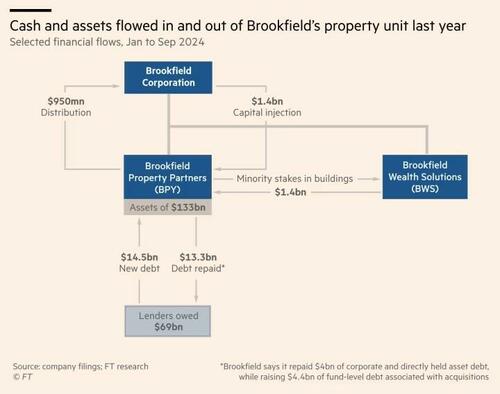

Last year, the company used $1.4 billion from its insurance arm to buy and sell properties within its own portfolio, boosting its “distributable earnings”—a key profit metric underpinning its $90 billion valuation, according to Financial Times.

Critics, including Veritas Investment Research’s Dimitry Khmelnitsky, argue Brookfield is using its insurance businesses to offload assets at inflated prices during a challenging market. The company denies wrongdoing, insisting its transactions are transparent and regulators approve its deals.

McCrum’s report notes that Brookfield owns an extensive but lossmaking real estate portfolio, including London’s Canary Wharf and New York’s One Liberty Plaza.

While it tells investors its real estate empire is in good health, filings from its property unit reveal significant losses, the report says, with $2 billion in red ink last year and some mortgages in default. The company also injected $1.4 billion in equity into its real estate arm—more than the earnings reported from the sector.

Some analysts see this as financial engineering. Independent analyst Keith Dalrymple calls Brookfield’s reporting “very deceptive,” arguing cash inflows are clearly stated while outflows require deep digging. The company rejects these claims, calling them “willfully mischaracterized.”

Further scrutiny comes as former Brookfield chairman Mark Carney runs to replace Canada’s Prime Minister Justin Trudeau. Meanwhile, billionaire investor Bill Ackman has heavily bet on Brookfield, seeing insurance as a key growth driver.

Concerns also surround how Brookfield uses its Texas and Iowa life insurers, which hold billions in investments linked to other Brookfield businesses. American National, one of its insurers, has seen its capital shrink from $4 billion to $2.3 billion while its liabilities surged. Critics warn this setup shifts risks onto policyholders.

The report says Brookfield insists its insurance operations are well-capitalized and transparent. However, its opaque structure, spanning thousands of entities controlling $1 trillion in assets, leaves investors questioning whether the company prioritizes stability over clarity, the report alludes.

Morgan Stanley analyst Michael Cyprys defended the company, however, saying: “Given the diversity of earnings streams that [it] unlocks by leveraging internal balance sheet capital as well as client capital, we see this translating into much larger earnings relative to fee-bearing capital, as compared to peers that lack balance sheet resources.”

As a journalist for the Financial Times, McCrum spent years uncovering fraudulent activities at Wirecard, a German payments company once valued at over $24 billion.

His reporting then revealed that Wirecard had fabricated profits and engaged in widespread financial misconduct, ultimately leading to the company’s collapse in 2020. His work faced intense pushback, including legal threats and surveillance, but was later vindicated when Wirecard’s CEO was arrested.

Read the entire longform Brookfield piece in the Financial Times here.

Loading…